Vietnam needs improved marketing strategy

Vietnam needs improved marketing strategy

The global outbreak of the Covid-19 pandemic has made the world realize the limitations in the current supply chain, which shows an over reliance on just one link, which is a plausible reason for the collapse of the system.

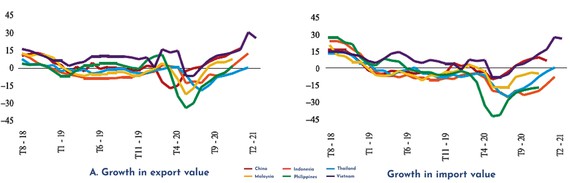

Fig.1: Exports & Imports of countries (%), August 2018-February 2121. Source: Haver Analytics.

|

The current ongoing pandemic is also providing the time to ease pressure on Vietnamese trade as restructuring of the Global Supply Chain is being dealt with. Only those countries that are well-prepared and have successfully controlled and contained the pandemic will be able to see a good outcome and macroeconomic stability in the future by an improved marketing strategy.

Break in supply chain

The repeated closure of the border, and immigration restrictions during the current pandemic have caused trade activities and global value chains to be disrupted or broken, especially the important supply chains to the US, China, Japan, Germany, and the European Union (EU). All these countries are reeling under the havoc being caused by the Covid-19 pandemic. At the same time, manufacturing and business facilities of 1,000 of the world's largest suppliers have upto 12,000 units in Covid-19 quarantined areas, most of which are located in China.

This explains why there is a breakdown in the Global Value Chain (GVC) that is seriously affecting trade activities for almost 50% of international trade. In addition, the application of digital transformation in manufacturing and business activities has made countries increase automation, in order to improve production capacity and withdraw from the GVC, so as to localize the economy. The disruption of Global Supply Chains is also due to sanctions inflicted during the US-China trade war, along with rise of protectionism. The industries in the world are overly dependent on China, so the leading countries tend to withdraw from what is considered the factory of the world.

Closer linking of the supply chain with the value chain is essential for ease of control. The US-China trade war had partially initiated and spurred this process when China thought it needed a strategy to undermine America's leading role in global trade. The pandemic is not the only reason that has caused a change in the structure of the Global Value Chain, though it may perhaps have been the catalyst to speed up the process. Since the 2008 global financial crisis, intensive production of imported raw materials for exports has decreased sharply. Looking back over the last 30 years, the decentralized production system has been effective and has made a great contribution to GVC, but it still depends on the ability to trade, transport, and implement different trade policies of each country.

At the same time, a new form of production in the Global Value Chain is gradually emerging. With the development of digital technology, multinational companies are moving closer to consumer markets to reduce transportation costs, and increase sales. The production activities of supply chain units will have to be restructured, forcing companies to consider strategies to reduce production fragmentation where cheap labor is available.

Raising Vietnamese trade

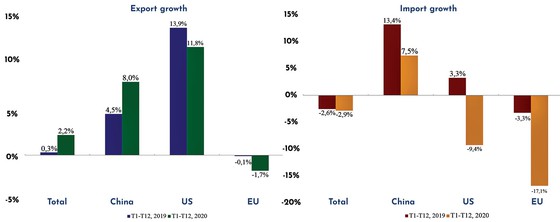

Vietnam had a record trade surplus of USD 19.1 bn in 2020, although the US remains the largest export market with a trade surplus of USD 62.7 bn. Meanwhile, the trade deficit with the largest importer of China was at USD 35.4 bn. When looking at the trade activities of East Asia and the Pacific (EAP) countries, it is easy to see that Vietnam has the highest growth in import and export value (Fig. 1). In exports, ASEAN-5 countries export more goods and services to the US than China and other major trading partners, while importing the most from China (Fig. 2). These trends are similar to the trade statistics of Vietnam in 2020.

Fig. 2: Exports & Imports of ASEAN-5 with selected partners(%), 2019-2020. Source: To Cong Nguyen Bao et al (2021), data extracted from WB (ASEAN-5 countries Indonesia, Malaysia, Philippines, Thailand, Vietnam).

|

The Covid-19 pandemic has also created an opportunity for Vietnam to access and thereby participate more strongly in the Global Supply Chain, so that it can become a new nucleus in the Global Value Chain. There are some factors that can contribute to this process. First, Vietnamese exports have now risen to approximately 53.4%. Second, labor costs in Vietnam are lower than in China. Third, the business environment and competitiveness in Vietnam has improved since 2020, ranking the country at 70th place, up 23 places compared to 2010.

However, raising Vietnamese trade to new levels will not occur overnight, but will require systematic planning in preparing the right solutions as well as resources. As the world is facing a multitude of challenges in unforeseen and uncertain ways, such as the ongoing Covid-19 pandemic, the rise of unilateralism, growing geopolitical rivalry between major countries, and the coming of the digital age, many factors need careful consideration.

There are now five basic principles that can shape the strategy for Vietnamese trade. First, we need to improve the business environment and enhance competitiveness. Second, we need to enhance our involvement in the global supply chains. Third, we must improve out value-added products for exports in the value chain. Fourth, we must apply digital technology to all our economic activities. Fifth, we need to make cognitive changes so as to adapt better to the world markets.