Authorities urged to address businesses' “inflating” capital

Authorities urged to address businesses' “inflating” capital

In a broader sense, such a practice would cause negative impacts on the stock market and the confidence of investors.

Director of the TGS Law Firm Nguyen Van Tuan, a member of the Hanoi Bar Association, told The Hanoi Times the necessity for local authorities to tighten management amid mounting cases of companies exploiting legal loopholes for inflating their capital.

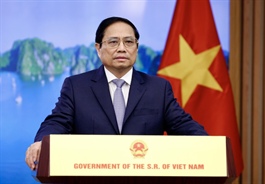

Director of the TGS Law Firm Nguyen Van Tuan. File photo |

There have been mounting cases of enterprises inflating capital, with the most recent example of FLC Group artificially raising its capital from VND1.5 billion (US$63,762) to VND4 trillion ($170 million). What are the loopholes that they can exploit to do so?

Actually, the law allows companies to register the authorized capital and 90 days to pay the amount to obtain the business license. As such, this is how FLC and its subsidiaries nominally increase chartered capital and continue public listing without having to pay before the 90-day period expires and disclose information as public companies normally do.

The question is whether the whole process was supervised by regulatory bodies. If this is properly done, Quyet may have not had the opportunity to inflate FLC chartered capital and commit fraud on investors for the number of millions of dollars.

The issue here is the loophole from unclear regulation to the state management of the capital registered by companies.

Who in this case should bear the responsibilities?

The State Securities Commission of Vietnam (SSC) should carry out the supervision works on the basis of input from stock exchanges regarding any irregularities in the market.

It is obvious that these agencies have not fulfilled their roles, and a timely intervention would have been able to protect investors from such fraud.

During the appraisal process for a public listing, the SSC’s role is key to ensuring companies’ compliance with regulations. In the future, the SSC should step up supervision works, especially in information disclosure on financial statements, and promote greater efficiency in the works of auditors.

What are the consequences of companies inflating their chartered capital?

This is an unlawful practice that could lead to other violations, or in preparation for an illegal act. There has been a rising number of companies with artificial chartered capital, which in turn poses high risks for their partners, customers, and the overall business environment.

From the customer's and business partners’ perspectives, they could not know the actual situation of financial situation of the business in question, which could distort any business plan or even become unwanted creditors.

How would countries in the world address this issue?

In the US, the Securities and Exchange Commission has a specialized unit to detect possible frauds, as transparent and clear corporate governance is a key matter. Meanwhile, the European Securities and Markets Authority (ESMA) during the Covid-19 outbreak had lowered the threshold for reporting short-selling to regulators to 0.1% of the issued share capital, compared with 0.2% before. The move, as ESMA stated, would support “more stringent action if required to ensure the orderly functioning of EU markets, financial stability, and investor protection.”

What should local authorities do to prevent companies from exploiting legal loopholes to artificially inflate their chartered capital?

The SSC should step up their supervision works to verify any information related to the business registration of a public company, as such the regulation should be clearer on the responsibility of each party involved in the process.

In addition, the authorities should raise awareness among the business community on complying with the law and regulations; imposing more stringent penalties for false declaration of chartered capital.

Thank you for your time!