Buyers no longer line up for gold purchases at banks as banks enable online registrations

Buyers no longer line up for gold purchases at banks as banks enable online registrations

Long queues of gold buyers were no longer seen in front of the designated sites of four State-owned commercial banks on Monday morning, as banks enabled online registration for gold purchases.

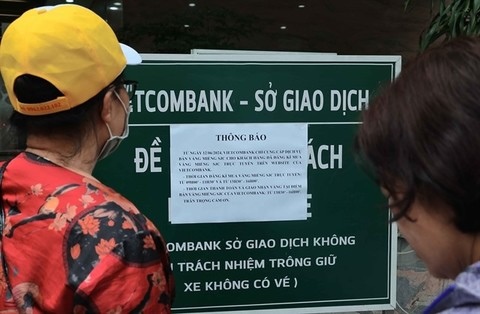

An announcement posted by Vietcombank to sell gold online. Long queues of gold buyers were no longer seen in front of the four designated State-owned commercial banks on Monday morning, with online registration for gold purchases now activated. — VNA/VNS Photo Hoàng Hiếu |

From June 17, two more banks, the Vietnam Bank for Agriculture and Rural Development (Agribank) and the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV), enabled registrations for SJC-branded gold purchases on their websites.

The Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) started this way of buying and selling on June 12.

Gold buyers can now access these banks’ official websites to register for gold purchases. After that they will get an email about the location, time and date for their transactions.

The banks say they can only sell gold bars to those successfully registering on the websites. If buyers come 30 minutes late, the registrations can be cancelled.

On Monday morning, only a few potential customers arrived at the banks’ branches to buy gold, but they were sent away by bank employees and told to register online.

The move came two weeks after the banks were directly selling SJC gold bars, leading to large crowds of customers queuing at designated sites.

The Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) is expected to implement online gold purchase registration within this week.

Earlier, the State Bank of Việt Nam (SBV) authourised Agribank, Vietcombank, Vietinbank, BIDV, along with the State-owned Saigon Jewelry Company Limited (SJC) to purchase SJC gold bars from the SBV and sell to the public. The move aims to promote market stability and ensure a balanced gold market.