New feed groups attempt to outmuscle top performers

New feed groups attempt to outmuscle top performers

In the fierce competition of animal feed, both local players and their foreign rivals are expanding performance, with the emergence of several newcomers.

Feed group sales are rising, but the competition is fierce with more farms outsourcing for husbandry companies. Photo: Le Toan

|

As the largest animal feed production country in Southeast Asia, the sector in Vietnam witnessed high growth of 13-15 per cent on average during the 2016-2020 period, according to Grand View Research, an India and US-based market research and consulting firm. Consumption output in 2019 and 2020 was around 20 million tonnes, and was as much as 30 million if including aquaculture feed.

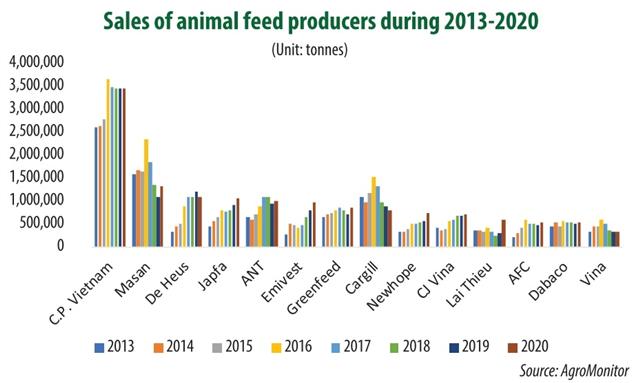

In a specific case, from just over one million tonnes in 2013, Cargill’s output increased to 1.5 million tonnes in three years. Currently, the company’s output remains stable.

John Fering, regional managing director of Cargill Animal Nutrition South East Asia, told VIR that pre-2017 the feed industry experienced rapid growth on the strong domestic demand, and pork that was moving to overseas buyers. The feed industry responded with investment plans to increase capacity to fulfil the demand. The overseas demand for pork stopped abruptly in late 2016, resulting in the demand loss of nearly 30 per cent for swine feed.

“In 2019, challenges like African swine fever (ASF) also suppressed demand for swine feed by another 30 per cent, which was partially compensated by growth in poultry and aqua segments. As the supply of pork contracted, pork prices increased and offered higher profits for producers,” Fering said. “This favourable margin for producers has resulted in farmers investing to modernise farms and expand operations – and resulted in improved demand for swine feed.”

“Cargill has long recognised the importance and huge potential of Vietnam as a top growth market in Asia. Vietnam will continue to be a key market for us,” Fering added.

|

Local emergence

In the same situation, Dutch-based De Heus reported positive growth year-by-year, from 314,000 tonnes in 2013 to 1.2 million tonnes of feed in 2019, but experiencing a 2020 drop down to just over one million tonnes. Talking with VIR, De Heus Vietnam and Cambodia general director Johan van den Ban said, “We were able to more or less stabilise our volumes, whilst moving part of our production from Vietnam to Cambodia, where we opened a new feed mill during the course of 2020.”

Some other foreign players are maintaining their production, with only modest rises in output. CJ Vina saw its sales from 423,000 tonnes of feed in 2013 to 716,400 tonnes last year; and American Feeds Company has only seen an increase from 203,000 tonnes in 2013 to 530,500 tonnes in 2020.

According to Vietnam’s AgroMonitor specialised in agricultural analysis, the most sustainable players in the market are those have strong finance and rich experiences like C.P. Vietnam, Japfa Comfeed Vietnam, Emivest, and Newhope with stable sales at 3.44 million, one million, 952,000, and 739,000 tonnes in 2020, respectively.

Bui Hoang Ha, an expert in animal feed distribution, told VIR that the up and down in the sales of the foreign producers could be caused by the emergence of some local players, including Masan Group. Masan acquired 52 per cent of Vietnam French Cattle Feed JSC and 70 per cent stake of Agro Nutrition Company JSC, ranking second in the list of animal feed producers, with the sales of around 1.3-2.3 million tonnes per year, over the last decade.

However, the presence of new local players like Hoa Phat (308,000 tonnes in 2020) as well as the efforts of others like Lai Thieu, Dabaco, Vina, and Hong Ha have been challenging overseas groups, despite their differing performances.

“The competition of feed production is quite fierce. Despite the increase of the market scale from 14 million tonnes in 2013 to 20.3 million tonnes in 2020, the development of the players’ feed production is not as fast as the market, and the sales of each player could change by millions of tonnes on-year,” said Ha. “And it is getting fiercer. As the number of household farmers is decreasing sharply after the ASF epidemic, most big farms are outsourcing for husbandry companies. Thereby, the more farms a company develops, the more animal feed the company can sell.”

This enables more chances for big feed producers, which are operating thousands of farms across the country, while the market share of animal feed is already dominated by them. Despite operating 68 per cent of the total number of factories including some big plants from Dabaco, Masan, Greenfeed, Vina, and Lai Thieu, productivity of local players is making up 35-40 per cent only.

While the number of foreign producers’ plants is 32 per cent, their output accounts for 60 per cent and could raise in the time to come, according to statistics from the Ministry of Agricultural and Rural Development.

Foreign expansion

In late-2020, C.P. Vietnam inaugurated the most modern and largest chicken breeding and processing project in Southeast Asia. With a capacity of 100 million broilers a year, CPV Food Complex in the southern province of Binh Phuoc is expected to generate $200 million revenue annually.

Last November Japfa Comfeed Vietnam inaugurated its sixth feed mill in the central province of Binh Dinh, with the total investment capital of $13 million and annual capacity of 180,000 tonnes. It also broke ground on a $230 million self-contained animal husbandry project in Binh Phuoc.

However, local conglomerates have been interested in the market for some time, with Vingroup acquiring aquaculture giant Viet Thang Feed JSC back in 2018. “Some local players are strengthening their linkage to build supply chains of production, husbandry, and consumption, and reaching small success first,” said Ha. “The foreign players should not be subjective, because the finance and experience of these local players are quite good, in addition to the advantages of a home playing ground.”

As for Cargill, it is building a $28 million feed mill in the southern region. “Overall, as a growth company, we will keep investing in and growing our business here over the medium to long term. This includes expanding our capacity and capabilities besides building strong talent and resilient communities,” Fering said.

Animal feed in Vietnam saw fast growth from only 8.5 million tonnes in 2008 to 20.3 million tonnes in 2020, while the total capacity of all plants rose from 12 million tonnes in 2008 to nearly 40 million tonnes last year. Vietnam ranks 10th in the world and first in the region in terms of animal feed, higher than Thailand (18.6 million tonnes) and Indonesia (18.3 million tonnes).

Experts say the demand for feed in Vietnam will rise to 30 million tonnes annually by 2025, valued at $12-13 billion, and annual growth at 13-14 per cent can enable Vietnam to become a promising market. However, expectations could be challenged by feed material price rises.

“Depending on overseas material supply could cause a lot of risks, so every animal feed producer should find out its own solutions to proactively manage supply and remain sustainable growth,” added Ha.