Prospects of sustained growth and success

Prospects of sustained growth and success

Vietnam is ushering in 2023 with new prospects on the horizon and challenges aplenty. Senior economist Raymond Mallon writes about the developments, risks, and opportunities for the Vietnamese economy in the new year.

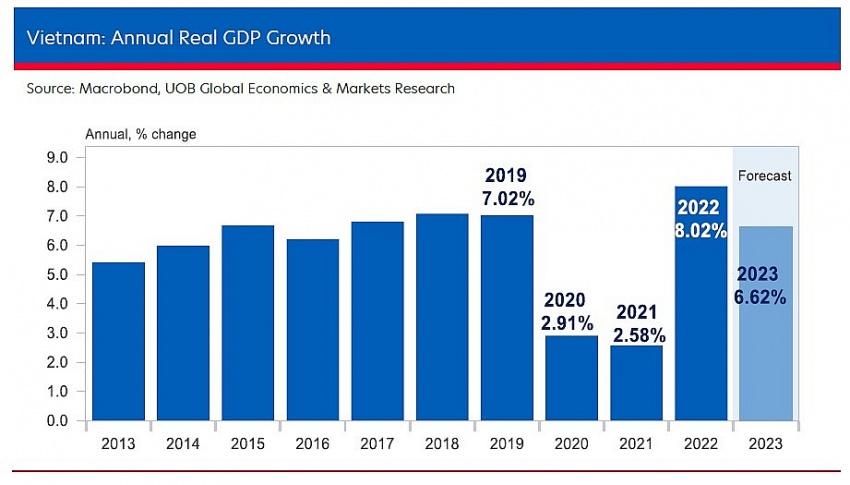

Following a sharp rebound in national economic growth in 2022, Vietnam appears to be returning towards its pre-pandemic development trajectory with solid growth in investment, incomes, and employment, with relatively moderate rates of inflation.

However, sustaining high growth into 2023 will be challenging because of global economic turbulence, increasing protectionism, slowing export demand, and moderating growth in domestic demand following the rebound from COVID-19. While the worst direct economic impacts of the pandemic may be over, global risks remain that could constrain access to markets and capital.

Some signs of slowing growth in national employment, credit, industrial production, ports, and the real estate market emerged during the last quarter of 2022. The Ho Chi Minh Stock Exchange index slumped by more than 32 per cent during 2022.

Past public investments in human and infrastructure development complemented by decades of policy reforms and institutional development targeting investment, economic integration, and business growth, encouraging innovation, and developing competitive markets have facilitated this strong recovery.

Both export and domestic demand remain important drivers of growth. Vietnam’s burgeoning domestic middle class is helping accelerate growth in domestic demand. And this is helping to reduce past dependence on trade as the primary engine of growth.

The rapid recovery in consumer and business confidence following Vietnam’s relative success in mitigating the worst impacts of COVID-19, and in implementing post-pandemic recovery measures, has helped boost consumer and investor confidence. This is reflected in the relatively high growth in consumer demand and business investment.

Technical innovation is also important. The use of cashless payment systems jumped during the past few years. Most tax payments are now conducted via bank account transfers.

Households are increasingly using non-cash systems to pay bills. Vietnamese firms are investing more in ICT, robotics, fintech and other information related industries.

Globally, investors are diversifying sources of production, providing foreign new opportunities for Vietnam-based firms to integrate into global value chains (GVCs) boosting investment, technology transfer, productivity, and incomes. This trend is continuing in the post-pandemic era with further impetus being provided by economic and trade cooperation agreements.

Sector developments

The share of the low labour productivity agriculture sector in GDP and employment continues to decline. Some progress is being made in transitioning to higher value-added agriculture products with improved post-harvest processing and quality standards.

Integration with GVCs, and the foreign direct investment-led transition towards more sophisticated manufacturing activities are facilitating strong industrial sector growth, with particularly strong in labour productivity, employment, and exports in the manufacturing sub-sector.

