Việt Nam turns gold plan into bold plan

Việt Nam turns gold plan into bold plan

A gold exchange is a strategic move towards transparency and deep integration.

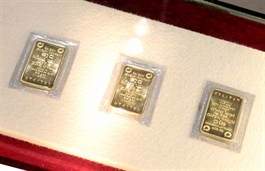

Buyers queue at a gold store in Hà Nội. The State Bank of Việt Nam is considering the foundation of a gold exchange. — VNA/VNS Photo Lê Đông |

Việt Nam is weighing glittering new options for its gold market, with the State Bank studying international models to establish a national gold exchange, permit bullion trading on the commodities exchange or create a gold exchange within the upcoming international financial centre, the central bank announced at a conference on Tuesday.

This is seen as a strategic step to enhance transparency and deepen integration, Deputy Governor Phạm Quang Dũng said at the meeting with credit institutions and gold trading firms to implement the newly issued Decree 232/2025/NĐ-CP on gold trading management.

The decree comes amid volatility in the gold market and is intended to tackle shortcomings in Decree 24/2012/NĐ-CP, which has been in force for more than a decade, Dũng said.

One key reform is the removal of the State monopoly on gold bar production, replaced by a licensing system for qualified banks and enterprises. The decree also permits gold imports and exports to boost supply and narrow the gap with global benchmarks, he added.

The central bank is now finalising detailed guidance on licensing procedures for gold imports and bullion production to help market participants enter quickly, a move Dũng said was vital to stabilise the market and set it on a path to sustainable growth.

“With the new decree, together with tightened inspection, the gold market would operate more transparently and stably, ensure legitimate demand of related parties while avoid causing risk to the financial system and the broader economy,” Dũng said.

Việt Nam on Tuesday launched inspections into compliance with policies and laws of credit institutions and enterprises engaged in trading the precious metal, following recent volatility in the gold market with the gap between domestic and global gold prices amounting to nearly VNĐ20 million (US$758).

Ready to join

Acting General Director of SJC Đào Công Thắng said the company will apply for licences to import raw gold and produce gold bars under Decree 323, which takes effect on October 10. With existing production capacity of 5,000 taels a day, SJC could start production as soon as licences are obtained.

Techcombank said it is also ready to return to the gold business. Deputy Director General of Techcombank Phạm Quang Thắng said the lender is preparing to apply for a licence for raw gold imports and bullion production once guidance is provided.

- 12:26 10/09/2025