Delicate balance needed to address Vietnam’s property risks: HSBC

Delicate balance needed to address Vietnam’s property risks: HSBC

The housing market may run away from economic fundamentals.

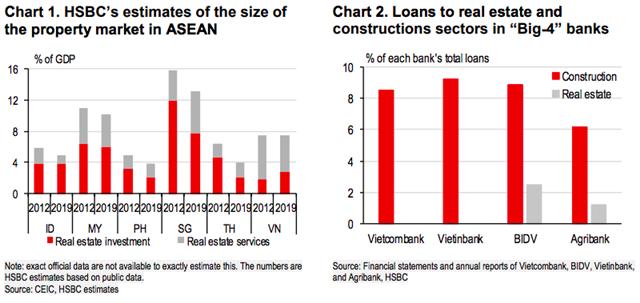

The State Bank of Vietnam (SBV) is facing a delicate balance of curtailing excessive lending to real estate developers while reducing imminent Covid-19 risks to the sector, according to HSBC.Referring the property sector as an increasing source of growth for Vietnam, the bank in its latest report noted real estate activity in the country accounts for 8% of the GDP, while the ratio in ASEAN is between 5% and 15%.

More restrictive macro-prudential measures would require if the property market shows more signs of overheating. Photo: Minh Long

|

“The memory of a housing bubble of 2007-12, which ultimately led to a prolonged banking crisis, looms large in the collective conscience. Even after a gradual recovery in the banking sector, real estate loans continue to account for a large proportion of bank balance sheets,” noted the HSBC.

While some banks do not have a specific classification on loans to the real estate sector, balance sheets of the “Big-4” SOE banks [Vietcombank, Vietinbank, BIDV, Agribank] reveal a key linkage with the associated construction sector, stated the bank.

As the real estate market has been hit by the pandemic, there are signs that it is recovering. Although output fell in year-on-year terms in the second and third quarters of last year, it registered a strong rebound from the fourth quarter.

|

Meanwhile, property prices continue to rise, partly due to accommodative monetary policy that offers low-interest rates and abundant liquidity, along with a sharp rise in the price of luxury condos, growing 9% year-on-year 2020 vs. a 4-5% price increase in the mid-end and affordable segments.

Demand for luxury and high-end properties remains elevated, with their market share increasing from less than 30% of total units sold in 2019 to more than 70% in 2020.

According to the HSBC, FDI data suggests that even though new FDI inflows into the real estate sector increased more than 200% year-on-year as of May, FDI was largely concentrated in manufacturing.

“This means that price rises are mainly due to domestic investors,” noted HSBC.

Rising housing prices limit the central bank for further rate cuts

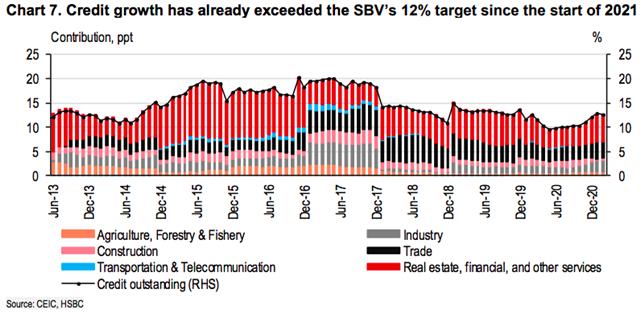

Along with price rises, there has been a surge in credit channeling into the sector, prompting the SBV to called for commercial banks to enhance their risk management operations.

|

Statistics data suggests that credit growth in the real estate sector accelerated to 15% year-on-year in January and February, exceeding the SBV’s target of 12%.

“If the property market shows more signs of overheating, there is scope for the SBV to do more, such as introducing more restrictive macro-prudential measures or further tighten its quantitative [credit] quota. That being said, there is also a risk that the most recent wave of Covid-19 may complicate the process, given the adverse impact on Vietnam’s growth,” stated the HSBC.

Over the years, the SBV seems to have used the monetary policy as a tool to support growth whereas it uses macro-prudential policies to manage property market risks, it added.

“Still, we expect rising housing prices to constrain the SBV’s ability to deliver any further rate cuts,” added the HSBC, while noting fiscal policy should be tasked with the burden of providing immediate targeted support amid the latest outbreak of Covid-19.

So far, the Ministry of Finance has proposed extending fee reductions for another six months until the end of 2021.

“ It is encouraging to see that the authorities are concerned that the housing market may run away from economic fundamentals, and are thus keeping an eye on the country’s real estate market. If needed, tighter macro-prudential policies could be used to further contain risks. That being said, this requires a delicate balance, given increasing downside risks to growth,” concluded the HSBC.