Second-half activities place positive path for economy

Second-half activities place positive path for economy

Fuelled by an uptrend in growth so far this year, Vietnam is optimistic regarding its economic performance for 2023 as a whole, especially in domestic production.

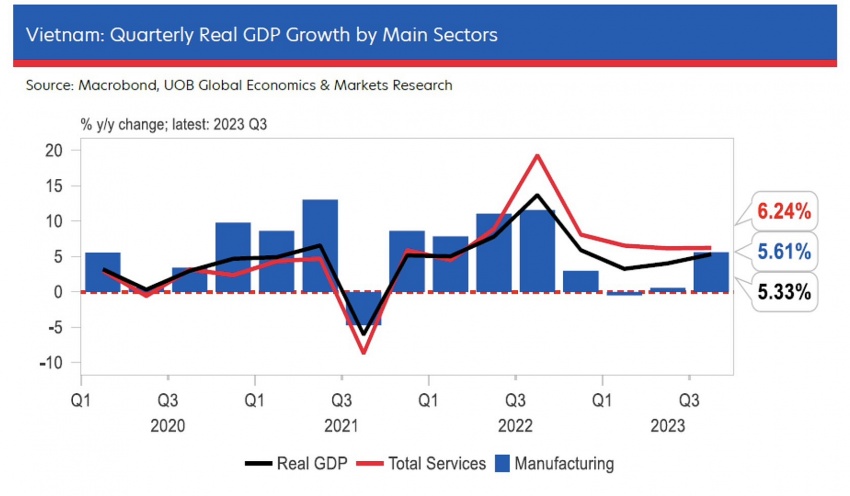

The General Statistics Office (GSO) last week reported that after growing 3.32 per cent in Q1 2023, the Vietnamese economy bounced back to 4.14 per cent on-year in Q2, and 5.33 per cent on-year in Q3.

The nine-month rate is 4.24 per cent as compared to the same period last year. In which, the agro-forestry-fishery sector expanded 4.43 per cent, while the on-year rates of the industry and construction sector and the service sector were 2.41 and 6.32 per cent, respectively.

“The socioeconomic situation has been bouncing back on a quarterly basis since June. The economy’s production and business activities in Q3 have witnessed a significant rise on-year,” said GSO general director Nguyen Thi Huong. “Many sectors have begun to recover, especially industrial production.”

In the first nine months of the year, the added value of the industrial sector increased 1.65 per cent on-year, in which that of the manufacturing and processing sector expanded 1.98 per cent.

Breaking down the situation, growing production has resulted in rising demand for electricity and fuel. The Ministry of Planning and Investment reported that the economy’s production and distribution of electricity in the first nine months ascended 2.9 per cent. The rate dropped 0.32 per cent in Q1, before bouncing back to 1.79 per cent in the first half of the year.

Vietnam Electricity (EVN) reported that all of its activities in August “have been ensured, meeting increased demand for electricity of the economy.” The group’s total electricity output in August reached 25.6 billion kWh, up 7.2 per cent on-year. Cumulatively in the first eight months, the figure hit 186.3 billion kWh, up 2.7 per cent on-year.

In which, the ratios of electricity contributors vary, with hydroelectricity (48.45 billion kWh, accounting for 26), coal-fired power (88.08 billion, 47.3 per cent), gas turbines (19.26 billion, 10.3 per cent), oil-fired power (1.23 billion, 0.7 per cent), renewable energy (26.35 billion, 14.1 per cent), and imported electricity (2.62 billion, 1.4 per cent).

Also, in January to the end of August, EVN commenced construction of 41 works and put into operation 54 power projects, the group reported.

In another case, PetroVietnam reported in the first eight months of this year, it completed all plans assigned, including exploitation of crude oil of 7.06 million tonnes – exceeding the eight-month plan by 14.5 per cent.

