Brewing up change with modern strategy

Brewing up change with modern strategy

Saigon Beer Alcohol Beverage Corporation (SABECO) has been on a journey of transformation to strengthen its operational capabilities and modernise its governance system over the past year, doubling down on its efforts to reap positive results – in which human capital is one of its core strategies.

During the most difficult period of 2020 that was plagued by COVID-19 and tough new local drink-driving rules, Neo Gim Siong Bennett, who is the general director of SABECO, kept the faith in its strategy. “This storm will soon pass, and the sun will be out again,” he said. “In the meantime, we will focus on weathering through this storm, and be fully prepared to make hay when the sun shines again.”

The spirit of being willing to accept tough trials is rooted in the company’s transformation strategy that started sharply three years ago after Thai Beverage acquired a majority stake when the state-owned brewer was sold off.

SABECO is one of the top Vietnamese corporate brands and the market leader in Vietnam’s beer industry. The sale set a pivotal milestone for its upcoming development, in which the company is focusing on sustainable business growth through harnessing synergies across brand strength, financial capacity, manufacturing and distribution systems, local market insights, and strong and transparent management.

Now, the transformation is set on much bigger challenges. While the beer and the branding may not change, SABECO is striving to change the organisation’s overall picture, creating jobs and contributing to the local economy.

|

|

Positive results

Before the changes in leadership, SABECO was a strong brand with a large position in a market of nearly 100 million people with the third-largest alcohol consumption in Asia. From a new marketing mindset to the strength of supply chain management, the new team has brought a different mindset to push SABECO further. Thus, the company focused on seven strategic pillars – sales, brand, production, supply chains, cost, human resources, and the board.

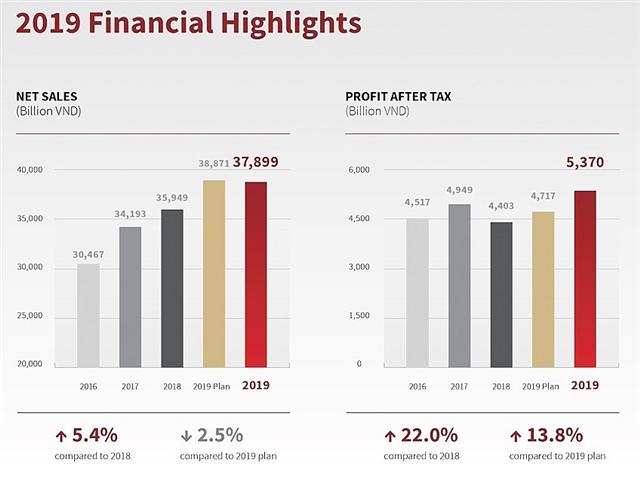

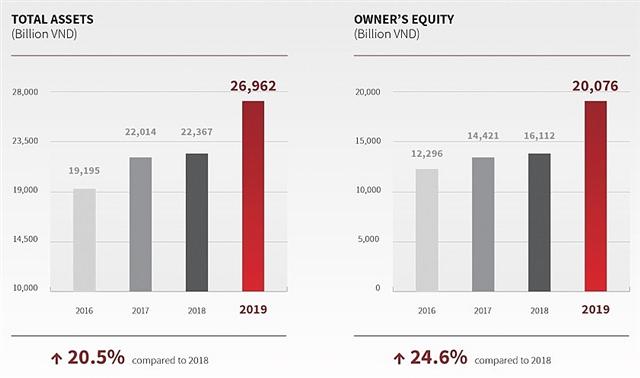

In 2019, the first year under the transformation strategy, SABECO achieved record profits as well as earned international awards.

It beat many strong candidates from countries around the world to win the gold medal for the International Smallpack Lager Competition, Class category, at the International Brewing Awards; and the gold medal for the German Heritage category at the International Beer Cup.

