Foreign-led enterprises have incentive for modern funding

Foreign-led enterprises have incentive for modern funding

Foreign-led businesses are repositioning supply chains amid US tariffs changes, geopolitical tensions, and global supply chain volatility. For instance, 47 per cent of South Korean enterprises expand production to different areas, as shown in a recent report from the Korean Chamber of Commerce and Industry.

Vietnam, which recorded impressive foreign direct investment (FDI) growth in the first half of 2025, is emerging as one among the targeted destinations.

The new US tariff decision, especially on transshipped goods, will create a strong impetus for Vietnam to truly accelerate technological autonomy and enhance domestic capacity. Foreign-invested enterprises (FIEs) will have stronger incentives to invest in research and development (R&D), technology transfer, and supply chain development in Vietnam to avoid tariff barriers. This aligns with the goals on private economic development and technological autonomy.

In this transformation, FIEs may face a strategic decision: accept the new US tariffs and optimise operations in Vietnam, or shift production completely out of Asia to avoid tariff risks. The new tariffs on transshipment, if applied, will accelerate this process, forcing companies to have “real production” in Vietnam or look for alternative markets like the EU or ASEAN.

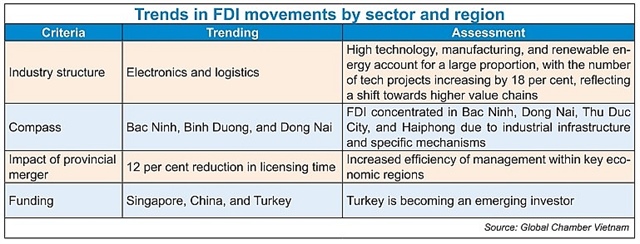

Looking at the investment trend, FDI from Singapore (making up 36.8 per cent of the country’s total) and South Korea will continue to be boosted into high-tech sectors such as AI, semiconductors, and renewable energy, thanks to tax incentives and successful trade negotiations.

Total registered FDI in the first half of 2025 saw technology projects increase by 18 per cent. This trend will continue strongly, showing a more pronounced shift to high-tech, AI, and semiconductor ventures, although it may slow down the pace of FDI attraction in the short term but towards higher quality.

In the long term, Vietnam is expected to strengthen its position and attract high-quality FDI with transparency in tax policy, local mergers, and a stable monetary policy will strengthen Vietnam’s position. This will engage high-quality FDI into the high-tech and renewable energy sectors. FDI will shift sharply from labour-intensive industries to high-tech industries, with dealmaking activity picking up sharply.

If Vietnam succeeds in reforming its institutions and addressing regulatory, legal, and inflation control barriers, it will help Vietnam compete in the ASEAN region.

Meanwhile, there are new opportunities for the local market. In terms ofvalue chain connection, Vietnam has created conditions for private enterprises to participate more deeply in global supply chains. For example, Samsung aims to localise 50 per cent by 2030, opening up great opportunities for Vietnamese enterprises.

Merger and acquisitions in the renewable energy sector have increased by 42 per cent thanks to public-private partnership (PPP) policies, and this trend is likely to continue to be promoted.

Regarding promoting deeper localisation, the new US tariff on transshipped goods will create pressure and simultaneously an incentive for FIEs to increase investment in actual production in Vietnam, including developing supporting industries and input material production, instead of mere assembly.

In spite of these, challenges remain. There is still a lack of a clear legal framework for high-tech PPP projects, leading to risks of disputes and delays. Approximately 70 per cent of Vietnamese small and medium-sized private enterprises have not met the necessary standards for cooperation with large FIEs. This hinders their ability to absorb technology and participate deeply in value chains.

Moreover, despite 200 per cent R&D tax incentives and technological autonomy goals, Vietnam’s technology absorption capacity currently stands at only about 35 per cent. Cost pressure and tariff changes are also a big challenge for traditional export sectors, requiring cost adjustments and market strategies.

FDI will not only be a source of capital, but also a channel for knowledge and technology transfer, helping Vietnam enhance its position in the global value chain and realise its aspiration to become a developed nation by 2045. However, Vietnam needs to quickly address legal gaps and enhance the capacity of private enterprises to effectively absorb this capital and technology.

Vietnam is entering a strategic transformation phase – shifting from balancing FDI attraction to technological autonomy and internal strength, where FDI and the private economy both play a core role. In a complex global context, the three pillars of government, foreign-led groups, and domestic enterprises will be the driving force to help Vietnam maintain its attractive investment position, while gradually rising to become an independent, autonomous, and globally competitive economy by 2030.

To achieve the goals, the country should carry out continuous institutional reform to simplify administration, and respond to tariff barriers by expanding negotiations and supporting businesses in shifting markets.

It should also boost synchronous infrastructure development by increasing public investment in transport, energy, and digital infrastructure; have prudent monetary policy to control inflation, stabilise exchange rates, and limit market shocks; and encourage FDI-private sector links by creating incentives for R&D, technology transfer, and human resource training.

For businesses, they should diversify supply chains by targeting the EU, ASEAN, and Japan; encourage tech innovation and digital transformation; and enhance domestic and international cooperation to leverage the opportunities of Vietnam’s current vision.

|

- 11:18 23/07/2025