The services sector is an increasingly important contributor to national employment and income growth. Trade and logistics sectors continue to expand. Domestic tourism continues to grow, and international tourism is recovering from pandemic-related travel restrictions. Further strong recovery in hospitality and other services are expected in 2023.

Urbanisation and the development of economic clusters is helping provide the economies of scale needed to sustain industrial sector growth. And urban centres are developing in diverse coastal and delta regions of Vietnam.

Relatively decentralised urbanisation should help reduce regional productivity gaps and promote equitable development, but there can be social adjustment costs as rural workers move to urban areas during this transition.

The domestic private sector continues to grow, with increasing numbers of larger firms emerging and declines reported in firm level corruption. The 2021 Provincial Competitiveness Index reports that the share of firms paying “informal charges” dropped, from 66 per cent in 2016 to 41 per cent in 2021. Efforts to develop a stronger domestic private sector will help strengthen national resilience to international economic shocks.

Some of the biggest risks to sustained growth are global economic instability, inflation and downturn, climate change, and protectionism. Meanwhile, immediate domestic challenges include sustaining poverty reduction and productivity growth, improving public sector efficiency, and addressing climate change, air pollution, and other environmental challenges.

Economic restructuring and technological advancements, particularly developments in ICT and AI, present challenges, and opportunities, to the workforce. Public support can help facilitate retraining and helping workers move out of industries adversely affected by restructuring.

Bottlenecks to efficient public investment and expenditure continue to constrain social and infrastructure development, business investment and employment growth. Recent high-profile efforts to contain corruption are slowing public sector decision-making and constraining public investment disbursements.

While containing corruption remains critically important, it is also important to ensure that public officials are incentivised to implement national development strategies in a timely manner.

Policy priorities

Broad-based productivity growth is crucial to improving living standards and will be increasingly important as the population begins to age and workforce participation rates decline. Equitable and effective delivery of public health, education and physical infrastructure are essential to accelerating productivity growth and reducing inequality.

There is a pressing need to provide more relevant primary and secondary education, vocational training, higher education, and life-long learning that is better targeted at meeting the emerging demands of an increasingly urbanised and middle-class society and a knowledge-based market economy.

Complexity and lack of transparency in markets for land use create inefficiencies and opportunities for corruption. Reforms should aim for stronger and more transparent systems for property rights protection, including contract enforcement and economic courts. Stronger regulators that are independent of commercial interests are needed to enforce competition policy, to ensure standards and to oversee network industries.

Strengthened corporate governance will be critical for sustainable capital market development. Strong, independent economic regulators can help to better protect individual and property rights and the environment, and to strengthen transparency, corporate governance, and accountability.

Stronger social organisations, independent of vested interests, can help to better protect the rights of consumers and workers. Continued engagement with the business community, workers, and educators to identify and address institutional and other bottlenecks is critical to identifying and addressing bottlenecks.

More economically competitive sources of renewable energy are providing new opportunities for Vietnam to gain a competitive advantage over countries that are slower in transitioning from fossil fuels. New technologies provide opportunities to reduce environmental waste in manufacturing and reduce the use of chemical pesticides and insecticides in rural areas.

Steps are also being taken to reduce the use of plastic and other non-biodegradable packaging. Accelerated progress in developing mass transport systems in urban areas and greater use of electric-powered public transport, cars, and electric cycles could help ameliorate pollution and congestion problems facing Vietnam’s major cities. And Vietnam needs to continue planning to ameliorate the impacts of climate change.

In summary, sustaining medium-term growth in the current uncertain external environment will require renewed efforts to better manage health, education, and the environment, to develop infrastructure and improve the business environment, while also sustaining macroeconomic stability.

Continuing national commitment to resolve bottlenecks to socio-economic development and building the institutions needed to develop a competitive, equitable, and sustainable economy provide a basis for optimism about economic prospects for 2023.