The company’s sales that year recorded nearly VND37.9 trillion ($1.65 billion), equivalent to an increase of 5.4 per cent compared to 2018. The increase in revenue mainly came from the increase in sales volume and higher selling prices for various products during the year while profit after tax reached VND5.37 trillion ($233 million), a rise of 22 per cent compared to the previous year.

New challenges emerged for all in 2020 with the arrival of the coronavirus pandemic. Widespread restrictions have disrupted supply chain and business operations, and dampened economic and social activities. Measures to contain the spread such as the closure of bars, pubs, karaokes, and night clubs have been prevalent in numerous cities and provinces throughout Vietnam.

The beer industry was further affected by the implementation of a new decree on zero alcohol tolerance while operating a vehicle, featuring heavy penalties. As a result, on-trade beer consumption was seriously affected.

But the hard times of 2020 could not destroy SABECO’s plans for product innovation and transformation, as well as initiatives to upgrade its facilities. It even launched a new beer named Saigon Chill to take over the premium beer segment.

According to Viet Capital Securities, the presence of new product such as Saigon Chill in stores and signboard increases over the past three months alone has helped cementing the company’s position in the market. SABECO also continues to rank in a range of updated awards such as top five in terms of value on the top 50 most valuable brands in Vietnam by Forbes Vietnam for the last five years in a row; and in the 50 best listed companies for the last four consecutive years, among others.

Last year, the company recorded net revenues of almost VND31.3 trillion ($1.36 billion), which was down 21 per cent compared to 2019 due to aforementioned pressures. However, profit after tax reached VND4.6 trillion ($200 million) due to cost-cutting, far exceeding its plan of VND3.5 trillion ($152 million) and down only 8 per cent on year. This demonstrated a strong position in the Vietnamese market as well as overseas with endless efforts, according to its report to the Ho Chi Minh City Stock Exchange in late March.

SABECO’s transformation strategy is a long journey and the pandemic is likely to continue to slow down growth, but not for the company’s willing and determination. “Good to great transformations do not happen overnight,” Bennett stressed.

|

The vision ahead

According to SSI Research’s Vietnam Beer Sector Outlook report, the beer sector has been very sensitive to the pandemic and pointed out that “recovery momentum will continue, but the demand is forecasted to return to pre-pandemic levels not in 2021, but 2022.”

Although Vietnam has handled situation very well compared to other markets, and the catering and entertainment has improved, food traffic is still a long way off 2019 levels.

SABECO predicts competition to remain stiff with every brewer vying for a higher market share, in which the trend of consuming mass premium beer brands will continue to grow over the long run. However, potential consumers’ down-trading may have an impact on 2021 sales due to their income being affected by the lingering pandemic.

“Vietnam is one of the fastest-growing countries in ASEAN, and as the country develops, the people’s income will increase,” said Bennett in a recent interview. “That is a growth opportunity not only for beer but also for many other industries. In the next 1-2 years, I think things will bounce back to the way they used to and the market will continue to grow.”

The pandemic also made the company think about what it would take for SABECO to continue being successful in the decades to come, and remaining part of the country’s rise and development. And one of the most important factors is to retain staff and keep them safe.

Human capital is one of core competitive elements in SABECO’s strategy, with global and regional talents helping to facilitate knowledge transfer via training and mentorship. Not only does this raise SABECO’s overall human capital and capabilities, but it will also enable the company to develop even more world-class talents among its ranks.

With an eye cast towards the future, SABECO is officially setting targets for the rest of the year as well as solutions planning at its annual general shareholders’ meeting. All will be discussed, including ideas from investors and shareholders this month.

Today, the company’s network includes 26 subsidiaries and 18 associates and joint ventures, with more than 145,000 product consumption channels spanning across the country. For the last three years, it has offered a brand portfolio consisting of some of the most well-loved beer brands in Vietnam including Bia Saigon Special, Bia Saigon Export, Bia Saigon Lager, Bia Saigon Gold, Bia Lac Viet, Bia Saigon Chill, and Bia 333.