Skyrocketing rents threaten long-term investment appeal

Skyrocketing rents threaten long-term investment appeal

Figures from the Housing and Real Estate Market Management Agency under the Ministry of Construction show a clear upward trend in industrial land rents since the beginning of the year, continuing rampant rises over the past years.

Skyrocketing rents threaten long-term investment appeal

|

While the average land lease has increased by a healthy 15-20 per cent against levels reported five years ago, rates at industrial zones (IZs) have seen runaway growth to reach levels that have a significant deteriorating impact on the country’s investment appeal.

In Tay Ninh for instance, land rent charged by IZ operators has risen 200 per cent since 2019 while in Long An province they went up to 1.5-2.5 times the 2015 rates. In Dong Nai province, land price and infrastructure costs in IZs increased by 30-50 per cent compared to five years ago.

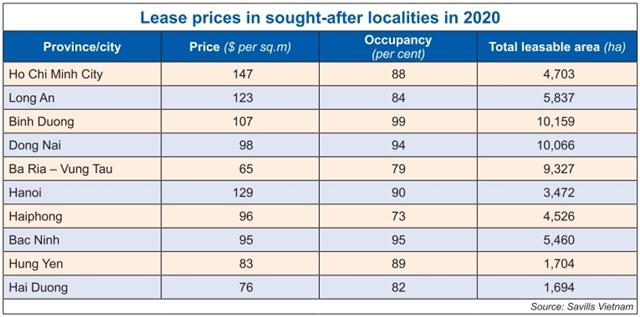

Figures from Savills Vietnam showed sudden growth spurts in lease enquiries for land, factory, and warehousing at IZs near major cities due to buoyant demand.

Discouraged investors

Rising rents have been a cause for concern among investors and tenants in IZs and are emerging as a major deal-breaker for new tenants.

John Campbell, manager of Industrial Services in Ho Chi Minh City at Savills Vietnam said, “in some provinces, rising prices will affect occupancy rates. If they go too far above average, they will become a major concern for higher value investors in electronics and high-tech industries.”

“However, there are a further 561 IZs in planning or development,” he noted. “When their supply starts coming online, it will be interesting to see how that helps the law and land lease prices. But for now, occupancy in the key provinces is high, which means that any remaining land there will almost inevitably be priced higher.”

Indeed, there is a strong pipeline of industrial land in the next five years in Vietnam, with developers rushing to meet the market demand.

According to the announcement of the Department of Economic Zones Management under the Ministry of Planning and Investment, a master plan for 561 upcoming IZ projects has been approved with an area of over 201,000 hectares to be released on the market in the next five years.

Of this, 259 zones (86,500ha – 43 per cent of the total area to be added) have not been established yet.

However, many of the newly-established IZs remain devoid of tenants or are operating with very low occupancy rates, due to substandard development and the recent hikes in rent.

Carrot or stick?

Provinces have spotted the issue of IZ rental rates reaching levels that are discouraging investors, essentially holding up the waves the frenzied IZ development is meant to ride. To alleviate troubles, most localities are rolling out newer, stronger incentives to retain their investor-friendly disposition, instead of reining in rents running amok.

“We cannot directly interfere with land rental rates but we can negotiate and offer investors better benefits,” an official from Long An province told VIR, adding that as long as conditions for profitability are sufficient, the higher rental rates should not be a deal-breaker for investors.

Indeed, the regulations on IZ land give sufficient freedom for operators to adjust rent charges and only regulate the price of empty land to be leased out to developers. The framework of these prices is set by the government for each region, depending on the land type. These minimum-maximum rates are applicable for a duration of five years – with the intention of stabilising the market – and each province can select an appropriate range within this allocation to fit their development plans.

Indeed, the land rental rate of empty land has increased by an average 15-20 per cent during 2020, in accordance with Decree No.96/2019/ND-CP dated December 2019, but the healthy increase for empty land provided little hold on developed IZ land.

This leaves little chance for local authorities but to offer stronger incentives to maintain investor demand and promote more compact industries.

Quach Van An, director of the Ca Mau Investment Promotion and Enterprise Support Centre, said many investors visit him to complain about the rent hikes.

“We are trying to incentivise investment in clean, high technologies. These fields do not require much land and are in line with the government’s broader orientations on investment,” he said.

Meanwhile, Ho Chi Minh City, the industrial heart of southern Vietnam, is working to lure giant manufacturers to its high-tech park through incentives on land rent and tax exemption, as well as by simplifying procedures and accelerating land clearance.

“The municipal authorities are offering special incentives for technology firms and each ‘eagle’ coming to Vietnam will help lure a flock of others,” explained Le Hoang Chau, chairman of the Ho Chi Minh City Real Estate Association.

The official from Long An added, “It is not easy at all for developers to choose a site with good infrastructure system and reasonable rent, but with the enthusiasm of local authorities we are sure that investors will be just as satisfied as the many others who came before them,” he continued.

Cities and provinces are in a balancing act trying to ensure adequate room for IZ developers while keeping Vietnam the place to be for incoming investors. While policy-makers appear confident of the incentives they offer, it opens the doors for the inviolate raising of rental rates that could destabilise Vietnam’s investment appeal on the long term. Indeed, low occupancy rates at newly-established IZs already suggest that restraining rents might be necessary.