Incentives at play for Asian groups to contend with GMT

Incentives at play for Asian groups to contend with GMT

While waiting for official announcement of actual investment cost-based incentives, South Korean and Japanese businesses in Vietnam are seeking more efficiency in administrative procedures to ease their possible burden via the upcoming global minimum tax.

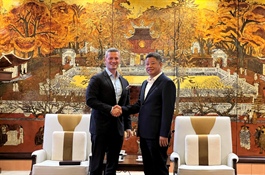

Hong Sun, chairman of the Korea Chamber of Commerce and Industry (KoCham), said that he and its member companies are evaluating the possible impacts of global minimum tax (GMT) on their preparations, while observing the situation in countries around the Asia-Pacific region where South Korean corporations also have investments such as Singapore, Malaysia, Thailand, and Hong Kong.

“It is necessary to have new policies that are both in line with international commitments and can benefit businesses, such as cost-based incentives and support like cash grants or qualified refundable tax credits,” Sun said.

“These policies, if granted on the basis of actual investment costs such as fixed asset, production, and research and development (R&D) costs, are assessed as both beneficial and encouraging enterprises to make long-term, and substantive investment in Vietnam.”

Enterprises from Japan are also in a similar situation. Takeo Nakajima, chief representative of the Hanoi office of the Japan External Trade Organization (JETRO) said, “We are concerned that the GMT will reduce the tax benefits related to substantial businesses by foreign direct investment. In any case, we are watching the development of this tax system in Vietnam with interest.”

According to Nakajima, who is also vice chairman of the Japanese Chamber of Commerce and Industry in Vietnam, the introduction of GMT means that low tax rates will no longer be an essential factor in the competition for the business environment in the region. Vietnam must demonstrate its competitive attractiveness in other elements, such as ease of business, administrative speed, human resources, potential partners, accessible finance, and more.

As shown in last year’s survey by JETRO, when asked about the attractiveness of Vietnam’s investment environment, the top reply was “future growth potential of the market” at 74 per cent, and second was “current market size” at 46 per cent. Around one-quarter of respondents cited “preferential tax treatment,” but it ranked ninth among the replies.

On the other hand, in terms of risk, 60-70 per cent of ASEAN countries cited inefficiency in administrative procedures and tax systems. Low tax rates and business costs are preferable, while incentives are necessary but meaningful if the procedures are simple and transparent, the report said.

Vietnam now has an average corporate tax rate of 20 per cent, alongside its closest neighbours. Among ASEAN countries, the lowest is Singapore, at 17 per cent. Malaysia is 17-24 per cent, Indonesia 22 per cent, and the Philippines 25 per cent. In the case of Vietnam, companies benefit significantly from preferential tax treatment: 10-17 per cent preferential; tax exemption for four years of immunity; and nine years of a 50 per cent reduction, which many Japanese companies use.

Countries in the region are making their first announcements about GMT implementation, and many are urging Vietnam to soon have specific moves.

“Singapore, Malaysia, Thailand, and Hong Kong all have their own declarations on the application of GMT, namely the qualified domestic minimum top-up tax (QDMTT), through budget plans or statements of government agencies,” said Sun of KoCham.

For example, those nations will apply QDMTT from 2024 or 2025 in the first budget plan of the year. Moreover, in some of these countries, there will be new preferential and supportive policies to continue to maintain and increase foreign investment attraction. Thailand announced that it will regulate 50-70 per cent of the additional tax revenue from the QDMTT to transfer it to a fund to support businesses that the country encourages investment from.

“We believe that although these countries have not yet issued specific policies, the early announcements partly help investors better understand the orientation of the receiving country, giving them peace of mind and a basis to make plans to assess possible impacts as well as appropriate investment plans,” Sun noted.