Vietnam’s manufacturing output continues an upward trend in July

Vietnam’s manufacturing output continues an upward trend in July

Manufacturers remained optimistic that production will increase in the next 12 months.

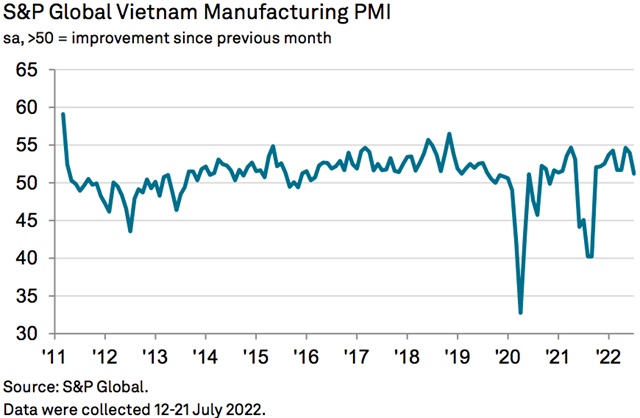

The S&P Global Vietnam Manufacturing Purchasing Managers' Index (PMI) remained above the 50.0 no-change mark for the tenth successive month at 51.2 in July, signaling a further strengthening of business conditions.

|

A reading below the 50 neutral marks indicates no change from the previous month, while a reading below 50 indicates contractions, and above 50 points means an expansion, according to S&P Global.

New orders increased for the tenth month running, but the rate of expansion eased to the weakest since April. New export business rose solidly, meanwhile, and at a faster pace than total new orders.

The continued growth of new orders encouraged manufacturers to keep expanding production in July. Output rose for the fourth successive month. That said, the rate of expansion was only marginal and the softest in the current sequence of growth amid signs of demand softening, shipping difficulties, and price pressures.

There were signs, however, of price and supply pressures easing at the start of the third quarter. On prices, the rate of input cost inflation slowed sharply and was the weakest since October 2020 as the prices of some inputs fell on global markets. That said, the latest rise was still above the series average amid reports of higher costs for oil, gas, and freight. Similarly, output prices continued to rise, but the rate of inflation slowed and was only modest.

“The recent burst of growth in the Vietnamese manufacturing sector gave way to a more modest expansion in July, but firms were still able to secure greater volumes of new orders and increase output and employment accordingly,” said Andrew Harker, economics director at S&P Global.

Production of lighting products at Rang Dong Company. Photo: The Hanoi Times |

"Although there were some signs of demand softening, there were pleasing developments in terms of price and supply pressures. The rate of input cost inflation slowed sharply, while supply chains neared stabilization. With these factors having provided serious headwinds for firms over a sustained period, signs of improvement should hopefully boost growth prospects."

Suppliers' delivery times neared stabilization as the rate of lead time lengthening softened for the second month running to the weakest in 22 months. Where delays continued, this was linked to issues with shipping and rising transportation costs.

Manufacturers continued to expand their workforce numbers in line with higher output requirements, the fourth month running in which this has been the case. The rate of job creation was solid despite slowing from the three-and-a-half-year high posted in June. Meanwhile, backlogs of work were unchanged following a decrease in the previous month.

As well as taking on extra staff, firms also expanded their purchasing activity in July, due to rising new orders and efforts to build inventory reserves. Any attempts to accumulate stocks of purchases were in vain as preproduction inventories decreased at the sharpest pace in just over a year.

Stocks of finished goods also decreased, falling for the fifth month running and at a faster pace than in June. Some firms lowered inventories in response to slower new order growth, while others had found it easier to dispatch products for export.

Manufacturers remained optimistic that production will increase over the coming 12 months. The positive sentiment reflected hopes for further improvements in customer demand, stable market conditions, new product development, and business investment. Close to 58% of respondents were optimistic about the outlook, while 11% were pessimistic.

|

Hanoi’s Index of Industrial Production (IIP) rose by 7.2% year-on-year during the first seven months of 2022. The city’s economic recovery was also reflected by the establishment of over 17,200 new businesses during the period, up 13% year-on-year. Meanwhile, Hanoi’s exports in January-July surged by 17.2% to US$9.8 billion, and imports of $24.8 billion, representing an increase of 27.5%. |