Reliable power policy urged for business progress

Reliable power policy urged for business progress

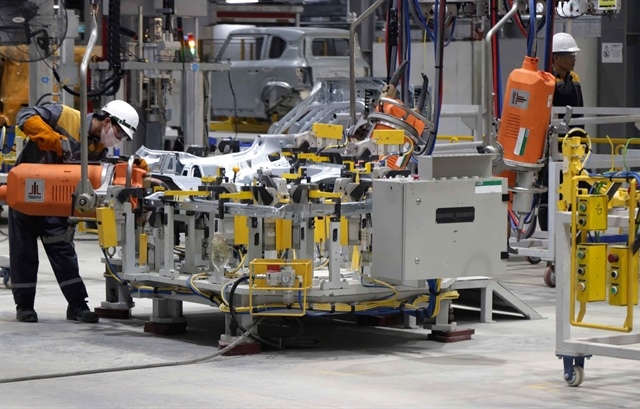

Ensuring stable electricity supply for manufacturing and exports is becoming one of the most pressing challenges for Vietnam as it enters the summer months.

Nguyen Van Dat, deputy director of Thai Nguyen Zinc Electrolysis Plant, pointed out at a seminar on the issue in Hanoi last week that power disruptions or instability directly affect productivity, product quality, and escalate operational risks and costs. Moreover, heavy industries are under growing pressure to adopt green practices and enhance energy efficiency, while the upfront investment for energy-saving technologies and renewable energy remains substantial.

“What businesses want is not just cheap electricity, but a stable, reliable power source with a transparent and predictable pricing mechanism aligned with market principles,” Dat emphasised.

His plant has engaged with professional energy audit firms to optimise operations, reduce energy consumption, and gradually shift to renewable sources such as rooftop solar and clean energy despite high initial investment costs.

Similarly, many export-oriented and deep-processing enterprises are restructuring their production chains to increase self-sufficient energy usage and reduce reliance on the national grid. Nevertheless, they also assert that without a truly market-driven electricity pricing mechanism and a transparent direct power purchase framework, private investors will hesitate to engage in clean energy projects.

For years, Vietnam’s electricity prices have remained among the lowest in the region and globally, which helped attract investment into its manufacturing sector. However, this low-price framework has now become a barrier as the country transitions to a new development phase demanding not only more electricity but also cleaner, smarter, and higher-quality power. This is a challenge that can no longer be addressed by simply maintaining artificially low electricity prices.

According to Dr. Tran Dinh Thien, former president of the Vietnam Institute of Economics, Vietnam is now entering a development stage where power shortages are no longer just a risk.

“They are a clear and present threat to the country’s growth trajectory. The bottlenecks in both electricity supply and infrastructure are increasingly apparent, and unless the private sector is given clearer, more predictable signals through market-based pricing and transparent mechanism,” said Thien.

Energy expert Ha Dang Son, director of the Centre for Energy and Green Growth Research, noted that while the government recently made strong moves to reform the legal framework to activate the competitive electricity market, particularly allowing direct power purchase agreements (DPPAs) between renewable energy generators and large power consumers, concrete steps to bring these policies into practice still require time.

“We are seeing positive signals from the government’s reform efforts, especially the recent decrees opening the door for DPPAs,” Son said. “However, these frameworks must be swiftly translated into tangible projects. The private sector is watching carefully, and unless there is discipline in execution, the risk of policy inertia remains high, potentially stalling the entire energy transition.”

In this context, Vietnam Electricity (EVN) increased the average retail electricity price by 4.5 per cent from May 10. Vo Quang Lam, deputy general director of EVN, said, “To meet the 8 per cent GDP growth target, commercial electricity output will need to rise by 12.2 per cent compared to 2024, equivalent to an additional 33.6 billion kWh, most of which must be sourced from high-cost generation facilities.”

With hydropower, traditionally Vietnam’s cheapest energy source, already reaching its operational limits and projected to decline by about seven billion kWh this year due to adverse weather conditions, the country will need to ramp up coal-fired power, particularly in the southern provinces, as well as liquefied natural gas (LNG) and oil-fired plants, all of which carry significantly higher production costs.

"To meet the GDP growth target, commercial electricity output will need to rise by 12.2 per cent compared to 2024, equivalent to an additional 33.6 billion kWh." - Vo Quang Lam deputy general director, Vietnam Electricity

EVN estimates that in 2025, low-cost hydropower will only account for about 25 per cent of total system output, while the remainder will have to come from higher-cost sources such as coal, gas, oil, and renewables. For the additional electricity required to support growth, the grid will largely rely on LNG turbines, imported coal, and oil-fired power plants.

According to Lam, EVN carefully weighed electricity price adjustments by considering demand forecasts, fluctuating fuel costs, and consumers’ ability to pay, ensuring that the chosen rate increase would strike a balance between maintaining competitiveness and safeguarding supply security.

“Given the realities of escalating input costs and the growing demand for stable, quality electricity to serve both the economy and society, this adjustment is both necessary and measured,” Lam stressed.

The Ministry of Industry and Trade forecasts that electricity demand will increase by approximately 12 per cent in 2025, while the power sector must simultaneously ensure the stable operation of existing sources, accelerate progress on key generation and transmission projects, and develop flexible operational scenarios for extreme conditions.

EVN representatives also admitted that any delays in critical generation or transmission projects would directly impact power mobilisation capacity, potentially causing supply-demand imbalances during peak summer or dry seasons.

- 10:40 19/05/2025