Cash flow heading for the real estate market

Cash flow heading for the real estate market

No one can foretell when the property market will defrost. However, analysts have pointed out that the sharp falls of the bank loan interest rates, plus the lessened attractiveness of other investment channels would drive the cash flow to the real estate market.

It’ll take time to defrost real estate market

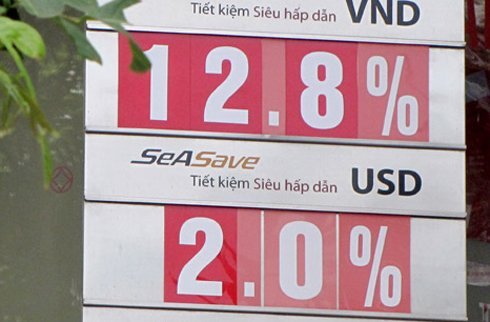

Nam believes that the deposit interest rate reduction to 9 percent per annum has made deposits unattractive to the people who have idle money. Meanwhile, investors also keep hesitant to inject money in gold and foreign currencies, since the two items have been put under the strict control by the State, and they are not considered the kinds of goods or payment instruments.

Meanwhile, the dong/dollar exchange rate is believed to be stabilized thanks to the big foreign currency reserves.

Investors also cannot see big opportunities with securities investment deals, because the stock market remains gloomy and listed companies, like many other businesses, are facing big problems in the economic downturn.

With the analysis, Nam has predicted that the cash flow would be driven into the real estate market. However, it would take time to see the real estate market warm up, because it would need some more time to restore investors’ confidence on the investment opportunities.

“The real estate market would thaw, but it would not be defrosted as quickly as the ice in your glass of water. It would warm up gradually according to the national economy recover,” Nam said when answering a question raised by a businessman about the state’s policies to revive the market.

According to Nam, the government has been aware of the difficulties of the property market and it would be determined to settle the existing problems to re-activate the market, which is considered an important part of the national economy. Once the market meets difficulties, this would lead to the banking sector losing its liquidity and to the increase of the bad debts.

Nevertheless, the government would have to be cautious with its steps in the process to revive the property market. The government can only loosen the monetary policies in a cautious manner, because it needs to keep vigilant over the possible returning of the high inflation.

In the immediate time, the government has made necessary interventions to help warm up the real estate market. For example, the housing development projects have been weeded out from the list of the sectors to which commercial banks are not encouraged to provide loans. As such, real estate developers now can access official credit sources at lower interest rates.

Nam believes that the real estate market would begin warming up in the last months of 2012 and regain its recovery by 2013.

Real estate developers cherish hope

Though real estate developers understand that they should not expect the market recovery overnight, they have been trying all the ways they can to boost sales.

Thu Duc House, for example, is offering apartments and landed properties in districts 9 and Thu Duc with flexible sale policies which offer a lot of preferences.

About 100 apartments at TDH-Truong Tho apartment block and TDH-Phuoc Binh have been put on sale. The apartments have been completed and they are ready to be delivered to buyers immediately. The price of 14.9 million dong per square meter and 950 million dong an apartment prove to be affordable to people.

Meanwhile, Hung Viet and South Korean KRDF03 (HVK) have begun seeking buyers for the first apartments of The Eastern project in district 9 in HCM City.

vietnamnet