2021 total annual demand for gold in Vietnam at 43t

2021 total annual demand for gold in Vietnam at 43t

2021 demand for jewellery in Vietnam was 12t, 11% higher than the 2020 figure of 11t. But the fourth quarter saw a 12% y-o-y fall to 2t, as the market was hit hard by COVID.

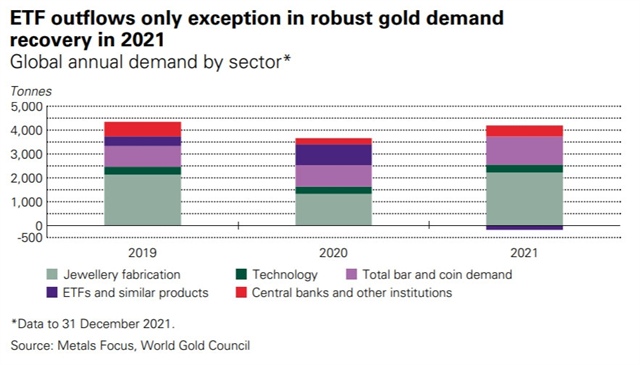

The World Gold Council’s latest Gold Demand Trends Report revealed that global annual demand (excluding OTC markets) has recovered many of the COVID-induced losses from 2020 to reach 4,021t for the full year in 2021.

|

Q4 retail investment in Vietnam declined by 11% y-o-y to 6t. Although lockdowns started to ease in October, consumer confidence is taking time to rebound fully. Q-o-q retail demand grew, due in part to concerns about inflation, a reduction in the savings rate, and weakness in the Vietnamese dong. Annual bar and coin demand in Vietnam was 31t, a slight increase on the 29t purchased in 2020.

Andrew Naylor, Regional CEO, APAC (ex-China) at the World Gold Council, said: “While many Vietnamese consumers were wary of high value purchases due to the severe effects of the pandemic, sales picked up in November with promotional campaigns and the wedding season. Cultural milestones, coupled with Vietnam’s recovery of consumer confidence led to a significant rise in annual consumer demand for gold.”

Returning to the global picture, demand for gold reached 1,147t in Q4 2021, its highest quarterly level since Q2 2019 and an increase of almost 50% year-on-year, according to the World Gold Council.

Gold bar and coin demand rose 31% to an 8-year high of 1,180t as retail investors sought a safe haven against the backdrop of rising inflation and ongoing economic uncertainty caused by the coronavirus pandemic.

Meanwhile, the World Gold Council’s data series reported outflows of 173t in 2021 from gold-backed ETFs as some more tactical investors reduced hedges early in the year amid COVID vaccine rollouts, while rising interest rates made holding gold more expensive.

Nevertheless, these outflows represent only a fraction of the 2,200t that gold ETFs have accumulated over the preceding five years, demonstrating the continuing importance investors place on including gold in their portfolio.

Turning to annual consumer demand, the jewellery sector rebounded to match 2019’s pre-pandemic total of 2,124t. This was aided by a strong Q4 when demand reached its highest level since Q2 2013 - a quarter where the price of gold was 25% lower than the average comparative price in 2021; further highlighting the strength of demand in the most recent quarter.

The use of gold in the technology sector in 2021 increased 9% to reach a three-year high of 330t. While technology demand is comparatively smaller than other sectors, its uses are far reaching and prevalent in a variety of electronics, from mobile devices to the sophisticated James Webb telescope recently put in orbit.

Gold is expected to face similar dynamics in 2022 to those seen last year, with competing forces supporting and curtailing its performance. Near term, the gold price will likely react to real rates, which in turn will respond to the speed at which global central banks tighten monetary policy and their effectiveness in controlling inflation.

Louise Street, Senior Analyst EMEA at the World Gold Council commented: “Gold’s performance this year truly underscored the value of its unique dual nature and the diverse demand drivers. On the investment side, the tug of war between persistent inflation and rising rates created a mixed picture for demand. Increasing rates fuelled a risk-on appetite among some investors, reflected in ETF outflows. On the other hand, a search for safe haven assets led to a rise in gold bar and coin purchases, buoyed by central bank buying. Declines in ETFs were offset by demand growth in other sectors. Jewellery reached its highest level in nearly a decade as key markets like China and India regained economic vibrancy”.

Historically, these market dynamics have created headwinds for gold. However, the elevated inflation seen at the start of this year and the possibility of market pullbacks will likely sustain demand for gold as a hedge. In addition, gold may continue to find support from consumer and central bank demand.