Vietnam’s manufacturing sector sees rising employment for first time in 4 months

Vietnam’s manufacturing sector sees rising employment for first time in 4 months

Confidence reached a one-year high as close to 55% of respondents expressed optimism.

Sustained growth in the manufacturing sector prompted a renewed increase in employment, marking the first rise in four months, according to S&P Global.

Electronics production at MBT Electrical Equipment Company. Photo: Hoai Nam/The Hanoi Times |

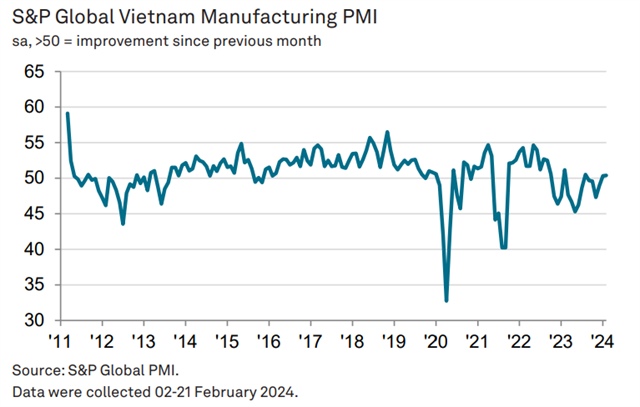

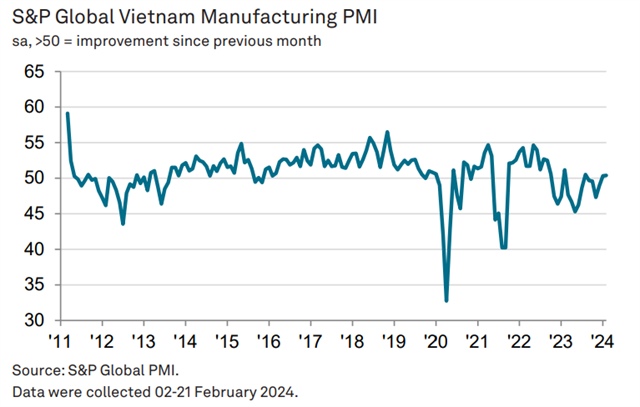

Vietnam’s Manufacturing Purchasing Managers’ Index (PMI) posted 50.4 in February, up from 50.3 in the previous month and above the 50 no-change mark for the second consecutive month.

A reading below the 50 neutral marks indicates no change from the previous month or even contractions; above 50 points means an expansion.

“Vietnamese manufacturers were able to build on the return to growth seen in January with a further expansion in February. Particularly positive elements of the latest PMI survey were renewed job creation and the strongest business confidence for a year,” said Andrew Harker, Economics Director at S&P Global Market Intelligence.

S&P report noted that new orders increased modestly for the second month running, with some survey respondents linking higher total new business to improved new orders from abroad. The rate of growth in new export orders slowed, however, and was only marginal.

Consistent with the picture for new orders, output growth was recorded for the second consecutive month in February. The latest rise was modest and broadly in line with that seen in January. Production increased in the consumer and investment goods sectors, but the intermediate goods category saw a reduction, it added.

Higher new orders encouraged manufacturers to expand their staffing levels for the first time in four months and to the greatest extent in a year. That said, a number of respondents indicated that new hires had only been on a temporary basis.

With employment up and new order growth remaining relatively muted, firms were able to deplete backlogs of work for the first time in three months.

In part, firms used stocks of finished goods to help meet order requirements, thereby resulting in a further depletion of post-production inventories. In fact, the latest fall was the fastest in four months, and joint-sharpest since January 2023.

|

Manufacturers also opted to use up stocks of purchased inputs in February as opposed to buying new items. Purchasing activity decreased marginally for the fourth month running, while the latest fall in stocks of inputs was the most pronounced since June 2021.

Where firms did purchase inputs, they were faced with lengthening suppliers' delivery times again in February amid reports of shipping delays. The rate of deterioration in vendor performance was only marginal, however.

Meanwhile, shipping delays coincided with reports of higher transportation costs, in turn often linked to rising oil prices. As a result, input costs increased markedly again in February, albeit to the least extent since last September. Investment goods producers saw a particularly sharp rise in input costs.

Some manufacturers passed on higher input costs to their customers, leading to a slight increase in selling prices following a marginal decrease in the previous survey period. The slight nature of the rise reflected efforts at some firms to limit price rises amid competitive pressures.

In particular, production expansion plans and work on new products contributed to a jump in business confidence midway through the first quarter, with positive sentiment regarding output also reflecting expected new order growth. Confidence reached a one-year high as close to 55% of respondents expressed optimism.

Manufacturers will need to see stronger and sustained growth of new business before they can be confident enough to invest in inputs and start to raise their selling prices more in line with their own cost burdens.