Domestic steel prices set to rebound in Q4 amid easing pressure from Chinese market

Domestic steel prices set to rebound in Q4 amid easing pressure from Chinese market

Prices of domestic construction steel and hot rolled coil (HRC) are expected to recover significantly from the fourth quarter (Q4), boosting industry profits, according to experts.

Inside a warehouse of Hòa Phát Group. — Photo hoaphat.com.vn |

Construction steel and HRC prices in the Vietnamese market saw a 32 per cent and 28 per cent decrease respectively in the first eight months of 2024, according to data from MB Securities (MBS).

These drops were due to weakened demand, largely driven by a sharp decline in steel consumption in China and its real estate crisis.

MBS anticipates the real estate sector crisis to continue until the close of 2024, with steel price potential hinging on supply dynamics as steel mills start cutting production, tightening supply in Q4 2024.

In China, the government is restricting licences for coal-based steel mills to uphold environmental standards and limit new supply.

Meanwhile, steel producers in Hebei and Tianjin have trimmed production by 20 to 30 per cent as gross profit margins hit a notable low of negative 4 per cent, the lowest in five years.

Consequently, steel production in China decreased to 77.9 million tonnes in August from nearly 83 million tonnes in July, data from the China Steel Association (CISA) shows, while its steel imports dipped by 9 per cent year-on-year in July.

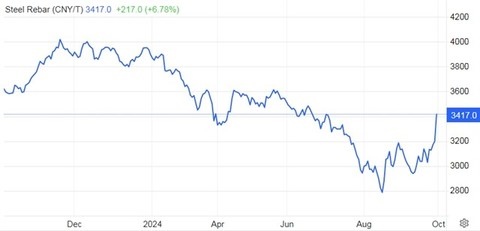

Tightening supply may have a positive impact on steel prices. In September, Chinese construction steel prices surged by 4 per cent from the August low. As a result, analysts anticipate a rebar price recovery from Q4/2024 in China due to decreasing oversupply pressures.

The recent announcement from China’s central bank about its biggest stimulus package since the pandemic is also providing some support.

Although the stimulus measures should stop steel market conditions from worsening, they are unlikely to boost short-term demand, as this year’s steel output remains on track to come in lower than 2023, ANZ analysts said.

Steel rebar futures on the Shanghai Futures Exchange rose to above CNY3,417 per tonne on Monday, reaching the highest level since July 3.

Source: tradingeconomics |

China recently faced Typhoon Bebinca, the most powerful storm recorded in 70 years, which caused damage to infrastructure projects in Shanghai and Tianjin. This is expected to boost China's steel demand in the short run as steel is used for housing reconstruction and infrastructure development.

On the other hand, Việt Nam's steel industry potential hinges on the promising recovery of the real estate market. The upsurge in residential supply and public investments has been instrumental in driving the revival of the construction steel sector.

US-based commercial real estate services and investments provider CBRE said that the supply of apartments in Hà Nội and HCM City is projected to rise by 30 per cent and 20 per cent year-on-year, respectively.

Additionally, there is a 12 per cent year-on-year growth in public investment disbursement, totalling approximately VNĐ638 trillion (US$25.9 billion).

This surge is fuelled by the government's efforts to enhance transportation infrastructure development to support economic advancement.

The securities firm forecasts a positive upturn in Việt Nam's construction steel and HRC prices from Q4/2024 onwards, as pressures from China ease.

Projections indicate that construction steel prices could average $571 per tonne, up 4 per cent over last year, while HRC prices may dip by 7 per cent to $556 per tonne due to Chinese steel influences in the first half of the year.

Looking ahead to 2025, analysts anticipate a 7 per cent and 6 per cent increase in construction steel and HRC prices respectively, reaching $611 and $590 per tonne.

In 2025 and 2026, construction steel prices are expected to climb by 7 per cent and 8 per cent, reaching $608 and $657 per tonne, respectively.

MBS is optimistic about the growth prospects of industry leaders Hòa Phát Group (HPG), Hoa Sen Group (HSG) and Nam Kim Group (NKG).

They expect substantial profit increases for HPG and HSG in the coming years, driven by production growth and improved margins.

Net profits for HPG are projected to surge by 74 per cent and 51 per cent in the 2024-2025 period, while the value of HSG is anticipated to grow 2.33 per cent and 6 per cent in 2024.

NKG is anticipated to benefit from positive market conditions in the EU and the US, positioning it as a key player in the industry, said MBS.

The company's post-tax profits are expected to embark on a recovery trend, with growth rates of 287 per cent and 111 per cent in the 2024-2025 period, driven by revenue upticks and improved gross profit margins.