Expanding fast food outlets place strain on obesity worry

Expanding fast food outlets place strain on obesity worry

As international organisations are at pains to warn of an increasing obesity problem in Vietnam, the country’s fast food industry continues to swell despite mounting losses for some chains and difficulties in attempting to alter local eating norms.

|

Despite its fast-paced development, Lotteria Vietnam has been operating at a loss. In 2020, the chain’s net losses surpassed $8.97 million, reducing its book value from $24 million at the beginning of the year to a little less than $14 million.

The COVID-19 pandemic was not the main culprit behind the chain’s losses, as it was only a continuation of the VND20 billion ($870,000) losses it suffered between 2017 and 2019.

Lotteria is not alone in this situation, as others like McDonald’s and Jollibee are also amassing losses.

Chain owner South Korea’s Lotte Group last month sent the market spinning after rumours surfaced that it would shut down its Lotteria restaurant chain in Vietnam. However, a representative refuted the news, saying that the chain will not only remain open but will expand with 10 new outlets as well as a food preliminary processing factory in the southern province of Long An. The company blamed the confusion on a misunderstanding of a South Korean media report, and the fact that it is leaving the Indonesian market.

Since its entry in 1998, Lotteria has opened 260 stores in Vietnam, including 100 through the franchising model.

According to Sean T. Ngo, CEO of VF Franchise Consulting, there are many reasons for the ongoing losses of foreign fast food chains despite their long presence in Vietnam, including increasing competition, high rental costs, and the limited supply of affordable premises.

“Other reasons include a supply chain that needs significant improvements and more qualified suppliers, fast-rising labour costs due to nearly annual increases in minimum wages throughout the country, and generally lower disposable incomes compared to many neighbouring countries,” he said.

However, the difficulties do not seem to stop the onslaught of fast-food chains, with more outlets being opened not only in commercial centres and big cities but also in the provinces, making the market more competitive.

Acquiring a taste

According to data from Euromonitor International, Vietnam’s fast food market is still growing strongly at 18-20 per cent a year. This comes partially from people incorporating more and more Western meals – including fast food but also pastries and dairy-based smoothies – into their diets.

Changing consumption habits are partially driven by rising incomes as well as modern Vietnamese families shifting to a busier, more cosmopolitan lifestyle that includes fewer home-cooked family meals and more dine-out and takeaway options to save time as well as money.

According to a survey of nearly 600 people across Vietnam published in August 2020 by Q&Me, 87 per cent of respondents had fast food in the past three months, with 55 per cent saying they went because of “good taste” and 39 per cent because of the location. Additionally, 87 per cent of respondents ordered fast food online due to ease of use (71 per cent) as well as good prices/promotions and low delivery costs (43-43 per cent).

The Lotteria at Hang Than street in Hanoi is a popular lunchtime haunt for secondary and high school students. Trung Thanh, a local student, told VIR, “We like coming here because it is close to our school. The food is delicious and the space is comfortable. It is also a good place to get out of the sun during summers.”

The obesity epidemic

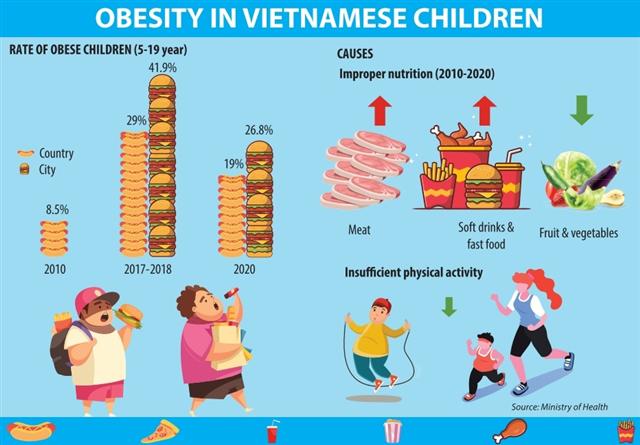

The increase in demand for fast food is one of the causes of the rising rates of obese and overweight children in Vietnam. Last month the Ministry of Health’s National Institute of Nutrition published the National General Nutrition Survey for 2019-2020, highlighting alarming increases in the number of obese and overweight children across the country.

The survey is the largest of its kind in Vietnam and involved over 22,000 households in 25 cities and provinces representing six ecological areas. It collected anthropometric data as well as data on micro-nutrients, individual food portions, food security, and food hygiene and safety.

