Higher pig prices lift farmers' expectations

Higher pig prices lift farmers' expectations

Live hog prices in the domestic market have experienced a bullish trend since the beginning of the year, raising investors' expectations for pig farming business profits.

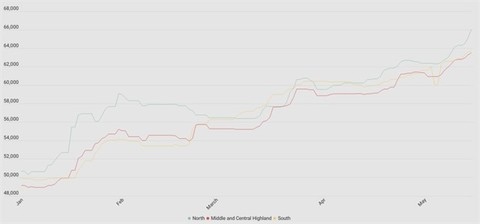

Live hog prices in the three regions. Domestic hog prices are now trading around VNĐ64,000 - 68,000 per kg. Data and graphic: Ly Ly Cao |

Statistics show that the local live hog prices rose about 30 per cent since the start of 2024.

Vietcombank Securities Company (VCBS) said that there are some primary factors contributing to this surge in prices, with the limited pork supply in the northern region running low, while the price equilibrium of live hogs across the three regions has resulted in weak pig transportation from the central and southern regions to the north.

Also, although domestic pig prices are higher than those in Thailand, pigs are not yet being imported into Việt Nam from the nearby country.

Speaking at the General Meeting of shareholders this year, Nguyễn Như So, Chairman of the Board of Directors of Dabaco Group, said he expects pig prices to continue inching higher, primarily due to a significant decline in supply compared to demand last year.

And it will take at least 18 months to overcome the supply shortage, he added.

Positive results

Given a higher price environment, many enterprises in the industry reported bullish changes in business activities.

In the first quarter of 2024, Dabaco’s net revenue reached over VNĐ3.25 trillion (US$127.6 million), marking 40.6 per cent growth year-on-year.

Despite a rise in the cost of goods sold, the pig farming enterprise in Bắc Ninh Province recorded a remarkable gross profit of VNĐ348 billion during the same period. Last year, it posted a loss of over VNĐ70 billion.

After deducting expenses, its profit after tax was VNĐ72.6 billion, while it lost VNĐ320.7 billion in the same period last year.

In a quarterly financial statement, BAF Vietnam Agriculture JSC also reported a robust business performance, witnessing a strong gain in net revenue of 58.2 per cent over last year to VNĐ1.29 trillion.

The company’s profit after tax was over VNĐ118.6 billion in the first quarter, 30.4 times higher than that of the first quarter of 2023.

However, Hoàng Anh Gia Lai JSC has missed the rising wave of live pig prices.

The company's pig segment generates less than VNĐ6 billion in gross profit.

In the first quarter, Hoàng Anh Gia Lai reported a net revenue of VNĐ1.24 trillion, down 27 per cent year-on-year. Fruit sales constituted the majority of its revenues, amounting to VNĐ887 billion and experiencing a notable 25 per cent increase.

But there was a significant drop of 48 per cent in revenue from pig sales, reaching only VNĐ292 billion.

The company explained that the delay in rebuilding its pig herd since 2023 was due to allocating resources to other business areas.

Workers feed pigs at a Dabaco farm. — VNA/VNS Photo |

On the stock market, shares of the three pig-raising companies hit ceiling prices on May 27 and extended rallies at the beginning of this week.

The surging momentum of livestock stocks has been recorded since mid-April. In just over a month, the stock prices of Dabaco (DBC), Hoàng Anh Gia Lai (HAGL) and BAF Vietnam Agriculture (BAF) have all experienced increases of around 20 per cent.

Notably, DBC stock has reached its highest price in over a year, approaching the historical peak achieved in early March 2022. BAF is also currently trading at a 21-month high, while the price of HAG stock is at its highest level since the start of February.

Accelerating herd restocking

Amid the upward trend in pork prices, numerous livestock enterprises have been intensifying their efforts to restock their herds, anticipating price increases throughout the year.

Since the end of April, Dabaco has imported a new batch of breeding pigs, which were transported to Việt Nam by airplane. The expansion of the breeding pig population has led to the highest level of pig farming productivity in the company's 28-year history.

Last year, despite a challenging disease situation, Dabaco took a bold step by importing 10,000 breeding pigs.

"If we hadn't taken the initiative to import pigs last year, Dabaco could have faced a difficult situation this year," the Dabaco Chairman said.

He also said that the company’s target is to secure enough land to expand the sow herd to approximately 90,000 heads and the fattening pig herd to about 1.5 million by 2025, at the latest by 2026.

BAF has announced its intention to swiftly launch seven additional farm projects. Of these, the Hải Đăng farm cluster, consisting of 5,000 breeding sows and 60,000 fattening pigs, the Tân Châu farm with 30,000 fattening pigs, and the Tâm Hưng farm with 5,000 breeding sows have already started operating as of March.

The company also plans to initiate seven more projects in 2024, including six livestock farms and one animal feed production factory in Bình Định Province.

As a result, BAF aims to double its total herd size by the end of 2024, reaching 75,000 breeding sows and 800,000 fattening pigs compared to last year.

Meanwhile, HAGL, although progressing at a slower pace, possesses advantages in terms of farm area and self-sufficiency in banana feed supply.

It has resumed investing in expanding its herd, utilising existing infrastructure and farms. Products are expected to be available within the next four to five months.

The company has significant ambitions for 2024. With the support of LPBank, HAGL anticipates recording profits starting at the end of this year. If pork prices remain favourable in 2025, the company is confident it will reap substantial benefits.

HAGL is beginning herd expansion with the financial support of LPBank, including a loan of VNĐ300 billion for increasing pig numbers, said Đoàn Nguyên Đức, the company's Chairman.