Positive growth signs with FDI influx

Positive growth signs with FDI influx

Foreign investment capital inflow to Vietnam is on a bright trajectory heading into 2025, especially from Northeast Asian markets.

In the final months of 2024, RSL Group, a promotion and consulting service provider, is busy welcoming delegations of investors from China to study opportunities in Vietnam.

RSL chairman Dao The Anh told VIR, “In the past two weeks, we have met many delegations of manufacturers and industrial park (IP) developers from China, including Sichuan and Chongqing provinces. Many of them are large-scale firms and vendors of eagles operating in Vietnam.”

The company took investors to visit IPs and industrial clusters to implement field surveys, and simultaneously organised investment promotion programmes with associations and the managing boards of IPs to connect them.

“Normally, Chinese investors are major manufacturers, but now we see that many Chinese industrial real estate developers are paying attention to building IPs in Vietnam to serve their business community. It is also a positive sign for foreign direct investment (FDI) in Vietnam,” Anh said.

China is just one of the markets in Northeast Asia to increase investment in Vietnam and simultaneously contribute a major part to the FDI statistics in the country this year.

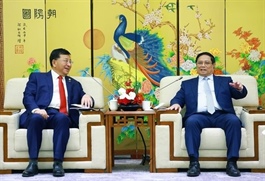

For example, South Korean industrial conglomerate Hyosung Group plans to inject another $4 billion into Vietnam. In mid-October, chairman Cho Hyun-joon had a meeting with Prime Minister Pham Minh Chinh in Hanoi.

“Vietnam will become a manufacturing hub in Asia and the country’s business climate is reliable. Hyosung is realising its commitment to placing its future for the next 100 years in Vietnam and positioning itself not only as a South Korean company but also as a Vietnamese one,” Hyun-joon said.

Statistics from the Foreign Investment Agency under the Ministry of Planning and Investment showed that, in the first nine months, four of the five largest foreign investors in Vietnam were from Northeast Asia with investment of $11.27 billion, equalling almost half of the FDI total.

Along with the overall contribution to investment, capital from the Northeast Asian market is also contributing to the breakthrough increase in FDI at many localities.

The northeastern province of Quang Ninh is one such example. It has reached its 2021-2025 FDI targets already and forecasts to entice $10 billion, equal to over 330 per cent of the initial plan, by the end of the period. The disbursed capital is expected to reach about $4.1 billion, equal to over 200 per cent of the initial goal.

The province is the production hub of many investors from the Northeast Asian market, namely Foxconn, Coremax, and Boltun from Taiwan; Pacific Construction Group and Xiamen Sunrise from China; Mitsubishi and Sojitz from Japan; and Daewoo E&C and Samsung Engineering from South Korea.

Currently, many foreign investors are waiting for administration procedure reform, and they say addressing institutional bottlenecks is crucial for attracting FDI into Vietnam.

Policy reforms, particularly those that foster a transparent, predictable, and favourable business environment, can help position Vietnam as a more appealing destination for international investors - especially amid the fierce competition among countries to capture FDI inflows.

Asset management group Dynam Capital said that removing the known barriers could unlock resources, improve economic performance, and boost investor confidence in Vietnam’s market. “A strong and adaptable institutional framework allows foreign-invested enterprises to operate more efficiently, optimising costs and minimising risks. Investors not only pursue profit but also seek long-term stability and predictability,” Craig Martin, executive chairman of Dynam Capital, told VIR.

Thus, a transparent, consistent, and modernised regulatory framework will alleviate concerns around administrative procedures, legal frameworks, and ownership rights.

“We anticipate that upcoming reforms will target three primary bottlenecks. The first thing is administrative procedures, such as streamlining and digitising processes to facilitate the licensing and implementation of foreign-invested projects. Simplified procedures will reduce both the time and costs of legal compliance, strengthening Vietnam’s competitiveness relative to other countries in the region,” Martin explained.

Protection of investor rights is the second expectation for this reformation, with ensuring consistency in regulations that safeguard ownership rights, assets, and profits. Regulatory stability will reassure investors about the security of their capital and the potential for optimising returns, Martin added.

At the eighth meeting of the 15th National Assembly, Party General Secretary To Lam emphasised the importance of removing issues relating to administration procedure in fostering power sources.

“The mindset of lawmaking needs to balance state management requirements with encouraging innovation, unlocking production capacity, and tapping all resources for development,” General Secretary Lam said. “The management approach must not be rigid. Otherwise, it will be impossible to unlock the full potential of production, attract domestic and foreign investment, or prevent barriers to development that lead to waste and missed opportunities for growth in the new era.”