Việt Nam among the most sought-after emerging markets: survey

Việt Nam among the most sought-after emerging markets: survey

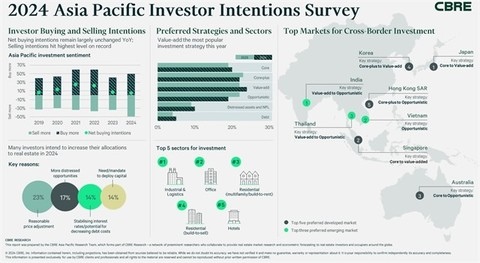

Việt Nam is the second most sought after emerging market for value-added and opportunistic investments, according to the recently released 2024 CBRE Asia Pacific Investor Intention Survey.

Việt Nam is one of the top markets property investors are looking at. — Photo Courtesy of CBRE Vietnam |

According to the survey done in November and December, Việt Nam is just behind India in terms of attractiveness to investors.

Việt Nam presents a unique landscape where portfolios consisting of income-producing assets are scarce and typically not available for sale.

As a result, most investors focus their attention on industrial and office assets just like elsewhere in the Asia-Pacific.

Its robust economy and export-oriented strategy have propelled trade, thereby underscoring the critical importance of efficient logistics and supply chain management.

Investors recognise these requirements, further driving the demand for industrial assets.

Residential development sites also continue to generate strong interest from foreign developers and buyers.

Many are actively exploring opportunities in distressed assets and properties owned by landlords facing legal challenges or limited access to funding.

Duy Nguyễn, investment properties director at CBRE Vietnam, said: "Investors with a long-term view on the potential of Việt Nam's economy and ready to deploy capital are most likely to reap the benefits of the repricing and decompression of asset yields.

“This is particularly true when sellers are seeking to exit at the conclusion of their investment window."

Regionally, central bank policy rates and economic uncertainty are the top two concerns for investors in 2024, though these worries have significantly eased compared to last year.

The mismatch in pricing expectations between buyers and sellers remains a major concern for investors despite repricing occurring in most markets and sectors in the Asia Pacific in 2023.

The survey uncovered persistently weak buying intentions across Asia Pacific while selling intentions hit the highest mark since surveys began.

While the interest rate hike cycle has come to a halt in major global markets, investors are waiting for indications that the current repricing cycle has finished before deploying capital.

Investors in most markets will therefore continue to adopt a wait-and-see approach in the first half of 2024.

But amid growing expectations that the US will begin cutting rates in the second half, with Asia Pacific central banks following suit, commercial real estate investment activity should accelerate in the second half of the year.

The survey said Japan retained its position as the most preferred developed market for cross-border investment for a fifth consecutive year. Singapore and Australia followed in second and third places.

Investors remain attracted to highly liquid markets with stable incomes.

With most investors in the Asia Pacific looking for double digit returns, investors have turned to value-added and distressed assets/debt solutions.

Value-added strategies topped the list for preferred investment strategies in 2024.

Over 60 per cent of investors, the bulk of them private equity funds, real estate funds and real estate investment trust (REITs), intend to retrofit existing buildings to be more sustainable or ESG-compliant in 2024, affirming their preference for value-added strategies.

The survey asked over 500 participants a range of questions related to their buying intentions, perceived challenges and preferred strategies, sectors and markets for the coming year.