Garment and textile industry look to turn fortunes around with green transition

Garment and textile industry look to turn fortunes around with green transition

The garment and textile industry is forecast to continue facing difficulties in the coming months after posting a two-digit drop in export revenue in the first quarter, pushing the industry to a pressing requirement of going green to enhance competitiveness.

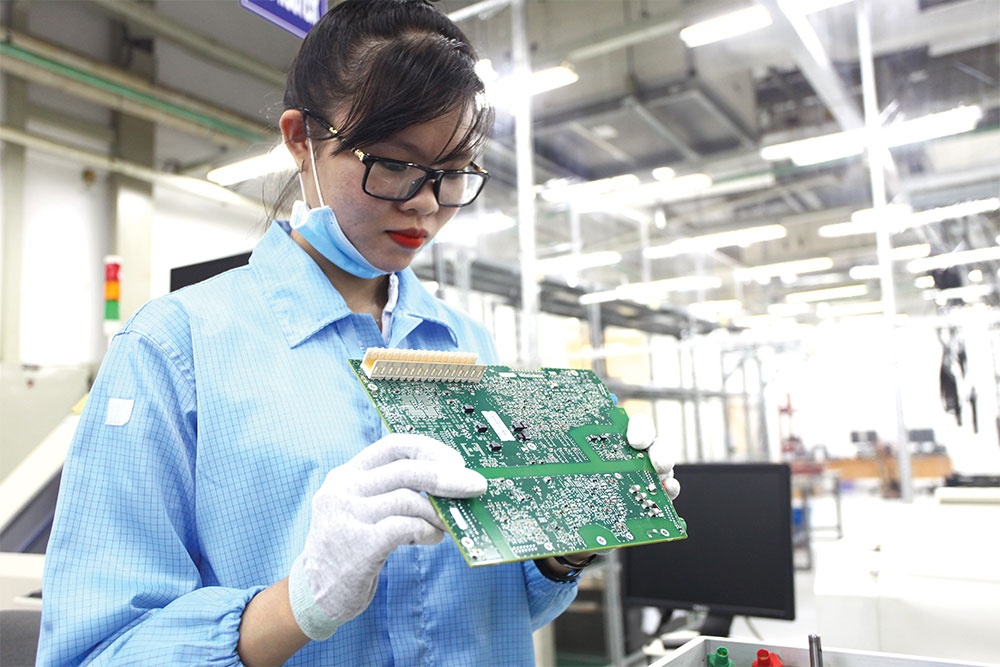

Difficulties were forecast to continue hitting garment and textile enterprises in the coming month on sluggish demand. — VNA/VNS Photo Hong Dat |

According to statistics of the Vietnam Textile and Apparel Association (Vitas), the export of garment and textile products decreased by more than 19 per cent to US$8.7 billion in the first quarter of this year, a disappointing result compared to the same period in the past ten years.

The import of raw materials also decreased by nearly 18 per cent in the quarter.

Truong Van Cam, Vitas’ Deputy Director, said that most producers were facing shortages of orders. The difficulty was not only for the garment and textile industry alone, Cam said, pointing out that the economic growths in major markets like the US and the European Union had not been as expected, significantly affecting consumer demand.

Difficulties were forecast to continue hitting garment and textile enterprises in the second quarter of this year, he said, expecting the market to start to warm up from July or August.

The biggest reason for the slowdown was the decrease in consumer demand caused by increasing inflation, general director of Garment 10 Corporation JSC., Than Duc Viet said. When prices rose too high, consumers tended to focus on essential goods more than consumer goods.

The garment and textile industry reported a good result in 2022, with export revenue of $44 billion, up by 10 per cent. Still, events such as the global economic slowdown, increasing inflationary pressure, and conflicts sent negative signals to the consumer demand for garments and textiles in 2023.

The difficulty was unavoidable to the garment and textile industry of Viet Nam when the global economy had problems, economic expert Huynh Thanh Dien said, pointing out that Viet Nam ranked third in the world in terms of garment export.

During the past three years, the global economy saw unprecedented fluctuations. The COVID-19 pandemic caused the global economy to drop by 3.6 per cent in 2022, forcing major economies to launch large stimulus packages at the end of that year to achieve a growth rate of 5.6 per cent in 2021.

However, the over-pumping of money amid the supply chain disruptions led to inflation, and Russia–Ukraine conflict made it more difficult to put inflation under control, Dien said.

According to Cao Huu Hieu, general director of the Vietnam National Textile and Garment Group, the situation would not improve much in the second quarter of this year, for the world economy in general and the textile industry in particular. The current global economic recession and tightened monetary policy were pushing down demand in major importing countries such as the US, EU, Korea and Japan.

The reopening of the Chinese economy also brought challenges, as China was the major competitor of Viet Nam in the US.

VNDIRECT Securities cited statistics from the US Office of Textiles and Apparel (OTEXA) that the US imported $132.2 billion worth of garment products in 2022, up 16.9 per cent, to which China was the largest exporter with a share of 25.56 per cent, followed by Viet Nam with a share of 14.87 per cent.

However, China’s reopening would provide opportunities for the export of fibre and yarn of Viet Nam in the second half of this year.

The producers needed to optimise production with a focus on improving productivity and product quality as well as keeping a close watch on the market to have flexible and timely responses, Hieu said, adding that this was an unprecedentedly difficult time for the garment and textile industry.

Going green

Deputy chairman of Cat Tuong Aurora Group Nguyen Van Tuan said that the heavy dependence on import fabric made the garment industry vulnerable.

He pointed out that Viet Nam had a demand for 11 billion metres of fabric in 2022, but the domestic production met only 36 per cent. Most enterprises only do Cut–Make–Trim (CMT) with a low profit of around $1.70 for a shirt.

Experts said that to promote the development of the garment and textile industry, it was necessary to switch to other production methods that brought higher added value, such as Free on Board (FOB) and Original Design Manufacturing (ODM), and the decisive factor of the success was that proactiveness in fabric supply.

According to Cam, the industry was working with the Ministry of Industry and Trade on the development of large textile and garment industrial parks with wastewater treatment systems to protect the environment and meet the demand for raw materials.

He said it was vital for the garment and textile industry to switch to green production, apply modern technologies and promote digital transformation to create competitive advantages.

Sustainable development was a global trend, thus, Viet Nam had no other choice, Tran Nhu Tung, Deputy Chairman of Vitas, said.