Cashew firms enhance processing to add value to products

Cashew firms enhance processing to add value to products

Long Son JSC, one of Viet Nam’s leading cashew processors and exporters, is stepping up intensive processing to boost exports of processed nuts.

It produces a number of items such as roasted and salted cashew with and without the skin, spicy cashew, cheese cashew, and sesame cashew.

The company said processed nuts only account for a small portion of its total cashew exports, and so it would focus on deep processing to gradually increase the proportion of high-value processed products.

Hoang Son 1 JSC has sold large volumes of highly processed cashew to the EU market.

Another firm that has also succeeded in exporting processed cashew products is Long An Food Processing Export JSC (Lafooco).

Its cashew can be seen on shelves in supermarkets in China, Hong Kong, Canada, Japan, and Europe.

Besides exporting through traditional channels, Lafooco also sells nuts abroad through e-commerce platform Amazon and has received positive feedback from customers.

It has said it will continue to research and develop a variety of cashew-based instant products, snacks and foods.

According to insiders, in recent years local cashew processing firms have invested in modern machinery and equipment for intensive processing.

Highly processed products offer high value and thus better profit margins. They also open up opportunities for Vietnamese cashew businesses to export under their own brands, thereby raising the country’s profile in the international market, they said.

Viet Nam has been the world’s largest cashew exporter for years, but mainly of semi-processed items of low value, they added.

High competitive pressure

Viet Nam’s cashew industry faces increasingly fierce competition from other countries, including some emerging ones.

Ivory Coast, for instance, for long the world’s biggest supplier of raw cashew, has started processing the nuts for export.

Speaking at the 12th Vinacas Golden Cashew Rendezvous in HCM City recently, Adama Coulibaly, director general of Ivory Coast’s Cashew and Cotton Council, said last year his country exported 36,807 tonnes of processed cashew to markets such as the US, EU and Australia in addition to exporting 719,900 tonnes of raw nuts.

According to the Viet Nam Cashew Association (Vinacas), though this volume is very low compared to Viet Nam's 500,000 tonnes, it shows that Ivory Coast is eyeing higher market segments.

There is a possibility that hitherto raw cashew suppliers to Vietnamese firms would become their competitors in the near future, it added.

Besides, cashew also has to compete with other nuts.

Vu Thai Son, chairman and general director of Long Son JSC, the output of nuts such as almond is skyrocketing and exceeds demand.

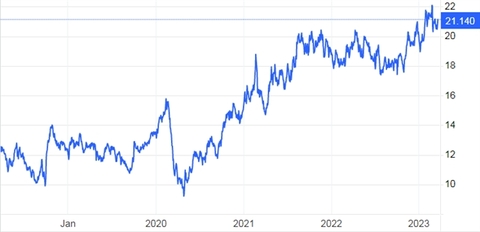

Ta Quang Huyen, chairman of Hoang Son 1 JSC, said the price of cashew has decreased significantly in the world market compared to two years ago, but that of other nuts such as almond and walnut have fallen below even cashew.

So other nuts are preferred by international roasters and retailers and consumers over cashew, he said.

Bob Baurer, president of the Association of Food Industries, a trade association with more than 1000 member companies involved in imports of food products into the US and Canada, said Viet Nam is the biggest exporter of cashew kernel to the US.

But with the US tending to apply stringent food safety regulations, Vietnamese exporters need to improve food safety and quality.

Nguyen Minh Hoa, Vinacas’s deputy chairman, said last year was a challenging one for the cashew industry, with exports falling from 2021, but 2023 could be even worse due to low demand amid global inflation.

To cope, local cashew processors need to carefully study markets and make appropriate plans for the import of raw nuts at competitive prices, he said.

They also need to further diversify their products and make them environment-friendly to meet the increasing requirements of consumers.