Hanoi’s real estate market shows optimistic signs of recovery

Hanoi’s real estate market shows optimistic signs of recovery

Potential foreign-direction investment flows and large-scale infrastructure linking Hanoi and its environs enhance Asian tenant pools for serviced apartments.

Hanoi’s real estate market has witnessed many optimistic signs spurring recovery and growth prospects for 2022.

The latest analysis of Savills Vietnam showed the market's development momentum in the districts outside the center and suburbs stands out that is considered the leading trend in the office and residential real estate segment this year.

Hanoi’s real estate market shows optimistic signs of recovery in 2022. Photo: Le Viet |

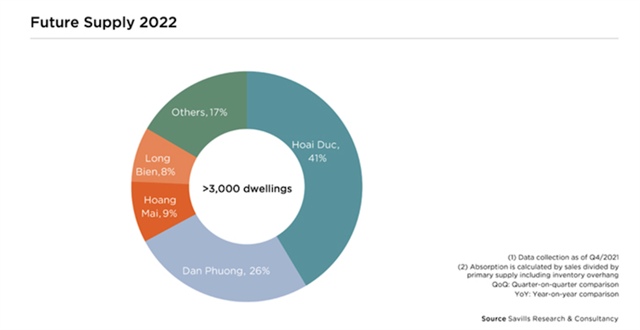

For the residential segment, future supply is expected to come mainly from projects located in neighboring provinces' suburban districts.

Regarding the apartment market alone, it is expected that in the future, projects in five upcoming urban districts including Hoai Duc, Dong Anh, Thanh Tri, Gia Lam and Dan Phuong will account for 27% of the supply.

Besides, in terms of villas and townhouses market, future supply will mainly come from districts far from the center, led by Dan Phuong District, followed by Hoai Duc and Dong Anh districts.

At a recent event themed “Property Outlook 2022: A Fresh Approach” in mid-February, Do Thu Hang, Senior Director of Advisory Services at Savills Hanoi said: “In some big cities like Hanoi and Ho Chi Minh City, we noticed there is a tendency to shift investment to neighboring areas.”

She added, one of the reasons for this phenomenon is that real estate prices in the inner city have already been set at a high level, and the expectation of profitability from this location has been lowered. “Investors often seek opportunities in districts outside the city center and surrounding areas such as Hung Yen, Bac Ninh, Quang Ninh, and Hai Phong, thereby reducing the pressure on price increases in metropolitan areas,” she noted.

Source: Savills Vietnam, 2022 |

Hang also emphasized the importance of infrastructure in attracting investors and buyers. According to the city’s plan, Hanoi is expected to spend more than VND51 trillion (US$2.2 billion) in public investment in 2022, of which infrastructure construction accounts for 30% of the total investment fund.

The city will prioritize investing in projects such as ring roads: 2.5, 3, 3.5 and 4, Vinh Tuy Bridge phase 2 and Thuong Cat Bridge as well as improving and enhancing the national highways. The completion of urban railway projects is also accelerated. The convenient transportation system will shorten travel time and support connections between projects in the suburbs and those in the center.

For the office market, Savills’ research recognized the diversity in tenants with different locations. In terms of geographical location, enterprises in the fields of finance, insurance, and real estate (FIRE) tended to be concentrated in the central and metropolitan areas while others in the manufacturing and information and communications technology (ICT) sector are located mainly in the west.

However, in recent years, the market has witnessed many businesses and organizations of FIRE groups moving to the western districts.

“Returning to work after a prolonged period of isolation may lead to increased office demand and rental recovery in 2022. ICT, manufacturing, and FIRE sectors will be the main drivers,” Savills experts predicted.

Source: Savills Vietnam, 2022 |

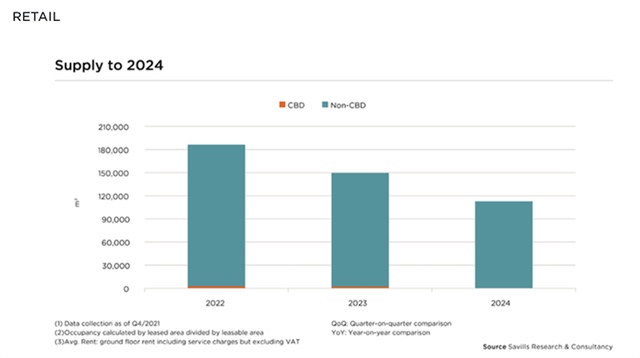

The retail market is expected, within three years, to have an additional 5,000m2 of floor space in the central area, partly meeting the current supply shortage. In the West, there will be an additional 10,000m2 of floor space with the inauguration of Nam Tu Liem District’s QMS Tower in 2022 and Cau Giay District’s Taisei Hanoi Office Tower in 2024.

Vacancy status will be improved this year thanks to two main factors including the business expansion of large-scale tenants and international brands and an increase in people's daily spending.

Hoang Nguyet Minh, Director of Commercial Leasing at Savills Hanoi said: “Retail brands were hesitant to open new sites, fearing lockdowns and business disruptions at their existing sites. However, there were more demands for flagship stores from cosmetics, fashion, and food & beverage businesses.”

For the hotel segment, after lockdown restrictions were eased last October, the sector had improved performance in Q42021. Average occupancy reached 27% and that of 5-star hotels hit 31%. The average room rate increased 6% quarter-on-quarter and 12% year-on-year. By 2023, 13 new projects are expected to launch, eight of which will be five-star hotels.

Matthew Powell, Director of Savills Hanoi said: “Easing travel restrictions meant Hanoi's hotels had improved occupancy in Q4 2021. The rapid vaccination program is a positive step to welcoming foreign tourists again. Nevertheless, domestic visitors will continue to drive Vietnam's hospitality sector.”