Int’l reserves surge amid economic growth

Int’l reserves surge amid economic growth

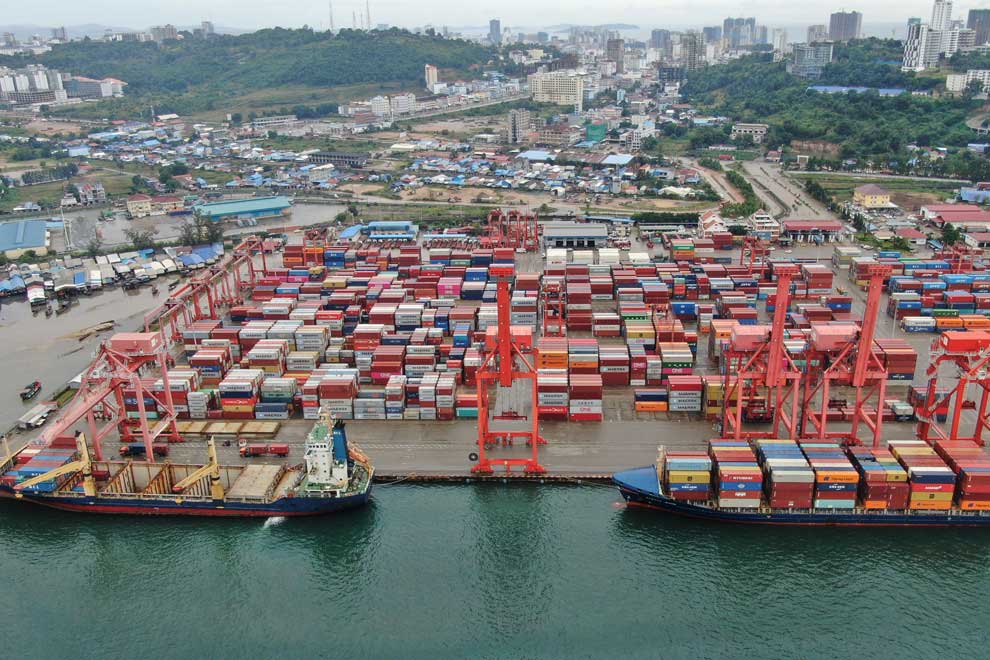

CAMBODIA’S international reserves are projected to surge past $21 billion in 2024 from more than $19 billion in the previous year, which could sustain the import of crucial goods and services for more than six months should the country face crisis, according to the Ministry of Economy and Finance.

Economists view the increase as not only a financial boost but also a sign of the country’s growing economic strength and rising foreign direct investment (FDI).

According to the ministry’s Budget in Brief for the fiscal year 2024, the country’s economy is expected to expand by approximately 6.6% in 2024. The growth is predicted to elevate the current gross domestic product (GDP) to around 14.957 trillion riel (approximately $3.659 billion).

International reserves for 2024 are forecasted to be $21.28 billion, up from an estimated $19.44 billion in 2023 and $17.8 billion in 2022.

The ministry estimates that the reserves could support the importation of goods from international markets for 6.6 months, a decrease from 6.9 months in 2023 but an increase from 6.1 months in 2022.

It noted that despite enjoying peace and political stability and an economy that is recovering and normalising post-pandemic, the country continues to face several internal structural challenges that hinder economic diversification and limit competition.

“On the other hand, Cambodia, like other countries in the world, is still beset by high risks and uncertainties from major external factors, such as geopolitical tensions, the slowdown in global economic growth due to trade wars, the continued tightening of monetary policy in developed countries in response to inflationary pressures, the prolonged Russia-Ukraine war, the Israel-Hamas conflict and China’s sluggish economic growth. In addition, the ongoing threat of climate change continues to have severe adverse effects,” stated the report.

“Overall, these risks and challenges have been affecting international trade and investment flows to Cambodia, which could impede the country’s economic recovery efforts and affect its socio-economic development path towards becoming an upper-middle-income country by 2030,” it added.

Hong Vanak, an economics researcher at the Royal Academy of Cambodia, explained that international reserves are funds set aside by governments for use in crises to pay for essentials like food, medicine or fuel to ensure social sustainability and the economy.

He noted that the increase in capital investment reflects the state of direct investment in the Kingdom, as well-functioning economic activities enable the government to augment reserves.

“International reserves are crucial for governments to ensure social sustainability in times of crises such as economic downturns, natural disasters, rising inflation and outbreaks of infectious diseases like Covid-19,” he elaborated, adding that these funds provide governments with a buffer to temporarily manage difficult situations.

He highlighted that although the amount of international reserves has increased, the number of months that they could sustain the country has decreased, likely due to fluctuations in exchange and inflation rates.

Anthony Galliano, CEO of Cambodian Investment Management Co Ltd, said the Kingdom maintains higher-than-normal international reserves for a developing country, which positions it in a strong financial stance.

“This is particularly prudent given the increasing loans in Cambodia. High levels of international reserves help mitigate liquidity risk, manage short-term debt and facilitate lower interest rates. All of these factors have positively impacted the recent issuance of sovereign bonds,” he explained.

The World Economic Forum (WEF) defines foreign exchange reserves, or international reserves, as cash and other assets such as gold, held by the central bank and other financial institutions, including the International Monetary Fund (IMF).

According to the WEF, the reserves play a crucial role in maintaining a country’s economic stability and financial security.