Coordinated policies to aid growth

Coordinated policies to aid growth

The government has requested measures to achieve new targets on economic growth and exports, and also to provide more assistance to enterprises this year.

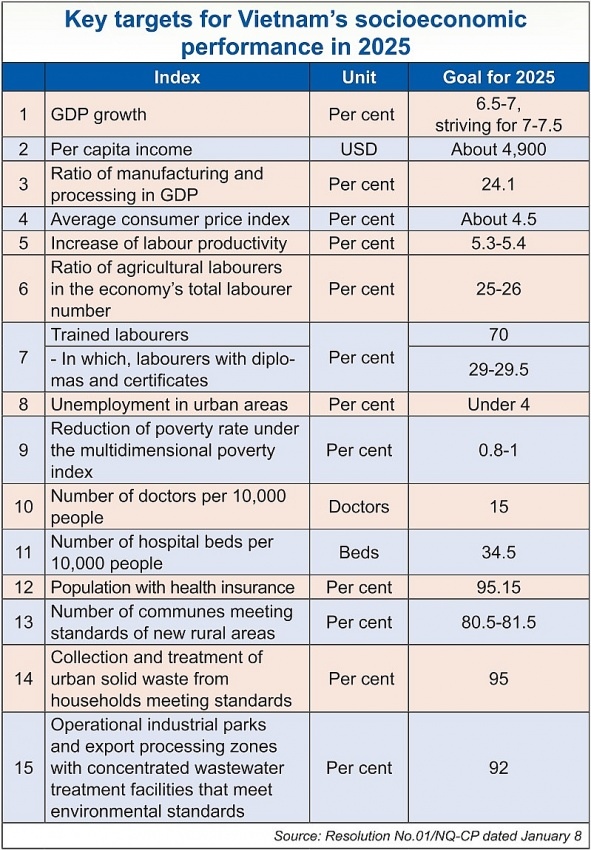

Based on positive achievements in 2024, last week the government released three detailed scenarios for economic growth for this year, with GDP of 6.5-7, 8, and 10 per cent, respectively.

“Greater efforts must be made to reach even 10 per cent if we have better conditions. This will lay a firm foundation and create big momentum for continued double-digit growth in 2026-2030,” said Deputy Prime Minister Nguyen Hoa Binh. “Localities that have big potential and serve as the country’s growth drivers [such as Hanoi, Haiphong, Danang, and Ho Chi Minh City] must strive to reach growth at a rate higher than the whole country’s average rate.”

The government stressed that it will maximise social resources, effectively exploit resources from state-owned enterprises, and develop private enterprises.

“New solutions will be used to mobilise resources from the state budget, domestic and foreign loans, public-private partnership resources, and other legal sources to accelerate investment in large-scale projects with spillover effects,” DPM Binh said. “The government will also urgently remove obstructions to effectively unleash resources from the real estate, securities, and corporate bond markets.”

Coordinated policies to aid growth, Source: freepik.com |

Accelerated support

While the country’s GDP last year growing nearly 7.1 per cent with a scale of $476.3 billion, its export-import turnover reached nearly $786.3 billion, up 15.4 per cent on-year, with a total trade surplus of $24.77 billion.

Resolution No.01/NQ-CP dated January 8 on tasks to implement the country’s economic plan and state budget estimates for 2025, released last week, ordered ministries and localities to boost activities on trade, and continue diversification of export markets, products, and supply chains, while maximising opportunities from key export markets.

The government has ordered authorities at all levels to make the best use of advantages from new trade links, while effectively tapping into new markets. They are also requested to support enterprises to take advantage of commitments in free trade agreements already signed or coming soon, as well as the comprehensive partnership agreement between with the United Arab Emirates coming into force.

The government has also asked ministries and localities to periodically meet with enterprises to listen to their ideas and proposals to help them remove difficulties, boost customs clearance at border gates, and provide prompt information about technical barriers in export markets.

According to the Ministry of Industry and Trade (MoIT), to help boost GDP and exports, efforts must be made to increase the economy’s index for industrial production in 2025 by about 9-10 per cent. The on-year index of industrial production for 2024 is estimated to have ascended 8.4 per cent, the highest increase since 2020.

To fuel industrial production, the MoIT has set a target that total domestically produced and imported electricity this year must reach 347.5 billion kWh, up by 12.2 per cent on-year. In which, the total power capacity, excluding rooftop solar power, will increase by about 6.2 per cent compared to last year.

Also, last week, the government issued Resolution No.02/NQ-CP on improving Vietnam’s business climate and national competitiveness in 2024. Under this, all difficulties must be removed for enterprises and investors so that their performance can be boosted, generating more employment. All breakthroughs, including institution, infrastructure, and education, must be accelerated, especially reviewing legal regulations so that they favour enterprises and the public.

The government also required ministries and localities to “speed up the reduction, and simplification of administrative procedures; improve the business climate; and facilitate and reduce costs for investment and business activities”.

