Vietnam gas consumption to double in next 10 years: Fitch Solutions

Vietnam gas consumption to double in next 10 years: Fitch Solutions

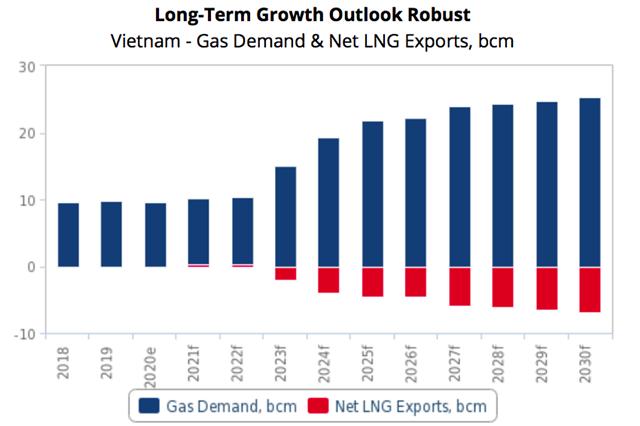

Gas demand is expected to rise from about 9.7 billion cubic meters (bcm) in 2020 to above 25.3bcm in 2030, while influx of LNG helps to counter the decline in domestic production.

Vietnam’s gas consumption is predicted to accelerate strongly over the coming decade, more than doubling, over the duration of the upcoming Power Development Plan VIII (PDP VIII) [2021-2030].

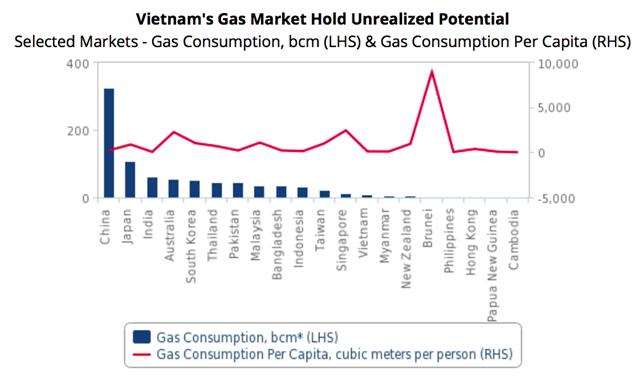

“The potential of the Vietnamese gas market is strong,” stated the Fitch Solutions in a note, saying in comparison to markets similar in terms the size of the consumer market as measured by population, Vietnam appears undersupplied in gas both in terms of absolute consumption volume and per capita.

Source: UN, JODI, Fitch Solutions

|

The domestic gas network is also found deficient with Vietnam ranking 15th out of 17 Asia-Pacific gas markets as per the CIA Factbook in terms of total gas pipeline length, despite having historically been self-sufficient in gas.

The current gas demand is predicted to be more than double over the next decade, from about 9.7 billion cubic meters (bcm) in 2020 to above 25.3 bcm in 2030. It is also expected that influx of LNG will help counter the decline in domestic production.

However, long-term growth has the potential to far outpace the current forecast, as more projects in the pipeline gain clarity and are brought online, stated Fitch Solutions.

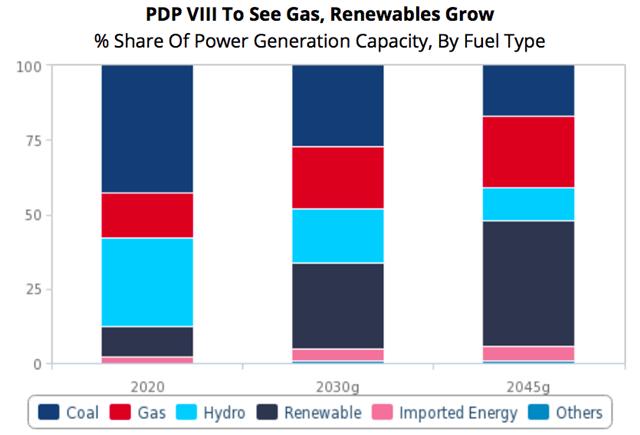

Source: Vietnam MoIT, Fitch Solutions

|

Under the draft PDP VIII, the Ministry of Industry and Trade (MoIT) outlines ambitious growth targets for power generation from natural gas and renewables.

The share of gas-fired generation capacity is forecast to grow from about 14.9% in 2020 to 21% in 2030 and further to 24% in 2045, while that for renewables is expected to increase from 9.9% in 2020 to 29% in 2030, and to over 40% in 2045.

“These are expected to occur at the expense of coal and hydropower, which are more pollutive and environmentally damaging to produce domestically,” added Fitch Solutions.

New LNG project from PVGas Vietnam. Photo: Minh Thi

|

The PDP does indicate that coal use in the domestic market would continue even as emphasis shifts to using cleaner forms of energy, although consumption will increasingly become dependent on imports as domestic supply declines.

e/f = Fitch Solutions estimate/forecast. Source: Fitch Solutions

|

The share of imported energy is also expected to see marginal growth, so as to minimize the environmental footprint from producing own energy.

Capital inflows into the sector also look set to strengthen over the duration of the PDP. The Plan estimates that an investment of about US$128.3 billion will be needed over the next decade in order to realize the aforementioned growth targets in natural gas and renewables generation.

From the sum, US$95.4 billion is expected to be allocated to the development of power sources with an excess of US$56 billion worth of LNG regasification and LNG-to-power projects already lined up to be commissioned over the next decade.

The current pipeline features 23 different projects and is notable for its strong US presence; of the 23, 11 projects worth a combined US$35.9 billion and 32.6GW in generation capacity, are backed up by pledges of funding from US firms, to be completed over 2023-2030.

In addition, about US$32.9 billion will be set aside for the duration of the PDP for expanding the national grid network.