Vietnam posts trade surplus of over US$8 billion in 5 months

Vietnam posts trade surplus of over US$8 billion in 5 months

The country, however, ran a trade deficit of US$1 billion in May, the first in nearly two years.

Vietnam maintained a positive trade balance of US$8.01 billion in the first five months of the year, with exports increasing by 15.2% to $156.77 billion and imports rising by 18.2% to $148.76 billion, according to the General Statistics Office (GSO).

Tan Cang Port, Haiphong. Photo: T.Binh/The Hanoi Times |

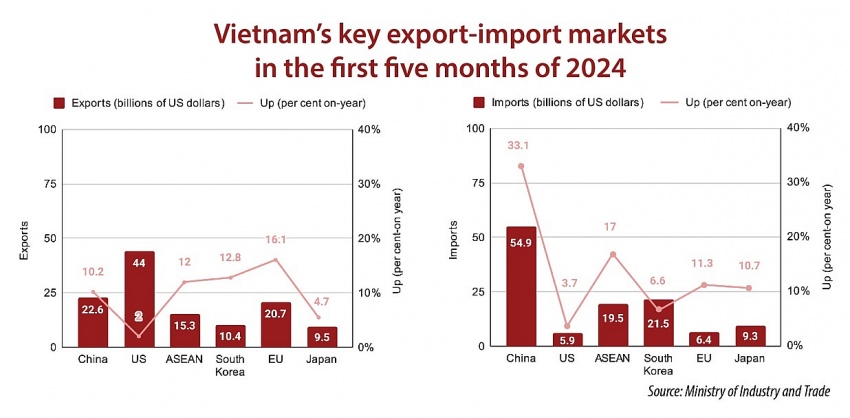

Regarding the import and export markets in the first five months of 2024, the US was Vietnam's largest export market, with an estimated turnover of $44 billion. China maintained its position as Vietnam's largest import market, with an estimated turnover of $54.9 billion.

Notably, the estimated export turnover of goods in May reached $32.81 billion, up 15.8% on year. However, imports accelerated at a faster pace, growing by 29.9% year-on-year to an estimated $33.81 billion.

As a result, Vietnam experienced a trade deficit for the first time in nearly two years. The last recorded trade deficit was in May 2022, at $2.02 billion.

Research organizations view this return to a trade deficit positively, suggesting that it indicates an increase in the purchases of raw materials and supplies by manufacturing enterprises.

According to the GSO, while the return to a trade deficit is noteworthy, it is not unexpected. "The trade deficit, driven by a sharp increase in imports of equipment, machinery, and raw materials for production, is a sign that industrial production will recover more positively in the near future," the agency commented.

Specifically, the import value of certain goods for manufacturing and processing saw significant increases, such as phones and parts (55.1%), steel (50.1%), electronics, computers and components (39.3%), gasoline (34.6%), raw materials for textiles, garments, and footwear (33.7%), and plastics (31.4%).

This increase in the import of raw materials and fuels comes against the backdrop of a continued improvement in the industrial production index (IIP), which is estimated to rise by 8.9% in May over the same period last year. Notably, several export-oriented industries saw significant growth, such as rubber and plastics (24.1%), wood processing and production (23.0%), electrical equipment (19.4%), electronics, computers, and optical products (17.4%), and apparel (9.4%).

Domestic consumption also showed positive signs. The total retail sales of goods and consumer services last month was estimated to have risen by 9.5% year-on-year.

A survey of Vietnam's Purchasing Managers' Index (PMI) released by S&P Global on June 3 also showed continued growth in Vietnam's manufacturing sector in May, with input purchasing activities increasing for the second consecutive month.

"The number of new orders surged amid signs that demand growth is being maintained, driving strong output growth in May," Andrew Harker, Economics Director at S&P Global Market Intelligence, assessed.

A newly updated macroeconomic report from ACB Securities (ACBS) suggested that the trade deficit should be viewed more positively than negatively. "At first glance, this may appear to be bad news due to increased pressure on the exchange rate. However, a thorough analysis of each data point reveals this could be a positive signal for the economy," the report stated.

ACBS pointed out that the strong import growth, especially in electronics, electrical appliances, and textiles, could be a precursor to growth in exports in these key sectors. Last year, slow import growth hampered the recovery of exports.

The brokerage predicts that the imports of electronic components, machinery, and equipment, which increased by 20-50% in May alone, will help boost exports of these items by 20-30% in the second half of 2024.

Similarly, the sharp rise in imports of raw materials for textiles and garments (33% in May and over 20% in the first five months) indicates that orders will rise strongly over the remainder of the year. The increased import of steel can be seen as a move to stockpile cheap goods to meet growing consumption demand and to hedge against fiscal risks.