Empowering green finance: enhancing legal framework for sustainable growth

Empowering green finance: enhancing legal framework for sustainable growth

The shift to a green and circular economy is an indispensable global trend for economic prosperity, environmental sustainability and social equity. However, Việt Nam's green credit market and bonds lag behind in supporting this green transition.

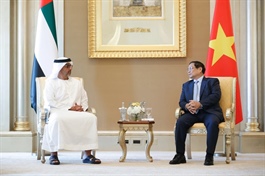

Delegates at the event on Thursday morning in Hà Nội. — VNS Photo Ly Ly Cao |

Việt Nam issued around US$1.16 billion in green bonds between 2019 and 2023, according to the Ministry of Finance (MoF).

Green credits now make up about 4.4 per cent of the total economic debt, but this issuance over the past five years remains significantly below the annual estimated capital requirement of $20 billion for green transformation and projects.

Insiders point to incomplete legal frameworks as a major obstacle hindering the growth of the green credit and bond markets.

The absence of clear environmental regulations, green project classification standards and specific State incentives and support for green credit and bonds in current Vietnamese laws has led to challenges in defining the sequence, procedures, roles and responsibilities of all stakeholders involved.

The green finance market is still in its infancy, with only a few cases showing early development, Dr Lê Xuân Sang, deputy director of the Vietnam Institute of Economics, told Việt Nam News as he was at a seminar themed 'Developing Green Financial Markets in Việt Nam: Barriers, Urgent Challenges, and Breakthrough Solutions' held in Hà Nội on Thursday morning.

According to Sang, income levels among citizens and the Vietnamese economy as a whole are not yet highly developed or broad enough to support a robust green finance market.

“This market demands notably high standards and seeks investors with specific, often distinct needs. They look not only for profit but also for social, environmental and governance contributions.

“In my view, only investors with substantial financial capacity can truly prioritise these selfless contributions to society and the environment.

"Việt Nam still has a relatively limited number of middle-to-upper-income investors, which affects demand,” he said.

On the legal side, Sang said that Việt Nam is only just beginning to establish frameworks, especially around green bonds and legal definitions.

Currently, only 15 countries globally currently have complete frameworks for green bonds, nine are still developing them and around five are actively discussing them. The legal environment is thus still incomplete, Sang added.

“Green finance is an advanced, intricate market with strict regulations that are challenging even for developed countries like those in the EU. Issuers often find themselves entangled in complex, detailed requirements, which can be overwhelming. For Việt Nam, with its lower development level and numerous ongoing priorities, the pace of green finance market development is, understandably, likely to progress gradually,” Sang said.

ADB Chief Economist in Việt Nam Nguyễn Bá Hùng said that in observing the green finance market, one of the most significant challenges in implementing green credit lies in the high capital requirements, long investment timelines, modest financial returns and inherent risks within green projects.

These factors create considerable obstacles in the selection, appraisal, evaluation and monitoring processes for green credit activities, making the implementation of green finance complex and demanding.

Creating a favourable legal environment

The wind and solar power plant complex in Thuận Nam District, Ninh Thuận Province. — VNA/VNA Photo |

Experts stress the importance of establishing clear mechanisms and policies to promote green financial products.

For instance, Hà Nội initiated a trial issuance of green bonds in the fourth quarter of 2016 for funding eco-friendly projects. While these bonds share issuance conditions with traditional bonds, green projects must adhere to the Ministry of Natural Resources and Environment (MoNRE) standards for certification.

The ADB expert recommended refining the legal framework to attract international funding through partnerships and multilateral financial bodies. This includes expediting the carbon credit certification process, launching a domestic carbon market and integrating it with global carbon markets. Additionally, issuing green bonds supported by eco-friendly budget management was suggested.

Deputy Director of the Institute for Financial Strategy and Policy at the MoF, Dr Nguyễn Thanh Nga, proposed solutions such as reviewing and enhancing the legal framework, policies and management mechanisms for green finance, particularly in the green bond sector.

To boost green credit growth, policies should entail incentives like interest rate reductions, loan extensions and tax exemptions for green bond investments, she said, adding that developing institutional investors and fostering an environment conducive to green funds and financial institutions in the green bond market are also pivotal actions.

Meanwhile, Sang from the Vietnam Institute of Economics said that a priority here is establishing a comprehensive legal framework that suits Việt Nam’s development stage and attracts a wide range of high-income domestic investors and especially foreign organisations.

“These are groups that prioritise green, sustainable and socially responsible investments over purely economic gains,” he said.

“Creating the right green investment categories is also crucial. We need a framework that isn’t overly complex but still sophisticated enough to attract investors by demonstrating clear benefits. It should help investors gauge potential risks, increasing their confidence to make bolder investments with higher expectations and lower perceived risks.

“Of course, this also depends on the broader economic investment channels available, which should set specific criteria and incentives for different types of investors.”

With this approach, Sang believes Việt Nam can foster balanced growth across the stock, bond, banking credit and carbon credit markets, leading to a more integrated and resilient green finance ecosystem.