THM Group responsible for bonds malpractice

THM Group responsible for bonds malpractice

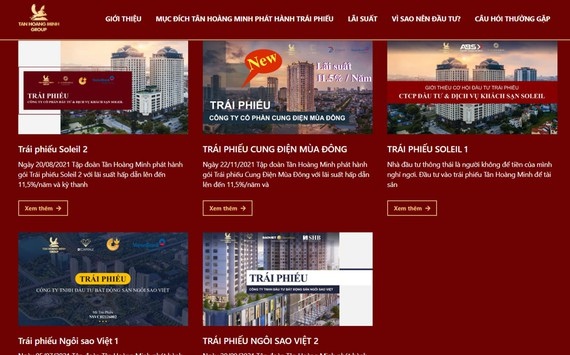

The cancellation of all nine corporate bond issuances worth VND 10,030 bn of the Tan Hoang Minh Group (THM) has caused much concern among investors in the last few days.

Illustrative photo. |

What is even more surprising is that no intermediary institution has accepted involvement in this case after the State Securities Commission of Vietnam (SSC) decided to cancel all the Corporate Bonds that were submitted with false information by the THM Group. The bond issuance and IPO were carried out between the parent company of the THM Group and its three subsidiaries, before they were further split into smaller packages and sold to gullible investors and ordinary people.

As soon as it was known that the SSC had decided to cancel all the nine bond issuances worth around VND 10 bn, other institutions, including commercial banks and securities companies named in the list of institutions that had recommended buying the THM Group corporate bonds immediately ducked any responsibility. The BaoViet Securities Company has said that it had only provided IPO advisory services and all bonds worth VND 800 bn issued by Viet Star Corporation were bought by the parent company of the Tan Hoang Minh Group.

The An Binh Securities Company said that it only provided advisory services for one corporate bond issuance worth VND 800 bn issued by Soleil Investment and Hotel Services JSC. All the bonds of this issuance were sold to one investor known as the Tan Hoang Minh Co., Ltd. While commercial banks like SHB and Vietinbank have also said they had only provided the services of accounting and management of assets for the issuances and not guaranteeing the issuances, or payment, or distribution of such bonds.

So it can be said that those separate issuances by subsidiaries of the THM Group were actually just buying and selling activities within the company. The THM Group was the primary buyer of the bonds issued by its subsidiaries. Corporate Bonds are in fact debts, but why had the THM Group made the loans look attractive by calling them Corporate Bonds, instead of directly giving the loans to its subsidiaries, which is a mystery. The reason could have been very simple. A loan cannot be sold to anyone to raise cash while Corporate Bonds are a financial tool which have been made highly fashionable over the last couple of years.

There has been an over enthusiasm in issuances of Corporate Bonds, especially by real estate enterprises over the last few years, although most of them have been officially issued through the banking channel. This is to say that banks can assess, evaluate, guarantee or even act as primary purchasers and major investors of such Corporate Bonds. This is an ordinary investment banking activity. In other words, they are Corporate Bonds with comparatively low risks even when the banks distribute them to individual investors or depositors.

Fact is that the THM Group wanted to do everything, which is, issue bonds and also distribute them through different channels to collect cash. Instead of seeking loans, the THM Group subsidiaries issued their bonds to the parent company of THM through ordinary IPOs, seemingly in compliance with all legal procedures. The parent company then split the bond packages and sold them as high profit investments to gullible investors and collected huge amounts of cash.

It is obvious that such separate issuances must have the involvement of some intermediary institutions. Any professional financial institution could have undeniably sensed an abnormality when the subsidiaries separately issued the bonds to their parent company. For this reason, those securities companies or commercial banks may have been involved to ensure protection against legal risks. The financial activities sound legal, but they were actually well covered up, and financial institutions were able to reap a certain amount of risk management fees, or find ways to cover their illegal activities if they were to be found out.

Multilevel selling

Separately issued bonds can only be sold to professional investors, mostly organizations. After a while, however, such bonds can be sold to secondary investors, and in fact, they can be sold to anyone that a stockbroker can contact on the phone. The author of this article has been at times bombarded with offers to buy Soleil 2 bonds with an offer saying that it is a wonderful investment opportunity at an interest rate of upto 11.2% per year and the initial package worth VND 100 mn. Investments could be on the basis of flexible plans or for a three-month term. An asset that was said to guarantee such bonds was a real estate company on Phu Quoc Island, yet the given name THM could be prestigious enough to make clients feel safe.

What could be convincing enough was the names of securities companies or commercial banks referred to as participating issuers or agents in charge of account management and payment, which could easily be mistaken for guaranteeing institutions. No stockbrokers would say explicitly that you are actually lending the company VND 100 mn at an interest rate of 11.2% per year.

The bond issuing agents are responsible for disposing of all these bonds to investors whose names can be found on a list with telephone numbers, which is actually a form of multilevel selling. Any promise could be made, even things like support for certification of a professional investor or rebuying bonds whenever the investor wants to sell them back, but such promises are completely baseless. It is not clear how many of THM bonds have been discarded to investors through a horrible network of telephone assistants, yet they may have achieved certain success.

The THM Group has sent all its customers a document without a seal or signature, saying that their investments would be returned at the earliest convenient time. However, it could be a gigantic puzzle while investors just hold a small proportion of the split bonds. How solvent the THM Group is, or how legally binding are the contracts, when will the interests and principals be paid and what are true relationships between investors and THM are just a few questions that ordinary people can hardly answer, and their debt collection could prove a lengthy process. What needs to be done now is gather all the investors in these past deals and provide them with sufficient legal support.