Rubber industry to bounce back in 2025

Rubber industry to bounce back in 2025

Vietnam's rubber industry is poised for strong growth in 2025, driven by rising rubber prices, expanding production, and increased export opportunities, despite potential challenges from global trade policies and shifting market dynamics.

Phuoc Hoa Rubber JSC (PHR) is aiming to extract 12,800 tonnes of rubber in 2025, for total revenues of over $59 million, including around $51.5 million from rubber sales.

Photo: baodautu.vn |

The company projects an average selling price of $1,750 per tonne, post-tax profit of $9.7 million, and a minimum cash dividend payout ratio of 10 per cent.

While revenue is expected to decline by 3.8 per cent on-year, post-tax profit is projected to increase by nearly 31 per cent. The company plans to optimise land use in Binh Duong province to enhance operational efficiency and exceed its revenue and profit targets by at least 10 per cent.

For the first quarter of the year, PHR has set a target of extracting of 1,920 tonnes of dry latex, processed rubber output of 3,420 tonnes, and sales of 4,900 tonnes, with an average price of $2,120 per tonne, generating $10.3 million in revenue and close to $1.2 million in pre-tax profit.

MB Securities anticipates that Phuoc Hoa Rubber’s 2025 revenue may dwindle by 3 per cent compared to 2024, but post-tax profit could grow by 10 per cent, driven by sustained high selling prices.

By 2026, the company’s revenue and net profit are expected to increase by 2 per cent and 8 per cent, respectively.

Dong Phu Rubber JSC's high-yield rubber plantations produce over two tonnes per hectare and are expected to support growth in both rubber extraction and industrial real estate.

The company’s undertaking in Bac Dong Phu Industrial Park expansion, encompassing 317 hectares (ha), was approved for investment on January 16, and is anticipated to generate cash flow over the next two years.

Meanwhile, Vietnam Rubber Group's (GVR) plantations generate an average yield of 1.5 tonnes per ha, yet the company’s 2025 outlook remains promising due to projected high rubber prices in the first half of the year.

The Association of Natural Rubber Producing Countries expects the demand for rubber to remain stable, particularly in China, Vietnam’s primary market for rubber exports.

An Binh Securities projects GVR’s revenue to grow by 6.6 per cent on-year to $1.12 billion this year, while post-tax profit is expected to rise by 4.7 per cent to $176.3 million.

As for Tay Ninh Rubber (TRC), the company is managing over 7,000ha of rubber plantations which continue to achieve high yields of over 2 tonnes per ha.

In Cambodia, its plantations, established in 2014, are entering peak production, yielding around 1.3-1.4 tonnes per hectare.

In Laos, the company oversees more than 10,000ha, with the majority entering peak harvest season between 2024 and 2029, expected to yield over 2 tonnes per hectare.

Over the past month, PHR shares rose by 25 per cent, TRC shares by 9.2 per cent, GVR shares by 6.2 per cent, Song Be Rubber shares by 6.1 per cent, and DakLak Rubber Investment JSC shares by 8.2 per cent.

Several stocks recorded substantial gains on-year, with Tan Bien Rubber JSC shares rose 123 per cent, Tay Ninh Rubber JSC grew by 151 per cent, and Dak Lak Rubber JSC went up 109 per cent.

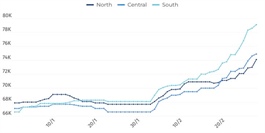

Market analysts predict rubber prices will continue their upward trend in 2025, benefiting the natural rubber sector.

MB Securities forecasts that prices will remain elevated through the second quarter of 2025, with an estimated annual increase of 5-10 per cent compared to 2024.

In the US, a declining reliance on rubber imports from China, Canada, and Mexico has created new opportunities for Vietnamese rubber exporters, who increased their exports to 29,200 tonnes in 2024, valued at $50.6 million, raising the market share from 1.5 per cent in 2023 to 1.7 per cent.

As global trade dynamics continue to evolve, Vietnam’s rubber industry remains well-positioned to leverage rising prices, supply constraints in competing markets, and increasing demand from key trade partners.

- 11:02 13/03/2025