Funding and regulatory hurdles challenge Việt Nam's developers long term

Funding and regulatory hurdles challenge Việt Nam's developers long term

Property developers in Việt Nam face a steep path to long-term growth, with various hurdles awaiting them in the next 12 months, including challenges related to funding access and an evolving regulatory landscape.

Apartment complex in HCM City. Over the past five years, Vietnamese developers have pursued aggressive growth through debt financing, leading to higher leverage ratios. — VNA/VNS Photo |

A recent survey by S&P Global Ratings sheds light on the heavy reliance of Vietnamese developers on short-term funding. This reliance leaves them susceptible to liquidity and default risks when access to funding becomes restricted. For example, Novaland has encountered difficulties in meeting its domestic debt payments and is currently seeking to restructure its foreign debt obligations.

As of December 31, 2022, short-term debt for Vietnamese developers exceeded their cash balance, surpassing 100 per cent.

Over the past five years, Vietnamese developers have pursued aggressive growth through debt financing, leading to higher leverage ratios. The report highlights that they often resort to debt to finance working capital for high-rise condominiums and capital expenditures for land acquisitions.

The government's tightening of developers' access to funding, including bank loans and the local bond market since June 2022, has constrained liquidity and led to project construction and handover delays. Buyers' sentiment has also decreased as developers can no longer provide sales incentives, and access to mortgage loans has diminished.

However, some early signals of easing appeared in early 2023, as the country took steps to reduce financial stress in the property sector. The recent policy changes aim to support the affordable segment of the market while discouraging property speculation, ultimately promoting more sustainable growth in the property market, the report said.

|

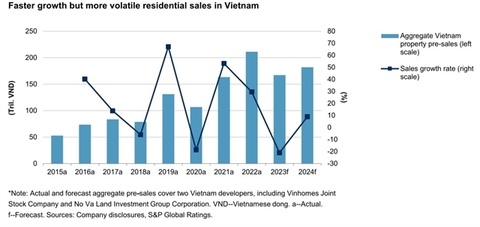

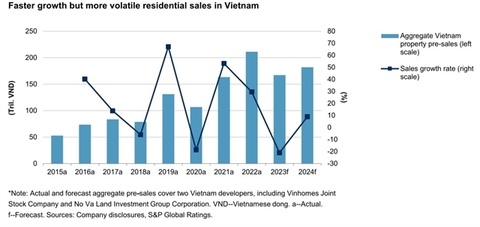

Additionally, investor-buyers accounted for approximately 86 per cent of property purchases in Việt Nam between 2020 and 2022, with overseas buyers contributing 45 per cent of the total, according to CBRE Group. The high proportion of investor-buyers in Việt Nam leads to greater sales fluctuations due to their sensitivity to economic cycles and market sentiment.

“In Việt Nam, we expect aggregate residential sales to decline by 15 to 20 per cent in 2023 after experiencing growth of 25 to 30 per cent in 2022.”

Developers in Việt Nam also tend to have higher off-balance sheet liabilities. These include debt-like obligations such as sales incentives. For example, some developers subsidise the mortgage interest expense for customers during the initial stage of project construction. Additionally, they provide guaranteed rental returns for a certain period after handing over the units (more common for hospitality-related projects).

The report said although such incentives are common in the Vietnamese industry, the disclosure of their extent and commitment period is limited under Vietnamese Accounting Standards. Consequently, developers' actual liabilities and cash flow burdens may be understated.

Additionally, Việt Nam’s developers face key-man risk, as they are often controlled by the founding family either directly or indirectly. Some developers have complex corporate structures involving multiple business lines and joint ventures. Debt obligations may be concentrated at the parent company, with debt servicing relying on dividends from operating subsidiaries and joint ventures. This complexity makes it challenging to track the flow of funds and assets.

Despite some challenges, the report also pointed out opportunities for Việt Nam's growth, driven by rising disposable incomes, increased foreign direct investments, a young population (over 70 per cent under the age of 45), robust GDP growth, and ample room for further urbanisation.