Boosting investment among Mekong Delta countries

Boosting investment among Mekong Delta countries

According to data from the Foreign Investment Agency of the Ministry of Planning and Investment, in the first nine months of 2022, four Greater Mekong Sub-region (GMS) countries invested US$13.23 billion in Vietnam through 707 projects. Thailand topped the list with 668 projects worth US$13.1 billion.

Dr. Nguyen Anh Tuan, Vice President of the Vietnam Association of Foreign Invested Enterprises (VAFIE), said that GMS investment in Vietnam is concentrated in processing and manufacturing industries, production and distribution of electricity, gas and water, real estate, wholesale and retail, agro-forestry-fishery, and accommodation and catering services.

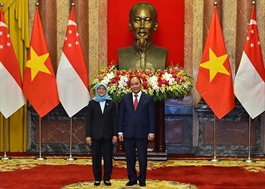

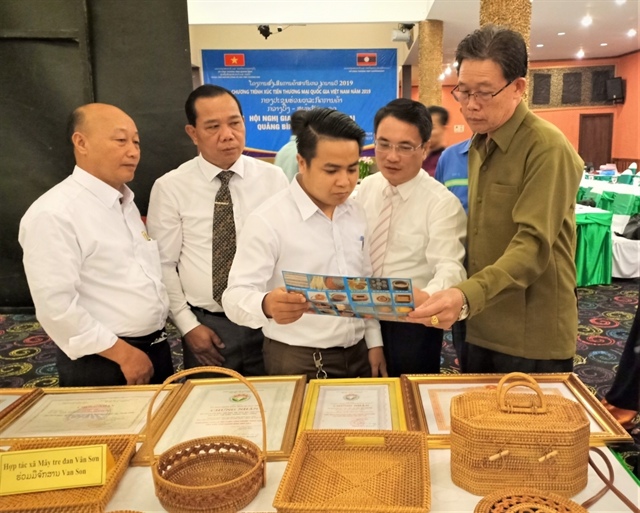

Lao, Vietnamese and Thai businesses explore investment cooperation opportunities |

Overall, investment by the GMS countries remains limited and incommensurate with its potential and expectations. Although global foreign direct investment (FDI) has shown signs of recovery since 2021, investment between GMS countries still faces difficulties.

Dr. Nguyen Anh Tuan said GMS economies are gradually recovering after two years coping with the impact of the COVID-19 pandemic. He added that GMS countries are all aware of the role of FDI for socioeconomic development. Vietnam has issued a strategy on foreign investment cooperation in the 2021-2030 period, prioritizing projects in the fields of high technology, creative innovation, research and development, and projects facilitating business participation in global supply chains.

Cambodia’s 2021 Investment Law simplifies administrative procedures related to registration and assessment of investment projects and licensing, encouraging investment in research and development, infrastructure construction, agriculture, green energy, and tourism.

Laos has improved its investment environment through tax/fee reductions and exemptions, loosened credit and increased loans for businesses manufacturing substitutes for imports and small and medium enterprises. Laos has also upgraded its transportation network and put into operation an online investment license granting system, smart customs and tax declaration systems, and an electronic management system for cargo in transit.

|

Along with favorable conditions, however, GMS countries are facing challenges in attracting FDI, including China’s zero COVID policy and global supply chain disruptions.

“The investment environment of GMS countries has improved but remains unfavorable. Moreover, GMS countries still lack appropriate policies to attract foreign investment as well as to support investment between countries in the sub-region. These factors slow down the FDI flows between ASEAN nations in general and GMS countries in particular,” Dr. Nguyen Anh Tuan said.

To boost FDI among GMS countries, the governments and businesses should be thoroughly aware of the role of FDI in the sub-regional economy, further improve the investment environment and facilitate mutual support for efforts to build the ASEAN Community. In addition, GMS countries should enhance their capability to withstand the adverse impact of external factors to maintain macroeconomic stability, control inflation and overcome supply chain disruptions and a shortage of high-quality human resources. They should seek international support for infrastructure development, especially transport connections, ensure energy security and shift to clean energy, provide capacity enhancement support for green growth, promote a circular and digital economy, and combat climate change.

| GMS is a geographical region consisting of countries and territories located in the Mekong River basin: Vietnam, Cambodia, Laos, Thailand, Myanmar, and China’s Yunnan and Guangxi provinces. |