Petrol car costs set to rise as Việt Nam transitions towards greener mobility

Petrol car costs set to rise as Việt Nam transitions towards greener mobility

The government has asked Hà Nội to study increasing various fees on fossil-fuel vehicles, including registration tax, licence plate fees and parking charges.

Traffic jam in Hà Nội. Financial levers are part of a broader roadmap to restrict the use of fossil-fuel vehicles in major cities by 2026 and gradually phase in electric-only access zones by 2030. — VNA/VNS Photo |

Việt Nam’s car market is shifting as the Government and consumers move away from petrol vehicles and push for greener, more efficient options like hybrids and electric vehicles (EVs).

Recent Government directives signal a clear message: fossil-fuel cars will soon face tougher financial and legal hurdles in urban areas, while greener options are being encouraged.

A key part of this transition is rising ownership costs for petrol vehicles.

Under Directive 20 issued on Saturday, the Vietnamese Government has asked Hà Nội to study increasing various fees on fossil-fuel vehicles, including registration tax, licence plate fees and parking charges. These changes are part of the country’s wider plan to limit pollution and promote clean transport.

As of now, the first-time vehicle registration tax in Hà Nội is set at 12 per cent for passenger cars (with up to nine seats), 7.2 per cent for pickup trucks and 2 per cent for motorbikes (recently reduced from 5 per cent). If this tax rises by 3 per cent – from 12 per cent to 15 per cent – it could add tens of millions of đồng to the cost of owning a petrol car.

For example, a Honda City priced at VNĐ499 million (US$19,200) would cost about VNĐ15 million more to register. For luxury cars costing VNĐ2–3 billion, the increase could be as much as VNĐ100 million.

In contrast, fully electric vehicles continue to benefit from a registration fee exemption until at least February 2027 – saving buyers substantial sums and further strengthening the appeal of EVs over traditional cars.

These financial levers are part of a broader roadmap to restrict the use of fossil-fuel vehicles in major cities by 2026 and gradually phase in electric-only access zones by 2030.

Hybrid cars: Việt Nam’s preferred middle ground

As Việt Nam prepares for the post-petrol era, hybrid vehicles are emerging as the most realistic short-term solution.

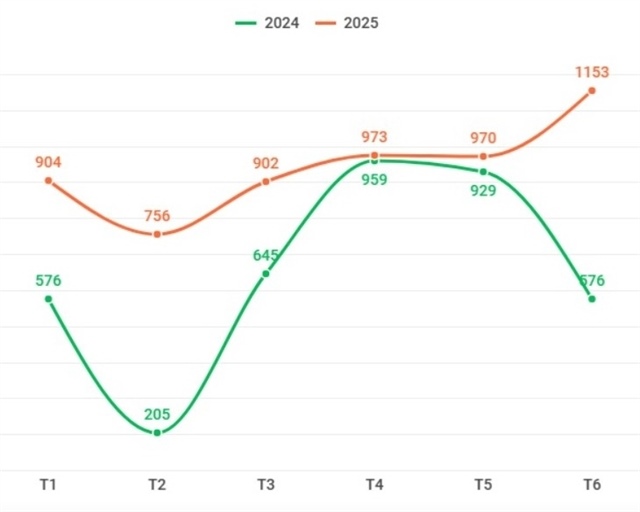

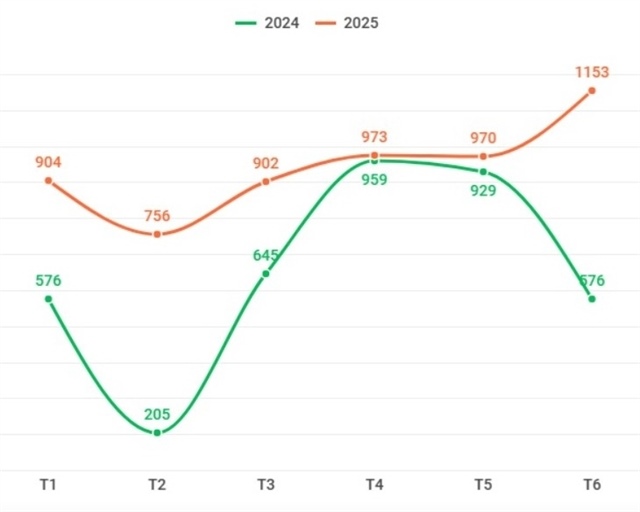

Data of the Vietnam Automobile Manufacturers Association (VAMA) showed in the first half of 2025, hybrid sales reached 5,658 units – up 64 per cent year-on-year, outpacing both the market average growth of 21 per cent and traditional petrol car growth of 18 per cent.

This surge reflects a shift in consumer mindset. Many Vietnamese drivers are not yet ready to adopt fully electric cars but are clearly looking for more fuel-efficient and eco-friendly options.

Traffic jam in Hà Nội. Financial levers are part of a broader roadmap to restrict the use of fossil-fuel vehicles in major cities by 2026 and gradually phase in electric-only access zones by 2030. — VNA/VNS Photo |

Japanese automakers currently dominate the hybrid segment. Toyota alone has three models in the top five bestsellers: Innova Cross Hybrid (1,313 units), Corolla Cross Hybrid (1,194) and Camry Hybrid (685). These are joined by Suzuki’s XL7 Hybrid (1,193) and Honda’s CR-V e:HEV RS (877).

Higher petrol prices (up by 7–10 per cent in the second quarter) and fuel savings of up to 40 per cent have made hybrids more attractive to city families and young professionals.

Still, challenges remain.

Hybrids are typically VNĐ60–120 million more expensive than their petrol counterparts and do not yet enjoy the same tax incentives as EVs. Moreover, most are imported as fully built units from Thailand or Indonesia, making supply chains vulnerable.

Hybrids may solidify their role as the 'bridge technology' between petrol and electric cars, especially if they gain more favourable tax treatment and better local servicing support. If current momentum holds, hybrid sales could hit 11,000–12,000 units by year-end – nearly doubling 2024’s figures.

While hybrids are rising, Việt Nam’s overall car imports have also skyrocketed.

According to the General Department of Customs, 102,817 completely built units (CBUs) were imported in the first six months of 2025, worth over $2.23 billion, up 38.3 per cent in volume and 44.5 per cent in value compared to the same period last year.

Indonesia has, for the first time, overtaken Thailand to become Việt Nam’s top car exporter, supplying 39,111 units – compared to 35,329 from Thailand and 22,944 from China. These imports cater largely to the growing preference for small SUVs and MPVs, especially from ASEAN countries that enjoy zero import duties under regional trade agreements.

Despite high volumes, the average import value differs widely. Japanese cars still carry the highest price tags at around $56,473 per vehicle. Meanwhile, Indonesian cars average just $14,175 and Thai models $19,142, making them far more accessible to the average Vietnamese buyer.

- 08:05 18/07/2025