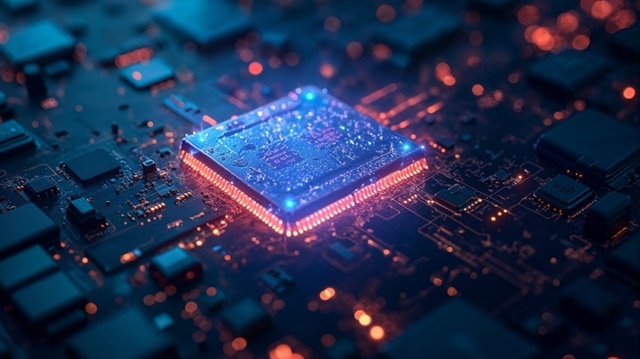

Nation’s high-tech ambitions require core of R&D and experts

Nation’s high-tech ambitions require core of R&D and experts

Vietnam is facing major shortages of funding for research and development activities, affecting its efforts in developing its semiconductor industry and climbing global value chains.

Under the World Bank’s (WB) report on nurturing Vietnam’s high tech talents released last week, there is now an imperative to build a skilled talent base that can support and accelerate the country’s innovation ecosystem. “Achieving Vietnam’s high tech ambitions and its goal of high income status by 2045 will require not only a broad and growing pipeline of young STEM graduates, but also a stronger core of experts who lead research, run laboratories, and turn ideas into market-ready products,” the WB stated.

Particularly, the report highlights the potential to raise public and private research and development (R&D) spending in the country, complementing broader business enabling reforms. The bank pointed out that chronic underinvestment and inefficiencies in higher education and R&D funding means Vietnam faces higher education and R&D investment gaps on the order of magnitude below those of regional leaders.

At present, total R&D spending remains at 0.5 per cent of GDP, far lower than for South Korea (5 per cent), the US (3.4 per cent), China (2.6 per cent), EU (2.1 per cent), and regional peers like Singapore (1.85 per cent), Thailand (1.2 per cent), and Malaysia (1 per cent).

“These low investment levels have left Vietnam without a major science and technology cluster of global significance, and without a critical mass of research output needed to power an innovation economy,” the WB stressed. “As a result, scientific publications, patents, and high-tech innovations remain modest, while technology transfers into industry are slow.”

Moreover, private sector R&D remains thin. Related spending by enterprises in Vietnam only equals 0.2 per cent of GDP, in contrast to 1.7 per cent in China and 3.6 per cent in South Korea. Few firms conduct significant in-house innovation, even mid-tier ASEAN peers invest more in private R&D.

“This weak industry pull for advanced research means limited demand for high-end talent and new technologies. In fact, Vietnam’s private sector has yet to emerge as a major driver of innovation as most companies rely on imported technology or minor adaptations rather than original R&D,” the WB said.

According to experts, high-tech ambitions have a crucial role to play in transforming Vietnam’s export-led growth model towards higher value-added sectors, supporting its goal of becoming a high-income economy by 2045. The goal centres on climbing further up the value chain into advanced manufacturing and innovation-driven services. Experts said achieving this will hinge on harnessing innovation and developing a highly skilled workforce to drive productivity gains.

Higher-value, R&D-intensive industries and knowledge-based services remain nascent in Vietnam’s economy today. According to Vietnam’s Ministry of Industry and Trade, in 2024, Vietnam’s export turnover of electronic products, laptops, and spare parts hit $72.6 billion, up 26.6 per cent on-year, and that of mobile phones and spare parts reached $54 billion, up 2.9 per cent on-year.

In the first eight months of this year, the respective figures are estimated to have stood at nearly $67 billion, up over 43 per cent on-year; and $38.2 billion, up 2.4 per cent on-year.

Vietnam’s booming electronics exports have made the country one of the world’s top electronics manufacturing hubs, reflecting a strong manufacturing base that could engage more high-tech investment.

“However, Vietnam mainly partakes in labour-intensive downstream activities and only provides some simpler chip design support services. The sophisticated steps - front-end chip design, intellectual property development, advanced wafer fabrication - are almost entirely done abroad,” said the WB. “As of 2024, an estimated 85 per cent of Vietnam’s electronics exports were produced by foreign-invested enterprises, primarily through assembly of components designed elsewhere.”

Felix Weidenkaff, employment and Labour Market Policy specialist, International Labour Organization Vietnam

|

Strategic investment in human resources and improving the quality and relevance of education and training systems is needed to sustain Vietnam’s economic growth and achieve the socioeconomic aspirations for 2045. Vietnam’s achievements in increasing levels of educational attainment provide a solid foundation for socioeconomic development, but gaps remain in translating these gains into decent work.

The economy’s capacity to absorb high-skilled workers remains limited. According to the National Statistics Office, only around one in 10 workers were in high-skilled occupations in 2024, and fewer than one-third hold formal degrees or certificates as of Q2 in 2025. At the same time, a declining share of tertiary-educated workers are employed in jobs aligned with their qualifications, underscoring the urgency of demand-driven skills development and job creation.

Employers and enterprises are key actors in skills development, complementing education and training institutions. Enterprise-based training is common in manufacturing sectors such as electronics, textiles, and garments.

However, stronger partnerships between industry and training systems are needed to close skills gaps and meet labour market demands. The recent launch of the Vietnam Semiconductor Industrial Resources Development Alliance illustrates how multi-stakeholder coordination can advance skills development in the sector, aligning education, industry, and policy.

Yet, strengthening education and training alone is not sufficient. Pro-employment macroeconomic and labour market policies are central to expand decent work opportunities in higher value-added activities and sectors for all women and men. This means creating more higher-skilled job opportunities, advancing up-skilling, reskilling and lifelong learning along with continued improvements in education and training, and supporting just transitions for workers through active labour market policies, social protection and social dialogue.

Vietnam’s strong commitment to skills development, technology, and private sector development has been reflected in various resolutions. To translate these aspirations into tangible results, effective implementation of the amended Employment Law and other key policies, robust labour market institutions, sectoral approaches to skills development, inclusive employment services and reliable labour market information systems are essential.

Strengthening labour market governance through social dialogue, modern industrial relations, adequate wage-setting and rights-based institutions aligned with international labour standards are vital for Vietnam’s inclusive and sustainable development.

- 11:43 17/09/2025