The State Bank of Vietnam is ordered to reduce interest rates and create better conditions for businesses and individuals to access bank loans. Credit must be focused on sectors that can serve as growth momentum such as consumption, investment, and exports.

The Ministry of Finance (MoF), meanwhile, must soon submit for approval of new policies on exempting, reducing, and deferring the time of payment of taxes, fees, and land rents.

Andrea Coppola, lead country economist and programme leader for Equitable Growth, Finance and Institutions at the World Bank in Vietnam, Cambodia, and Laos, told VIR that a comprehensive package of coordinated policies – including fiscal, monetary, financial sector and structural policies – is needed to effectively support a faster and sustainable growth path for the Vietnamese economy.

“Accelerating disbursement of public investment would support aggregate demand in the short run, while also helping to close emerging infrastructure gaps,” Coppola said. “On the other hand, monetary authorities may have limited room for additional interest rate cuts due to the possible appreciation of the US dollar that may materialise during the next months.”

According to him, building on recent reforms, further steps to mitigate financial sector risks and vulnerabilities remain important.

“The authorities could encourage banks to improve capital adequacy ratios and strengthen the institutional framework for prudential supervision - including to detect and address issues arising from the affiliation of banks with business groups - and early interventions, to promptly address emerging challenges,” Coppola said.

Figures from the MoF showed that in 2024, total financial assistance value from exemption, reduction, and extension of payment of assorted taxes, fees, and charges, as well as land rental for enterprises and the public is estimated to have stood at $8.22 billion – including policies implemented since 2023, with exemption and reduction worth about $4.1 billion and extension of $4.12 billion.

|

Fostering exports

The MoIT is now working with Vietnam’s trade offices overseas to seek more information and demands from the markets where they are located to timely provide information for the government and the prime minister on how to boost exports.

According to the MoIT, major export markets have been increasing import demands, including those from Vietnam.

In 2024, Vietnamese exports witnessed an on-year rise in key markets, including the US ($119.6 billion, up 23.3 per cent), the EU ($52.1 billion, up 19.3 per cent), ASEAN ($37 billion, up 13.7 per cent), South Korea ($25.5 billion, up 8.7 per cent), and Japan ($24.6 billion, up 5.6 per cent).

The Ministry of Planning and Investment has also warned of major risks in the global markets, which can affect the Vietnamese economy, mostly exports. The economy is open to the global economy, with the country’s total export-import turnover being 1.65 times higher than GDP in 2024. Thus, it is vulnerable to external shocks.

Nguyen Minh Vu, Deputy Minister of Foreign Affairs, said, “Though the global economy is recovering, there are many potential risks, and supply chain disruptions. This necessitated urgent market opening, diversification of export markets. Moreover, there must be policies on greener industrial production. New environmental and trade standards in the international market are creating significant challenges for Vietnam’s export activities.”

At present, industrial production enterprises are continuing to face many difficulties in access to bank loans, despite some reduction in lending rates. Additionally, costs for importing raw materials have increased, along with the high USD exchange rate, which has reduced the price competitiveness of export products. Also, domestic production depends heavily on imported materials from outside.

At present, the country’s supporting industry remains weak, and that has led to a high level of imports in service of export-oriented production.

In 2024, the goods import value is estimated to have touched $405.53 billion, up 14.3 per cent on-year. In which, $114.6 billion was from Vietnamese enterprises, up 19.8 per cent and accounting for 28.3 per cent of total, and $290.94 billion came from foreign invested enterprises, up 12.3 per cent and responsible for 71.7 per cent.

|

Vietnam’s ample fiscal space continues to allow the government to provide targeted support to vulnerable segments of the economy, while expediting the disbursement of the budget for public investment. Nevertheless, revenue collection can be improved by broadening the tax base and enhancing compliance of tax laws. To expedite infrastructure development, the lack of consistency and clarity in the laws pertaining to public investment, which leads to slow disbursement, should be addressed. As inflation is well anchored and brought under control, monetary policy can remain accommodative to support a more broad-based recovery. To deepen financial market developments in tandem with rapid economic growth, the monetary policy reform should adopt a more market-based interest rate approach, while further enhancing exchange rate flexibility as a buffer against external shocks. To complement amended credit institution laws, the banking system should be enhanced by increasing the capital buffers of commercial banks, improving bad debt recovery, and strengthening the resolution frameworks. Macro-prudential measures such as loan-to-value ratio, debt service to income ratio, and credit concentration limits should be considered. Commercial banks should continue improving corporate governance and risk management. With the new real estate related laws coming into effect in August 2024, subordinate regulations should be rolled out promptly to boost housing market activities. To promote a more inclusive and sustainable development, it is important to upgrade infrastructure, upskill labour, and encourage firms to improve the quality of their products. The rapid digitalisation of the economy necessitates more action to prevent cyber threats. Stronger coordination among public agencies is necessary for climate change mitigation and adaptation. Enhancing the financial sustainability and transparency of the social insurance fund is crucial for Vietnam to prepare for the challenges posed by a rapidly ageing population.Source: ASEAN+3 Macroeconomic Research Office |