Gov’t confirms higher budget deficit plan

Gov’t confirms higher budget deficit plan

More capital will be pumped into the economy in the rest of this year, as the State Bank of Vietnam (SBV) said it would seek to loosen both budgetary and monetary policies to outcast the gloomy cloud over the local economy.

Speaking at the concluding session of the Autumn Economic Forum in Hue on Friday, deputy governor of the central bank Nguyen Dong Tien vowed to boost credit growth to some 12%-14% by the end of this year. That means a huge amount of credits will be injected now that the credit growth was posted at a mere 6% as of the end of September.

“We predict credit growth will reach 12%-14% by the end of this year, which should be accommodative to economic growth and suitable with the inflation control target,” Tien told the forum attended by officials and top economists.

Such a stance by the central bank reflects earlier petitions from many groups that want easier money flow to spur economic growth. However, international and local experts have warned against any loosening for fear that high inflation should return and macro-economic stability be harmed.

The central bank’s Tien remarked that credit growth often accelerate in the final months of the year, so it is highly likely that such a credit growth can be achieved.

Tien also noted that credit institutions have to date purchased government bonds and treasury notes worth as much as VND400 trillion, or over US$19 billion, and this source of capital via the State Budget will help with economic expansion.

Regarding the fiscal policy, higher budget deficit will be considered, said Nguyen Van Giau, chairman of the National Assembly’s Economic Committee.

Giau, who is also former governor of the central bank, said the Ministry of Planning and Investment had submitted a plan to his committee seeking the NA approval for raising the budget deficit to 5.5% of the gross domestic product compared to the earlier target of 4.8%. If approval is forthcoming, that means nearly US$1 billion of additional funds will be made available for investment.

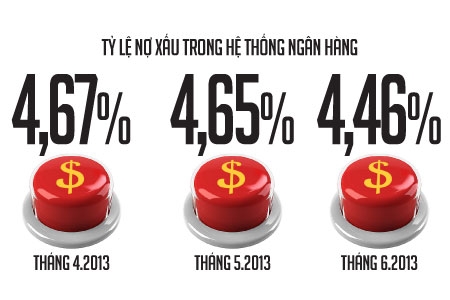

In fact, capital is now awash at banks, but the problem is the low capital absorptive capacity of the economy as well as the hesitation and discretion among banks in making loans.

A survey conducted by the Vietnam Chamber of Commerce and Industry (VCCI) shows that only 54% of enterprises had demands to borrow funds in this year’s first half despite fairly soft interest rates, a tad lower compared to 57.3% of enterprises in need of funds by end-2012.

Pham Thi Thu Hang, general secretary of VCCI, noted that the demand for funds among the business community has been on the decline.

Among enterprises wanting to access credits, only 41% have been given loans.

Some experts at the forum showed concerns over the loosening, saying there should be other ways to secure capital instead of boosting credits and allowing for a higher budget deficit.

Dang Van Thanh stressed that a higher deficit should not be approved, since deficits have accumulated over the years, aggravating public debts and macro destabilization.

Thanh proposed that the National Assembly look at some 70 State-controlled funds, some of which have possibly never been known to the law-making body.

* Minister-Chairman of the Government Office Vu Duc Dam on Sunday confirmed that the Government is seeking approval from the National Assembly for increasing the budget deficit this year to 5.3% from the initial endorsed rate of 4.8%.

Speaking to reporters at the regular press briefing in Hanoi on Sunday, Dam said: “It’s correct that the Government has proposed to lift the State budget deficit ceiling to 5.3%.”

Reasons behind the proposal, according to Dam, include the very high demand for public investments, as it is difficult to attract private investors into key infrastructure projects, such as roads and hospitals.

Dam estimated that the total investment from the State Budget and government bonds would be some VND235 trillion, or over US$11 billion. The investment should grow by 5.5% to 5.8% next year, so the capital need will be some VND255 trillion.

Therefore, lifting the budget deficit is necessary, Dam said, adding the additional capital should come from land rents, mining, and lotteries.

vir