Viet Nam continues to face challenges in Q2/2023: HSBC

Viet Nam continues to face challenges in Q2/2023: HSBC

After a sluggish GDP performance in the first quarter this year, Viet Nam is still not out of the woods yet. In particular, it has not seen the light at the end of the tunnel on the trade front, according to an HSBC report.

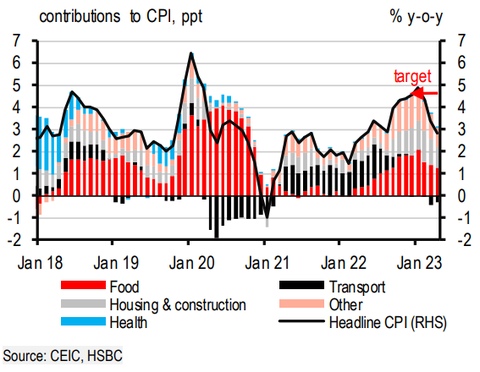

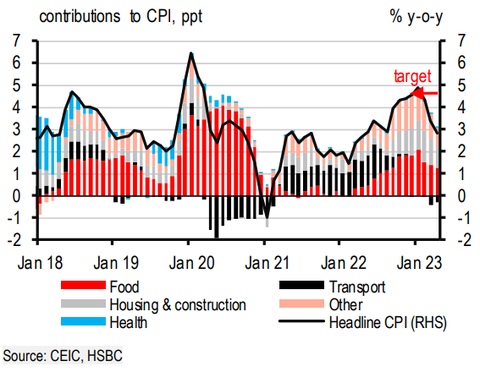

Inflation eased to below 3 per cent y-o-y, thanks to lower food and some energy prices. — Source HSBC |

Tourists from mainland China saw an impressive 70 per cent month-on-month rise in April, but the recovery pace remains lagged. — Source HSBC |

While tourism can provide some partial support, its recovery will only be a slow process, and will not be enough to offset this year’s challenges. Indeed, growth headwinds can be seen through the lens of extremely sluggish credit growth. Despite an annual credit growth target of 14-15 per cent and two moves by the State Bank of Vietnam (SBV) to cut its key interest rates in March, loans only grew around 2 per cent by mid-April, half of the growth of the same period in 2022, reflecting ongoing concerns of economic difficulties. As a result, the authorities have introduced a series of support policies recently, including a VND120 trillion credit package for social housing, a 2 percentage point cut of VAT until end-2023 and plans to restructure some loans. In particular, there are initial signs of a relaxation in the policy stance towards the property sector, which has been facing a liquidity crunch since last October.

Despite slowing growth, inflation has been better behaved, offering some relief to policymakers. Headline inflation fell 0.3 per cent month-on-month, translating into a benign year-on-year print of sub-3 per cent, moving further away from the SBV’s 4.5 per cent inflation ceiling. For one, food inflation momentum continued to ease, thanks to a decline of 1.6 per cent month-on-month in pork prices (recall pork inflation has a sizeable impact on overall food inflation). Meanwhile, energy prices saw a mixed picture. While transport costs rose marginally, due to higher oil prices, other energy inflation, such as electricity and gas, fell. That said, caution is still warranted on the supply-side of inflation. After all, OPEC’s decision to cut oil production and Vietnam Electricity's (EVN) proposed electricity price hike had not materialised by mid April.

All in all, Viet Nam continues to face challenges in the second quarter 2023 after a tough first quarter economic performance. While it will likely see weak growth in the first quarter this year, the bank expects the services sector to receive a punchier boost and the trade tide to turn in the second quarter, lifting whole-year growth to 5.2 per cent in 2023.