The survey showed that the rate of overweight and obese school-age children (5-19 years old) increased from 8.5 per cent in 2010 to 19.0 per cent in 2020. Within this figure, the rate reached 26.8 per cent in urban areas and 18.3 per cent in rural areas.

Speaking at a conference to announce the results of the survey, Rana Flower, the representative of the United Nations Children’s Fund (UNICEF) cum acting chief of the Food and Agriculture Organization of the UN in Vietnam, said that the country is facing the triple burden of stunting, overweightness-obesity, and lack of micronutrients.

UNICEF’s State of the World’s Children 2019 report in addition directly linked the marketing of unhealthy foods and sugar-sweetened beverages to the growing number of overweight and obese children.

“Marketing, packaging, and aspirational status symbols have a seductive pull on all consumers, but adolescents are especially influenced by these factors. Fast food and prepared snacks are widely available in urban areas worldwide and can be especially appealing to young people. Fast food restaurants, with their clean, bright interiors, are places where teens can hang out with friends,” the report noted.

Tran Minh Chau, health coach and the operator of HAB Cyber Club in Hanoi told VIR that while fast food might taste good, they are extremely rich in aromatic spices and trans fats, one of the most unhealthy kinds of fat to consume.

“Fast food is very harmful to health because the oil used to fry food is of a very high temperature and is reused many times. Fast food increases visceral fat and has been proven to contribute to the incidence of cardiovascular diseases and even cancer,” Chau said. “The problem is that these diseases set in slowly, so parents often overlook the signs and are unaware of how harmful their children’s diets are.”

| McDonald’s

Six years ago when McDonald’s opened its first restaurant in Vietnam, thousands of people lined up for a taste. The chain set the target of opening 100 stores within 10 years. So far, they have only 23 stores in Hanoi, Binh Duong, and Ho Chi Minh City, while in culturally similar markets such as China and Japan, the chain has more than 2,000 stores. Reacting to comments that its meals do not match Vietnamese people’s taste, in September 2020, McDonald’s launched a Pho burger. However, it has thus far failed to satisfy the taste buds of customers and is deemed too pricey at around $3. To date, McDonald’s Vietnam has not published its business results, but its worldwide operations are not too bright. It reported a 68 per cent drop in net profit in the second quarter of 2020 to $484 million. Its in-store sales in the second quarter of 2020 decreased by 24 per cent. Its revenue fell 30 per cent on-year to $3.76 billion. |

| KFC

Famed American fried chicken brand KFC entered Vietnam in 1997 by opening its first restaurant in Ho Chi Minh City. Since then, the chain has increased to over 140 units in 32 cities and provinces across the country, generating jobs for over 3,000 employees. In the early years, it took KFC seven years to open 10 stores and begin generating profit in Vietnam. Since then, profit has been fluctuating. According to its financial statement for 2019, KFC Vietnam Joint Venture Co., Ltd. reported revenues of $65.2 million, up 1.3 per cent on-year. The chain reported an average pre-tax profit of $4.35 million in the period of 2017-2019. Notably, the pre-tax profit of 2017 was $4.47 million, $5.17 million in 2018, and $4.43 million in 2019. According to the Q&Me survey conducted in August 2020 of people between the ages of 18 and 55, KFC is by far the most frequently visited fast food restaurant chain in Vietnam, with 45 per cent of respondents visiting its stores often. |

| Jollibee Vietnam

A brand from the Philippines, Jollibee entered Vietnam in 1996 and started franchising in late 2015. Currently, it has 120 stores in 47 cities and provinces nationwide, with plans of further expansion. In 2019, Jollibee Vietnam acquired approximately $43.5 million in revenues, an increase of over 40 per cent compared to 2018. The chain’s average growth rate in 2017-2019 was slightly above 37 per cent, far outperforming KFC (4 per cent) and Lotteria (5 per cent). However, of the three names, only KFC made profit. Jollibee is planning to expand to Japan and the United States with the target of reaching 4,000 stores worldwide by the end of 2017. On its home turf, Jollibee opened its 1,000th branch in Taguig to celebrate its 40th year of establishment. In Vietnam, the company launched a food processing factory in the southern province of Long An in 2019. The plant has four production lines comprising of pre-processing chicken, sauce processing, flour mixing, and baking. The company expects the plant to help it dominate the quick service restaurant sector in Vietnam. The company also had set the target of opening 300 stores in Vietnam by 2020. Despite initial confidence, five months into 2021, it is only halfway to the target. |