ADB sets moderate 2023 growth outlook for Vietnam

ADB sets moderate 2023 growth outlook for Vietnam

After a strong performance last year, the Vietnamese economy can expect moderate growth of 6.5 per cent this year, followed by a slight improvement to 6.8 per cent in 2024, according to a recent economic publication from the Asian Development Bank (ADB).

“Vietnam’s economic growth will be constrained in 2023 by the global economic slowdown, continued monetary tightening in advanced economies, and the spillover from global geopolitical tensions,” said Andrew Jeffires, ADB country director for Vietnam.

“However, Vietnam’s growth support policy of monetary easing, the reopening of the Chinese economy to global trade, and the large amounts of public investment to be disbursed later this year will help the country counter these headwinds,” he added.

Declining global demand has hit manufacturing, driving the industrial production index down by 6.3 per cent in the first two months of this year relative to the same period last year. Industrial growth is forecast to slow to 7.5 per cent in 2023, contributing 2.7 percentage points to GDP growth. Construction could pick up, however, if major infrastructure projects can be implemented as planned.

Services are expected to expand by 8 per cent in 2023 thanks to revived tourism and associated services. As China is Vietnam’s largest tourist market, the country will benefit considerably from its reopening.

China's return will also benefit agriculture. The economic giant could generate significant demand for Vietnam's agricultural exports, as the country already receives 45 per cent of Vietnam’s exported fruit and vegetables. The sector is expected to expand by 3.2 per cent this year.

Public investment will be the key driver for economic recovery and growth in 2023, with $30 billion set to be disbursed later this year.

However, Foreign direct investment (FDI) remains hampered by the global slowdown. Newly registered capital and disbursed FDI fell by 38 per cent and 4.9 per cent on-year respectively in the first two months of 2023.

The fiscal deficit in 2023 could exceed its target, which is 4.4 per cent of GDP. In the future, Vietnam is likely to continue its reforms to make financing more sustainable, thereby significantly reducing dependence on sources such as land and oil.

On the demand side, domestic consumption will continue to rebound in 2023. Revived tourism, new public investment, stimulus programmes initiated in January 2022, and a salary increase effective in July 2023 are expected to keep domestic consumption on the rise, although higher inflation may hamper this somewhat. However, retail revenue in the first two months of 2023 was 24.9 per cent higher than in the same period in 2019, albeit partly influenced by the timing of the Lunar New Year.

Weakening global demand will continue to dampen trade this year. Exports in the first two months of 2023 decreased by 10.4 per cent on-year, while imports declined by 16 per cent. Both imports and exports are forecast to shrink by 7 per cent this year and next. Slowing trade could create a deficit that equals 1 per cent of GDP this year before moving back into surplus in 2024.

Surprise policy rate cuts make Vietnam the first economy in Southeast Asia to ease its monetary policy. The central bank cut the discount rate from 4.5 to 3.5 per cent, the overnight rate for interbank electronic payments from 7 to 6 per cent, and the interest rate cap on short-term VND loans to priority sectors from 5.5 to 5 per cent. The refinancing rate remains unchanged at 6 per cent.

According to the ADO, external risks to the forecast represent a significant potential downside. The principal external risks are a deeper global economic slowdown, continued monetary tightening by major trade partners, and an escalation of the Russian invasion of Ukraine.

The ADB also sees some policy challenges for Vietnam to manage financial and capital market stress. Financial markets were turbulent last year, and financial fraud hit the corporate bond market. Further risk of contagion may come from banks’ exposure to real estate and construction and a high ratio of property as collateral held by banks. Many loan-to-deposit ratios have breached the 85 per cent threshold.

To counter this, the government responded quickly to worsening market conditions. Decree No.65 was passed swiftly in the third quarter of 2022 to strengthen governance in the corporate bond market. Last month, the State Bank of Vietnam proposed a credit scheme worth $5 billion for social housing to be implemented by four state-owned commercial banks.

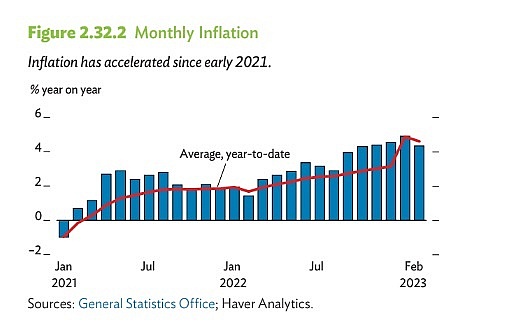

Average inflation in the first two months of 2023 rose from 1.7 per cent a year earlier to 4.6 per cent, and is forecast at 4.5 per cent for the whole of 2023. In the long term, financial reform should continue to reduce dependence on bank finance and enhance transparency in the bond markets, the ADO highlighted.