Vietnam’s GDP growth forecast to hit 4.7% in 2023: IMF

Vietnam’s GDP growth forecast to hit 4.7% in 2023: IMF

Fiscal policy can have a greater role in support of economic growth and the poorest and most vulnerable.

The International Monetary Fund (IMF) lowered its GDP growth forecast for Vietnam this year to 4.7% from 5.8%, before picking up again.

Quality control process at Phu Dong Dairy Processing Cooperative, Gia Lam District, Hanoi. Photo: Lam Nguyen/The Hanoi Times |

The assessment was mentioned in the IMF's report after the head of an IMF team, Paulo Medas, visited the country from June 14-29 to hold a discussion for the 2023 Article IV consultation with Vietnam.

Medas noted that Vietnam's post-Covid-19 pandemic economic recovery was interrupted by various domestic and external challenges.

“The recovery was interrupted by strong external and domestic headwinds," Medas said.

He explained that exchange rate pressures mounted throughout 2022 as global interest rates rose sharply. A major domestic bank suffered a deposit run and was placed under the State Bank of Vietnam (SBV)’s control. Financial stress among real estate developers, especially those highly leveraged, emerged and the corporate bond market froze.

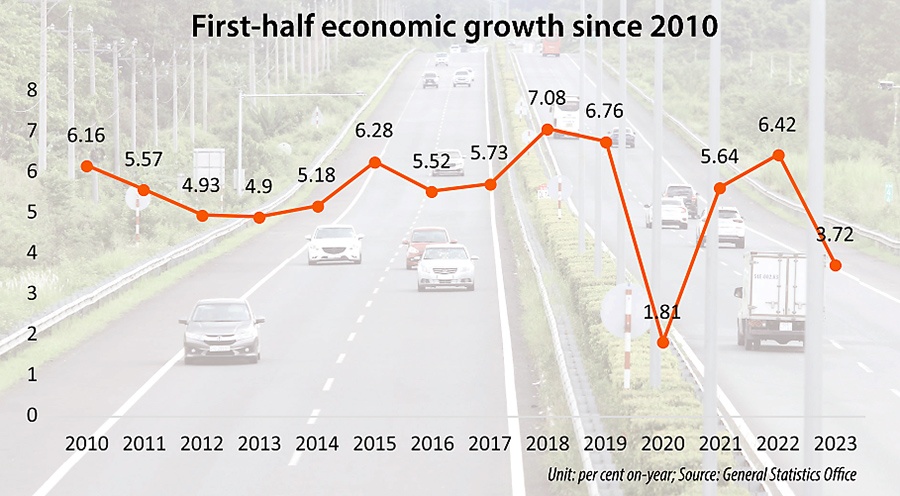

The economy was further hit by a sharp deterioration in external demand since late 2022, with exports declining by 12% in the first five months of 2023. Liquidity and inflationary pressures have eased recently, but growth slowed down significantly in the first half of 2023, he added.

The IMF expects Vietnam's economic growth to recover in the second half of 2023, reaching approximately 4.7% for the full year, supported by a rebound in exports and expansionary domestic policies. Inflation is also expected to remain contained below the SBV’s 4.5% ceiling, it noted.

The General Statistics Office (GSO) released data showing that Vietnam's GDP grew by 4.14% in the second quarter of the year. For the first six months of the year, the country's economic growth increased by 3.72%, falling short of the set targets.

Industrial production, exports and services, which have not fully recovered, were affected by external factors. The GSO also assessed that the government's target of 6.5% growth is not feasible under the current circumstances.

In the short term, Vietnam faces significant risks to its economic growth. The IMF stresses that growth may not meet expectations if external demand and investment remain weak.

Moreover, issues in the corporate bond and real estate markets and rising non-performing loans could hamper banks' ability to support growth.

However, the IMF believes that Vietnam has the potential to achieve high growth rates in the medium term through the implementation of structural reforms.

To ensure macroeconomic and financial stability and accelerate reforms, policies should focus on specific areas, the report said.

Cautious approach advised on regressive tax reduction

The IMF recommends that fiscal policy play a greater role in supporting economic growth and helping the most vulnerable segments of society.

For example, introducing more flexible exchange rates and continuing efforts to modernize the monetary policy framework can yield significant benefits. However, the IMF cautions against further monetary easing and measures to stimulate credit growth at this stage, as global interest rates may remain high for an extended period, and Vietnamese banks face rising non-performing loans and a high ratio of outstanding loans to total deposits.

As for fiscal measures, planned increases in budget spending, such as wage hikes, investment in public infrastructure, and tax cuts, can help boost domestic demand.

However, Vietnam should be wary of regressive tax cuts that could harm the environment, such as reducing car registration fees. Instead, given Vietnam's relatively low tax rates, the authorities could focus on increasing fiscal spending to improve infrastructure, strengthen the social safety net, and address other social needs.

The IMF also advises Vietnam to take decisive measures to restructure the property market and promote the healthy development of the corporate bond market. In addition, accelerating reforms to improve the business environment, upgrade critical infrastructure, and invest in education are essential steps for long-term growth and development.

|

The IMF's Article IV consultation is a regular assessment conducted by the International Monetary Fund with its member countries. It involves IMF staff visiting the country and discussing with government officials and other stakeholders. The consultation covers various economic and financial aspects, such as fiscal policy, monetary policy, exchange rates, financial stability, and structural reforms. The objective of the consultation is to provide an independent analysis of the country's economic situation, identify risks and vulnerabilities, and offer policy advice and recommendations. The IMF's assessment and recommendations are based on its global expertise and aim to support the member country in achieving sustainable economic growth, stability, and poverty reduction. |