Significant opportunities brewing for Vietnamese coffee this year

Significant opportunities brewing for Vietnamese coffee this year

Coffee is an important commodity, accounting for three percent of the country's GDP, and about 15 percent of the total export turnover of agricultural products.

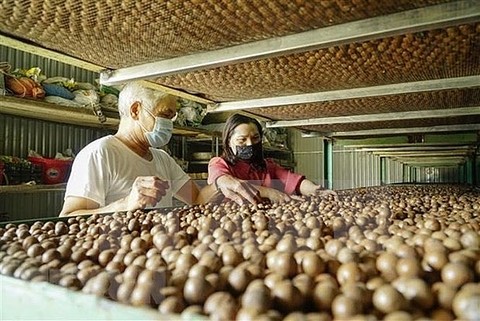

Consumers are gradually getting used to drinking Vietnam’s roasted and ground Robusta coffee |

Vietnam is the second largest producer of coffee in the world after Brazil, with Robusta accounting for around 95 percent of its annual output of 30.1 million 60kg bags.

According to the Agency of Foreign Trade under the Ministry of Industry and Trade (MoIT), Vietnam's coffee exports in the first two months of 2022 were estimated at 293,000 tonnes, and valued at US$674 million, up 3.4 percent in volume and 35.6 percent in value compared to the same period last year. The average export price of Vietnam's coffee was estimated at US$2,299 per tonne, up by 31.1 percent over the same period of 2021.

The results are attributed to efforts by enterprises in the industry to diversify their products and ensure the best quality, digitize sales platforms and pay more attention to e-commerce sales. The Vinh Hiep Co., Ltd., for example, has been digitizing its 30-40 hectare raw material area for 10 years and is becoming increasingly responsive to market fluctuations.

The Vietnam Coffee and Cocoa Association (Vicofa) wants to double the value of Vietnam’s coffee exports to US$6 billion by 2030 by increasing the proportion of processed coffee it exports, including instant brands, from 10 percent today to at least 25 percent by 2030.

Opportunities and challenges

Vietnamese coffee is exported to most countries in the world, including discerning markets such as the EU and Japan.

Coffee is an important commodity, accounting for three percent of the country's GDP |

The Vietnam Trade Office in Japan said that European coffee drinking culture has generated increased demand for coffee among young Japanese. Data from the International Trade Center (ITC) showed that in 2021, Japan imported 409,800 tonnes of coffee, worth approximately US$1.32 billion, up 2.7 percent in volume and 11.6 percent in value compared to 2020. Japan increased coffee imports from Brazil and Vietnam in 2021, but decreased imports from key suppliers such as Colombia, Guatemala, and Ethiopia.

The EU, the largest coffee market in the world, accounts for 47.9 percent of the total import value worldwide and is also Vietnam’s largest coffee consumer.

The EU is a highly discerning coffee market. In the Netherlands, 80 percent of consumers choose Arabica, while the rest prefer Robusta. France is also seen as a potential market for coffee exporters, especially in the premium segment. It is estimated that the premium coffee market share in the country could increase from two percent annually to 10 percent by 2025.

Processed coffee is the product that most benefits from the zeroing of 93 percent of tariff barriers under the EU-Vietnam Free Trade Agreement (EVFTA), providing significant opportunity to expand the Vietnamese coffee market in the EU. At the same time, coffee is also one of Vietnam’s 39 geographical indications that the EU commits to protect under the EVFTA.

|

Global coffee prices will remain high this year, according to the MoIT’s forecast as a result of pandemic effects that limited supplies from major South American producers like Colombia. In the long run, this could help change consumer tastes in favor of Vietnamese roasted and ground Robusta coffee. |