Vietnam Gov’t urged to further lower policy rates to aid growth

Vietnam Gov’t urged to further lower policy rates to aid growth

Given the adverse global environment, achieving 6.5% GDP growth this year would be a challenging task for Vietnam.

With inflation and exchange rate pressures now lower than at the end of 2022, the government should continue to consider lowering policy rates to support economic growth.

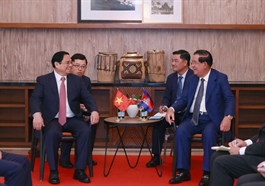

Head of the NA's Economic Committee Vu Hong Thanh. Source: VGP |

Head of the National Assembly (NA) Economic Committee Vu Hong Thanh made the remarks earlier this week at the 23rd session of the NA Standing Committee.

Looking ahead from now until the end of 2023, Thanh said it would be a challenging task for Vietnam to achieve its 6.5% growth target. "It is imperative for the government to focus on macroeconomic stability, inflation control, and strengthening the adaptability and resilience of the financial and banking system," he said.

Thanh also stressed the importance of removing obstacles in the financial, foreign exchange, corporate bond, and real estate markets. He also called for a focused and targeted fiscal policy, while monetary policy should be proactive, flexible and effective.

Another priority mentioned by Thanh is to accelerate the disbursement of public investment funds, noting that this is essential for the successful implementation of the Socio-economic Recovery and Development Program.

Meanwhile, Thanh urged the government to closely monitor and proactively respond to the Covid-19 situation and other infectious diseases, as well as possible epidemic situations in the future.

"Efforts should focus on facilitating the export of goods, including using traditional markets and diversifying export markets," Thanh said, while calling for more support for businesses to benefit from free trade agreements to which Vietnam is a party.

Thanh expected the government to adopt a comprehensive, synchronized and effective approach to external activities and international integration to maintain a peaceful and stable environment for national development.

"This would eventually enhance Vietnam's position and prestige on the world stage," he said.

Minister of Planning and Investment Nguyen Chi Dung at the meeting. |

Focusing on growth engines

During the meeting, Minister of Planning and Investment Nguyen Chi Dung suggested that Vietnam's timely economic reopening and flexible approach to the Covid-19 response were key to ensuring a decade-high GDP growth of 8.02% in 2022, higher-than-expected State budget revenues of VND1,815 trillion ($77.36 billion), and controlled inflation (3.15% against a target of 4%).

Minister Dung acknowledged that the implementation of the socio-economic development plan in 2023 will be challenging due to the complicated and unpredictable global context.

"Vietnam's economy, with its high degree of openness but limited international competitiveness, continues to be heavily influenced by the global economic environment, especially in areas such as exports, imports, processing and manufacturing, investment, and real estate," Dung said.

Despite these difficulties and challenges, he expected positive changes as the global situation improves.

The minister also noted that various policies and administrative solutions that have been revised, supplemented, and issued since the beginning of the year have had a positive impact, especially solutions for socio-economic recovery and development. "These solutions have helped remove difficulties and obstacles in production, business, enterprise, investment, import and export, real estate, corporate bonds, social security, and disease control," he said.

According to Dung, the upcoming launch of several major projects in the processing and manufacturing sectors will contribute positively to Vietnam's economic growth in the second quarter and the whole of 2023.

"These projects are seen as key drivers to achieve the highest possible economic growth rate in 2023," he concluded.

| For the first time in two years, the State Bank of Vietnam decided in mid-March to lower its key interest rate by 1%, which in turn allowed commercial banks to lower their respective lending rates, easing the challenges faced by businesses and the economy in general. |