JP Morgan, May Bank selected TCB share as the top pick among Vietnam’s listed banks

JP Morgan, May Bank selected TCB share as the top pick among Vietnam’s listed banks

As one of the leading tech-enabled commercial banks in Vietnam, Techcombank is among the most appealing stocks thanks to its profitability and operational efficiency with a high-calibre management team.

JP Morgan, May Bank selected TCB share as the top pick among Vietnam’s listed banks

|

In a report, JP Morgan has stated that Vietnamese banks offer the best combination of growth and Return on Equity (ROE) in ASEAN. High nominal GDP growth and resilience in the last 12 months provide visibility on credit and earnings growth over the next few years.

In particular, JP Morgan has reiterated its “overweight” rating on Techcombank – Vietnam’s leading commercial lender – with an upbeat outlook on the bank’s performance. The target price for the bank’s share is VND55,000 ($2.4) per share as of December 2021, calculated via JP Morgan’s two-stage dividend discount model.

The rally in the bank’s share price as the top pick among Vietnam’s listed banks is fuelled by multiple indicators.

According to the US-based financial group, Techcombank is the most profitable bank in the country on ROA despite having a low deposit market share of 3 per cent.

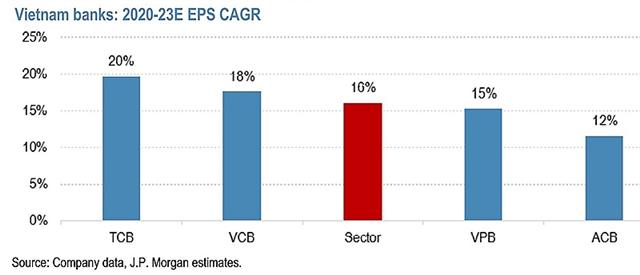

Expecting a 16 percent EPS CAGR for the sector, led bay TCB

|

The bank’s zero-fee programme and 1 per cent cash back debit card have led to sharp improvements in current accounts saving accounts (CASA) and to deposits going from 22 per cent in 2017 to 44 per cent in 2020. The brokerage also expects further improvement in CASA ratio to 50 per cent by 2023, leading to higher net interest margin (NIM).

Specifically, Techcombank has the highest capital (16.1 per cent capital adequacy ratio [CAR]) and lowest NPL (0.5 per cent), allowing for a 20 per cent CAGR for loans over the 2020-2023 period.

Techcombank is also one of the rare banks across the region that is making money on both sides of the balance sheet, as well as on fee income, adjusted for all allocated costs. This allows for longer-term visibility on returns.

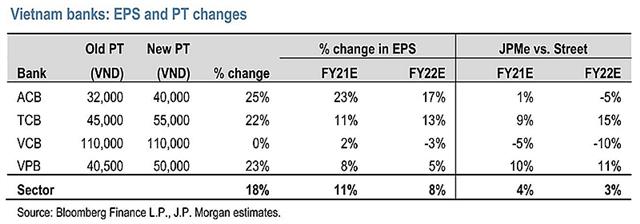

Increasing PTs after EPS changes

|

The lender also rolled out a system to regulate total credit. This is due to a large corporate bond book and a 63 per cent loans-to-assets ratio. Further, high capital and low NPL holdings have allowed credit quotas in the 20 per cent range for the next three years, according to JP Morgan.

JP Morgan also expects the bank to be on a self-sustained capital level, given its combination of solid Return on Equity (RoE) and growth.

Sharing the same boat, Maybank Kim Eng Securities has recently voted Techcombank as Vietnam’s No.1 private-sector bank with a strong brand, deposit franchise, and a solid banking platform for high-profile companies in Vietnam.

The lender is considered the top player in bond underwriting and bancassurance competition, with a high-calibre management and execution team.

On the other hand, Techcombank has maintained consistent, robust profit growth in 2020, up 23 per cent on-year.

“We forecast Techcombank’s profit will grow 26 and 22 per cent in 2021 and 2022, respectively. Accordingly, ROE will improve to 19 per cent, with stronger credit growth and faster-than-expected easing in provisioning bringing about significant upsides,” noted Maybank.

The lender’s strategy is to focus on top private-sector companies, upper SMEs and affluent retail, and is run by a highly capable team. All of these factors enabled it to stay resilient through the unprecedented health crisis.

“Techcombank is now being traded at 1.4x price-to-book value (P/BV) in our 2021 expectation, which is in line with local peers’ average, despite its banking platform, earnings power, and quality being superior. We believe the bank’s robust profit growth outlook on the back of a strong balance sheet, along with improved market sentiment towards the bank’s stock in recognition of the bank’s strengths, will support further rerating,” the brokerage added.

Maybank also recommends investors to buy Techcombank stocks, with higher target price of VND43,700 ($1.9) as of December 2021, up 21 per cent compared to the current price.

The brokerage believes the market’s stronger sentiment towards Techcombank, in recognition of its strengths and improving ROE, will drive up its valuation close to that of industry-leading banks.

Earlier this month, Techcombank is also one of the nine Vietnamese lenders topping the Brand Finance Banking 500 list, with its brand value increasing from 327th in 2020 to 270th in 2021.

Bloomberg recently also stated that Southeast Asian stocks could be safe havens amid the disruption in global risk assets led by spiking yields. Thus, Techcombank – as the most dynamic, profitable bank in Vietnam – is among the best shelters from the global yield havoc.

|

Techcombank has the highest upside of 42 per cent (followed by ACB with 29 per cent) according to JP Morgan. Analysts also raised target price on resilience observed in 2020. Particularly, JP Morgan raised earning per share for the 2021-2022 financial year and target price for ACB, TCB, and VPB by 8-11 |