US opens anti-dumping investigation on Vietnamese paper file folders

US opens anti-dumping investigation on Vietnamese paper file folders

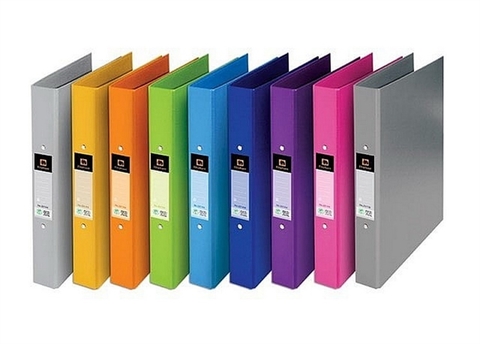

The US Department of Commerce (DOC) has begun an anti-dumping investigation regarding paper file folders imported from several countries, including Viet Nam.

On November 1, DOC's International Trade Administration announced they were investigating paper file folders allegedly being sold in the United States at less than fair value.

According to the Trade Remedies Administration from the Ministry of Industry and Trade, products imported from Viet Nam were accused of dumping in the United States based on an investigation request dated October 12, 2022, of the US domestic industry.

On November 2, 2022, the DOC started an anti-dumping investigation on clipboard products imported from Viet Nam, China and India.

The investigation period for Viet Nam was from April 1 to September 30, 2022.

The plaintiff of the lawsuit is the American Union of Clipboard Manufacturers, consisting of two companies, Smead Manufacturing Company, and TOPS Products LLC.

Investigated goods include file folders with HS codes 4820.30.0040 and 4820.30.0020. The alleged dumping margin for Vietnamese exporters is 182.67 to 236.38 per cent.

The DOC has issued a Quantity and Value Questionnaire to nine businesses named in the investigation request to collect information to select a mandatory defendant in the case, with the deadline for businesses to respond to the DOC's questionnaire before 5 pm Eastern time on November 15, 2022.

In case of necessity, businesses can submit a letter of request for an extension and explanation.

It is expected that the DOC will select the required defendant within 20 days from the date of publication of the notice of initiation of the investigation. The United States International Trade Commission (ITC) will issue a preliminary finding on the matter of injury to the US domestic industry within 45 days of receiving the request for an investigation.

The Trade Remedies Department recommended that enterprises producing and exporting related products determine a suitable appeal strategy for them, diversifying markets and export products.

They should fully cooperate with the DOC throughout the incident. Any act of non-cooperation or inadequate cooperation may lead the US Investigative Service to use the available evidence against their own advantage or impose the highest anti-dumping duty on the businesses.

The Trade Remedies Department noted that in previous cases investigated by the DOC, enterprises would not be considered to enjoy separate tax rates if enterprises did not respond to the questionnaire.

In addition, businesses need to regularly coordinate and update information for the department to receive timely support.