Cambodia boosts growth with local rating agency

Cambodia boosts growth with local rating agency

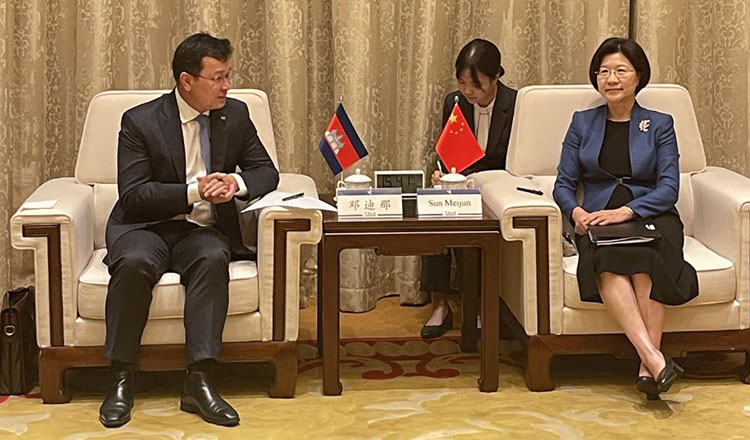

Sou Socheat, director-general of the Securities and Exchange Regulator of Cambodia (SERC), stressed the importance of the country’s local rating agency, noting the crucial nature of such mechanisms in earning investors’ trust and enhancing the credibility of corporations.

He said the institutions facilitate the delivery of independent and transparent ratings; however, he added that domestic agencies must adopt best-practice rating processes and methodologies that are on par with regional peers.

At a February 7 technical assistance workshop for the Rating Agency of Cambodia Plc (RAC), the country’s first locally-owned credit rating firm, Socheat pointed out that many countries benefit from having local assessors in their capital markets, as they provide professional ratings for listed firms and are essential for the success of the capital market.

“The intervention from the regulator, together with the development partner in financial literacy in rating, will build a robust and sustainable financial ecosystem. When companies are well-prepared and ready to gain the best credit rating, this will lead to sustainable economic growth in Cambodia,” he said.

In July 2022, SERC issued an operating licence to the RAC, enabling it to offer credit rating services in the securities sector and to financial institutions, marking an important milestone in the development of the country’s capital markets, as per the regulator.

Sisowath Chakara, executive director of RAC, highlighted that the establishment of the entity is an important step in building the systems and expertise needed for efficient credit risk assessment in the Cambodian capital markets.

He underscored that well-functioning markets are vital for economic growth.

Chakara previously told The Post that there is an ‘information asymmetry’ in financial markets, where investors are at a disadvantage compared to issuers due to having less information.

Credit rating agencies, he said, help address the issue by providing access to better information, thereby improving the quality and quantity of information available to financers.

He also noted the importance of the agency in educating the public and training companies and financial institutions, given the Cambodian populace’s relative unfamiliarity with financial markets.

“The objective of the RAC is to benefit investors and borrowers in the securities market. The availability and quality of information are key,” Chakara said.

“Academic literature has demonstrated that investors demand a higher premium to offset information asymmetry, resulting in higher funding costs for borrowers. RAC can help reduce these costs and increase market participation by enhancing the information available,” he added.

Vivek Rao, principal financial sector specialist at the Asian Development Bank (ADB), who attended the workshop, stressed the significance of ratings in expanding investments and their role in promoting market liquidity.

“Credible ratings based on international best practices and backed by rigorous data collection and analysis will reassure issuers, investors and guarantors,” he said.

According to Socheat, the regulator had licensed and accredited 120 securities companies to operate and provide services as of December 19, 2023.

This included 13 securities companies; four financial and two investment advisory firms; three securities distributors; five central counterparties; 22 derivatives brokers; 16 fund and eight asset management companies; four companies engaged in selling, repurchasing or repaying; and three fund managers; in addition to granting permission and recognition to 40 other companies.

As of December 13, the regulator had issued a total of 45,870 investor identification numbers.