Will Cambodia be Southeast Asia’s next financial hub?

Will Cambodia be Southeast Asia’s next financial hub?

A new report by Cambodia Securities PLC considers significant factors that suggest the Kingdom has the potential to become Southeast Asia’s next major financial hub, based on the positive outlook of several renowned market insiders.

The analysis included the nation’s strong economic growth, political stability, absence of foreign exchange controls, accelerating infrastructure and labour force development, and an influx of foreign direct investment (FDI), as key indicators of strong future growth for investors within Cambodia’s capital market.

According to the report, trends suggest that Southeast Asia is likely to be the next global economic growth centre, as evidenced by large increases in international capital flows in recent years.

The International Monetary Fund (IMF) has also said that Cambodia is projected to lead the entire region in 2024 growth trends, with a gross domestic product (GDP) growth rate of 6.1 percent.

Thierry Tea, Vice President of OCIC Group and CEO of Negocia Capital, commented in the Cambodia Securities PLC report, that while Cambodia’s capital market is still in its early stages, it possesses immense growth potential.

This growth potential makes it an attractive opportunity for investors now, he said, with the possibility of substantial returns in the next ten years.

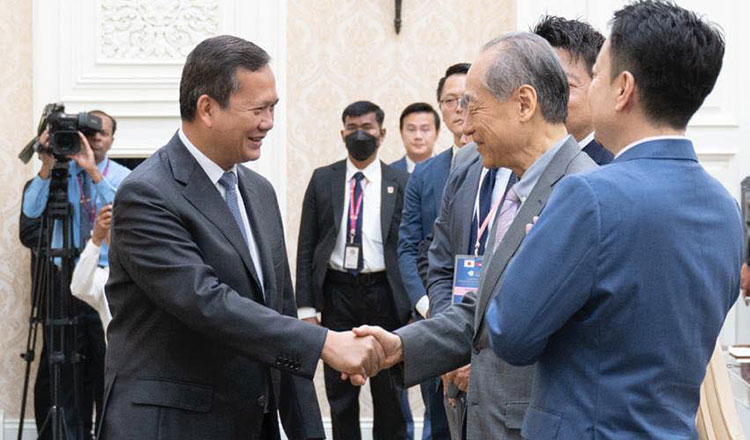

Tea also highlighted the significant efforts made by the newly instated Cambodian government, under Prime Minister Hun Manet, to drive national economic growth, and increasingly align with international economic standards.

Notably, he said that important progress has been made in areas such as digital transformation and international cooperation.

Tea also commended several major infrastructure development projects, ongoing and completed, including the Techo International Airport (TIA), Funan Techo Canal (FTC), the deepening of the Sihanoukville Autonomous Port (PAS), and major logistics connections including the Phnom Penh-Sihanoukville Expressway and the Phnom Penh-Bavet Expressway.

These projects, and others like them, will significantly modernize Cambodia’s logistics networks, Tea noted, strengthen its connections with the world, and provide efficient communication networks and stable logistics to facilitate financial operations and future expansions.

Ong Chee Keong, CEO of Singapore Global Trust, also agreed that the pace of development in Cambodia is impressive compared to global comparisons.

“It strengthens my belief that, with the united efforts of the government and the people, Cambodia can indeed become Southeast Asia’s next financial center,” he said.

Meanwhile, Chy Sila, Chairman of Sabay Digital Group and founder of Kirisu Milk, said that the country’s investment potential has also become increasingly broad in recent years, and now allows financial investors to diversify successfully in the market.

Chy said, “Twenty-five years ago, I invested in the restaurant industry; in early 2007, I ventured into the internet sector; later, I entered the film industry, and now I’m investing in agriculture.”

Supporting this diverse investment portfolio, Chy said that there are now vast potential business opportunities waiting to be uncovered in every sector in Cambodia.

“Especially with the new government’s ‘Pentagon Strategy’ clearly identifying agriculture as one of the key industries for development, it provides investors with clear direction and goals,” he said.

Another factor supporting Cambodia’s financial sector growth includes strong improvements to the domestic manufacturing sector, suggested the Cambodia Securities PLC report.

According to Jack Lee, founder and CEO of Smile Mall, “Cambodia’s manufacturing has evolved from an initial focus on textiles to include emerging industries with high added value, innovation, and competitiveness, such as auto parts, tires, and photovoltaic materials.”

Increasing foreign investment in the Kingdom’s manufacturing sector is driving Cambodia’s industrial and economic transformation, Lee said, and supporting a transition from labor-intensive industries to high-tech sectors.

This continued growth in the manufacturing sector allows a solid base for financial markets to flourish, suggested the report.