Vietnam's retail sector to experience a rapid rebound next year

Vietnam's retail sector to experience a rapid rebound next year

This report explores some of these transformative trends in Vietnam’s retail sector and the opportunities they present for retailers to innovate and develop multi-fold strategies.

Vietnam’s retail sector is expected to experience a rapid rebound in the year ahead, according to the latest report conducted by Deloitte Vietnam.

Vu Duc Nguyen, Vietnam Consumer Industry Leader, Deloitte said: “We believe that at least some of the new omnichannel habits will become permanent as consumers grow accustomed to the convenience that they offer.”

Omnichannel takes off

BRG Retail's store, one of the large supermarket chains in Hanoi. Photo: BRG Group |

According to the report titled "Retail in Vietnam 2022: Omnichannel takes off," this year, Vietnam's economy looks poised for a rapid rebound despite the slowdown in growth over the past two years as a result of the Covid-19 pandemic. This promising outlook is expected to have positive spillover effects on its retail sector, which is in the midst of several major transformations.

One trend that stood out was the accelerated normalization of omnichannel retail on the back of the pandemic. Most Vietnamese consumers in urban areas are used to omnichannel purchasing, making purchases via brick-and-mortar stores, brand websites, and third-party instant messaging platforms and food delivery apps – toggling between them to find the right delivery slot or promotional deals.

According to the report, from the perspective of retailers, the shift to omnichannel retail represents a multifold strategy: by expanding their digital presences, retailers not only can mitigate some of the revenue losses associated with Covid-19 disruptions, but also tap into new customer bases. Specifically, through online or mobile platforms, retailers can now reach consumers who are located far away from their physical stores and have previously found it infeasible or impractical to visit them.

In addition, digital presences can also help retailers enhance their customer engagement. The e-commerce platform Shopee, for example, is one player that has leveraged the use of mobile games to enhance the overall user experience of its mobile application. Then, there is also the added benefit that a digital presence can help to drive traffic to physical stores, or vice versa, Deloitte noted.

Or, customers searching and comparing product information online may decide to eventually visit a store to view the physical product before making a purchase. Conversely, they may browse products in different physical stores, before making the final purchase decision on the website.

As retail players seek to capitalise on this omnichannel trend, the consulting firm is also witnessing the emergence of several new innovative partnerships within the marketplace. The “Ung ho nong san Viet” (supporting Vietnamese agricultural products) program, for example, was launched by the Saigon Union of Trading Cooperatives in collaboration with mobile payment platform Momo to support the local agricultural sector. Some of its recent initiatives include the promotional sales of locally grown lychees through the Momo e-wallet platform.

Evolving market dynamics

The report found some impacts of Covid-19 on non-grocery and grocery retail segments in Vietnam and the ways in which their market dynamics have evolved over the last two years.

Within the grocery retail segment, traditional grocery retailers continue to hold the majority of market share. This dominance, however, experienced some degree of erosion during the pandemic: following the detection of a substantial number of Covid-19 positive cases in their premises, many traditional grocery retailers had to temporarily suspend operations during the pandemic.

As a result, consumers who typically purchased from these retailers shifted their consumption to other grocery retail channels, such as convenience stores, supermarkets, and hypermarkets.

Given the boom in the grocery sector as consumers switched to pandemic-induced, at-home consumption habits, it is also worth noting that many non-grocery retailers have also begun to make their foray into the grocery retail segment. Earlier in May 2021, for example, the e-commerce platform Tiki launched its grocery arm TikiNgon to cater to the growing demand for online shopping in the fresh foods category.

Convenience stores develop omnichannel presences: Amidst the pandemic, many convenience store chains quickly moved to develop their omnichannel presences, and expand their presences on food delivery platforms. Some players have also built and launched their own proprietary mobile applications to engage more directly with their customers.

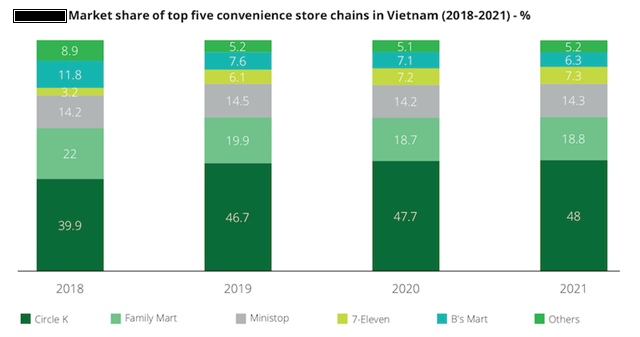

Regarding the market share, foreign chains dominate Vietnam’s convenience store sub-segment, with four of the top five brands owned by foreign multinationals such as Canada’s Circle K (48%), Japan’s Family Mart (18%) and Ministop (14.3%), and the US’s 7-Eleven (7%).

Source: Deloitte |

Hypermarkets grow in popularity for bulk buying and assortment: During the pandemic, the hypermarkets sub-segment had sought to capitalize on the shift to digital channels by expanding their online presences, both in terms of e-commerce and mobile commerce.

Foreign multinationals’ chains including BigC (Go!), Lotte Mart, Tops Market, AEON, continue to dominate the hypermarkets sub-segment, with many players able to leverage their unique product assortments as a competitive advantage.

Supermarkets capitalize on private label products and smaller formats: the supermarkets sub-segment had benefited from the shift in consumer expenditure away from traditional grocery retailers during the pandemic. Moreover, as consumers become increasingly price-conscious, supermarket chains have also been able to capitalize on this with the attractive pricing of their own private label products.

“Looking ahead, two other developing trends are expected to continue to play out in the retail sector, with wide-ranging, long-term knock-on effects. They are accelerated uptake of digital wallets and non-cash payments; and growth in wholesale B2B e-commerce segment,” the report noted.