In which, domestically exploited crude oil surpassed the goal by 17.3 per cent; overseas-exploited crude oil surpassing 3 per cent; production of 108,000 tonnes of nitrate, exceeding 5.2 per cent; electricity production of 1.07 billion kWh, surpassing 4.2 per cent; production of 588,600 tonnes of liquefied petroleum gas, exceeding 21 per cent.

PetroVietnam’s total revenue in the period is estimated to reach VND575.8 trillion ($24.3 billion), exceeding the initial plan of 27 per cent. Its contributions to the state budget stand at an estimated VND90.5 trillion ($3.8 billion), which is 16 per cent exceeding the whole-year goal.

PetroVietnam’s pre-tax profit is estimated to surpass the entire-year target by 8 per cent.

However, according to the GSO, despite some signals for recovery, businesses’ confidence has yet to strongly recover due to difficulties.

So far this year, Vietnam saw 116,300 newly established businesses registered at $45.85 billion, using nearly 748,900 workers. This was up by 3.1 per cent in the number of enterprises but down by 14.6 per cent in registered capital and down by 1.2 per cent in the number of employees – as compared to the same period last year.

If another $62.71 billion registered by 35,600 operational enterprises is included, the total capital supplemented into the economy in the period stood at $108.57 billion – down by 34.2 per cent on-year.

Meanwhile, the first nine months also saw 75,800 businesses with halted operations – up 21.2 per cent as compared to the corresponding period last year; 46,100 enterprises stopped operations and waited for dissolution procedures – up 26.9 per cent; and 13,200 enterprises completed such procedures. On average, about 15,000 businesses were kicked off from the market every month.

Global analysts FocusEconomics told VIR that Vietnam’s industrial production will likely contract 3.1 per cent in 2023, before expanding 6.7 per cent in 2024.

“The economy is projected to miss the government’s 6.5 per cent growth target this year due to subdued private spending and exports. However, stronger public spending and looser monetary policy mean Vietnam should remain among ASEAN’s top performers,” FocusEconomics said. “High levels of private debt and factories relocating from China are key factors to watch. We see GDP expanding 5 per cent in 2023, and 6.3 per cent in 2024.”

Meanwhile, in its recent global research report on Vietnam’s GDP for Q3, Standard Chartered Bank forecasts Vietnam’s Q3 GDP growth to pick up to 5.1 per cent on-year. A rebound is expected in H2, after early signs of a recovery in Q2. The bank remains 2023 GDP growth forecast at 5.4 per cent.

According to the international bank, September data is likely to show a slight improvement over August, supported by retail sales. The bank expects September retail sales growth to stay robust at 8.2 per cent on-year, exports is predicted to fall 6.2 per cent on-year, imports to fall 7 per cent, and industrial production growth to pick up to 3.2 per cent.

The trade surplus may narrow to $1.3 billion. Inflation may rise again to 3.2 per cent on-year from 3 per cent in August. Education, housing and food prices have driven inflation recently, while transport inflation has eased.

The International Monetary Fund last week also said that Vietnam’s growth in 2023 is expected to accelerate and reach 4.7 per cent for the whole year, assuming that the real estate turbulence is contained, and exports and credit growth pick up gradually in the second semester and in 2024.

Meanwhile, according to the Asian Development Bank (ADB), Vietnam’s economic growth is expected to slow down to 5.8 per cent in 2023 and 6 per cent in 2024, compared to the April 2023 forecast of 6.5 and 6.8 per cent respectively, mainly due to weak external demand.

The Asian Development Outlook (ADO) September 2023 released last week noted that the main forces impacting the economy have been the global economic slowdown, monetary tightening in some advanced countries, and the disruption caused by exacerbated geopolitical tensions.

“Weak external environment, including from a subdued recovery in China, has hampered export-led manufacturing, thus shrinking industrial production in Vietnam,” said ADB country director for Vietnam Shantanu Chakraborty.

“However, the economy remains resilient, and recovery is expected to pick up in the near term, driven by strong domestic consumption, which is supported by moderate inflation, an acceleration of public investment, and improved trade activities.”