Ripple effect of US fiscal stimulus to Vietnam’s growth

Ripple effect of US fiscal stimulus to Vietnam’s growth

The passage of the $1.9 trillion COVID-19 aid package in the United States will significantly and directly benefit Vietnam’s GDP growth and exports, and may also indirectly help boost stock prices in Vietnam.

By Michael Kokalari-Chief economist VinaCapital

|

Regarding the former, the size of the latest US fiscal stimulus package is enormous at over 8 per cent of GDP, and most economists expect that the package, which includes $1,400 stimulus checks to US households, will also boost the economies of countries that have close economic ties with the US.

Canada has the closest economic ties to the US, and the International Monetary Fund estimates that every $1 of US fiscal stimulus spending also boosts Canada’s economy by about $1. Vietnam is obviously not as closely linked, but the US is Vietnam’s largest export market at circa one-quarter of total exports, and Vietnam’s overall trade activity is higher than any other country in modern history, so the country should benefit significantly from the US stimulus plan.

The clearest, most concrete evidence that US fiscal spending will benefit Vietnam is included in the economic statistics of both for the first two months of this year, because the US government sent $600 fiscal stimulus checks to US households at the end of December 2020. Those stimulus checks, which were part of a previous aid package, significantly boosted US retail sales in January. This in turn boosted Vietnam’s exports and manufacturing activity since US consumers purchased an enormous amount of products that are made in Vietnam.

For example, sales of electronics jumped by 15 per cent on-month in January, and furniture sales rose 12 per cent on-month. As a direct result of the surge in the sales of those products, Vietnam’s exports to the US soared by 35 per cent on-year in the first two months of 2021, and Vietnam’s total electronics exports increased 34 per cent on-year.

|

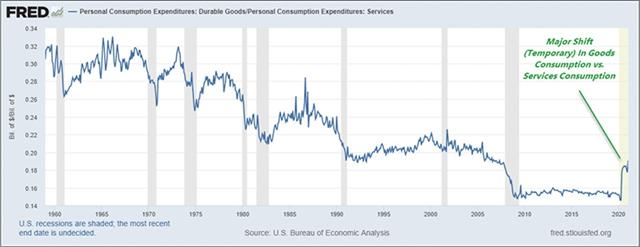

There are two reasons that so much of the stimulus money US consumers spent was used to purchase products that are made in Vietnam. The first reason is that US consumers are currently unable to spend much of their disposable incomes on services such as restaurants or cinemas due to social distancing restrictions.

Instead, they are purchasing products (especially ordered online), so the ratio of consumer spending in the US and in most developed countries on goods versus services has surged since the outbreak emerged.

The second reason is that US consumers have been buying so-called “stay at home” goods such as electronics, furniture, and home gym equipment, and many of those products are made in Vietnam.

To illustrate how powerful this phenomenon is, PC sales in the US increased by 15 per cent in 2020 (versus 1 per cent in 2019) and sales of games and hobby items jumped by 19 per cent because consumers are buying products that make spending time at home more enjoyable and/or that facilitate working from home.

The production and export of such goods to the US and other developed countries supported Vietnam’s manufacturing sector and GDP growth last year – and looks certain to do so again this year.

Furthermore, foreign-invested companies that manufacture high-tech products in Vietnam import most of the components required to make those products, and imports of those critical parts/inputs surged by 35 per cent on-year in the first two months of this year. This is a clear indicator that these companies are preparing to ramp up production this year, presumably in response to the increased demand those companies expect from US consumers.

Finally, in 2020 and in the first two months of 2021, the two main drivers of Vietnam’s economic growth were consumption and manufacturing. This explains why we expect a direct connection between US fiscal stimulus and Vietnam’s GDP growth this year, but strong GDP growth in Vietnam should also support the VN-Index.

However, in addition to directly supporting Vietnam’s economic recovery, the US fiscal stimulus package may also indirectly benefit Vietnam’s stock market because a significant portion of the money that US households received from the government was invested in the US stock market, according to the NY Federal Reserve.

Many economists believe the massive scale of the US fiscal stimulus will lead to a decline in the value of the US dollar, which would in-turn help boost stock prices in emerging and frontier stock markets like Vietnam’s.