Vietnam to borrow money from foreign sources to settle bad debts?

Vietnam to borrow money from foreign sources to settle bad debts?

Whether Vietnam can settle bad debts or not will decide how the Vietnam’s national economy performs in 2013. Meanwhile, it’s still unclear where the money to settle the bad debts comes from.

How big is bad debt?

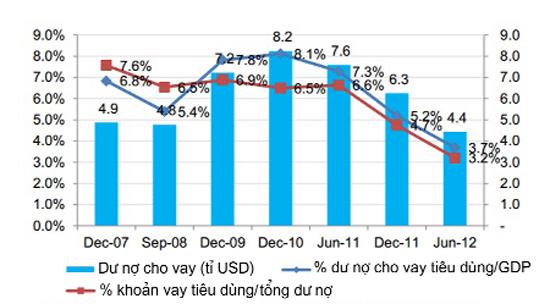

A report by the State Bank of Vietnam showed that the total bad debts by October 2012 had reached 250 trillion dong, or 8 percent of the total outstanding loans.

However, Dr. Tran Dinh Thien, Head of the Vietnam Economics Institute, said he has learned from a source that the bad debts have reached 400 trillion dong.

Thien said since there is no accurate figure about the bad debts, it is still unclear how serious the situation is.

According to the Ministry of Construction, the outstanding loans in the real estate sector alone has reached 1,000 trillion dong, which includes a high percentage of bad debts.

By the end of 2011, the debts owed by local authorities to construction enterprises had reached 91,273 billion dong. Meanwhile, it is still unclear when the debtors can pay debts, because most localities now face serious budget deficit.

Meanwhile, no agency has made public the total commercial bad debts among businesses and between banks and businesses.

Regarding state owned enterprises, a report by the Ministry of Finance said the total accounts payable of state owned general corporations and economic groups had reached 1,292.4 trillion dong by the end of 2011. However, it remains an unknown how much the bad debt is.

Meanwhile, Nguyen Huu Nghia, Chief Inspector of the State Bank of Vietnam, on December 27, 2012, told the press that the bad debt has become big enough to lead to the stagnation of production activities and threaten the banking system’s safety.

Vietnam to borrow foreign money to settle bad debts?

Experts have estimated that in order to settle bad debts, Vietnam would need tens of billions of US dollars. Governor of the State Bank Nguyen Van Binh, at the year-end meeting with the local press, admitted that it’s still unclear how to mobilize financial resources to settle bad debts, while the bad debt needs to be settled as soon as possible.

Dr. Thien has also urged to settle bad debts as soon as possible, because it would require higher financial costs if the settlement process is delayed.

Experts have suggested establishing a company in charge of dealing with bad debts. However, such a company would be set up after a series of complicated procedures. At first, the establishment of the company must be approved by the National Assembly.

Especially, the thing that needs to be done now is to find the answer to the question of where the money for the bad debt settlement comes from.

Dr. Thien believes that it would require some five billion dollars to settle banks’ bad debts.

Agreeing with Thien, Dr. Le Dang Doanh said that it is necessary to prioritize the restructuring of bad debts of general corporations and economic groups together with the restructuring of the banking system.

Doanh believes that Vietnam can seek capital from foreign sources to deal with its bad debts, stressing that this is really a feasible solution, because international institutions themselves are really interested in the matter. Besides, they may also provide technical support to Vietnam.

Vietnam has recently borrowed 300 million dollars from the World Bank to restructure state owned enterprises. The sum of money seems to be too modest if compared with the huge debts incurred by enterprises.

US$1 = VND20,800

vietnamnet