Accountability sought in e-commerce

Accountability sought in e-commerce

Unless they enhance their responsibilities in controlling trading activities in order to improve competitiveness, e-commerce platforms may face troubles caused by new legal provisions and sanctions.

Accountability sought in e-commerce, illustration photo

|

A draft decree amending 2013’s Decree No.52/2013/ND-CP on e-commerce, which will see comments collected from businesses and consultant firms, has recently caused concern for e-commerce operators if the draft is adopted.

Nguyen Chi Linh, representative of an e-commerce platform which is a subsidiary of the Chinese tech giant Alibaba Group, noted her criticisms to VIR about an adjusted article which orders a searching tool for state authorities to manage all information of their traders to check and inspect any violations or complaints.

“This regulation is unnecessary and can seriously impact the convenience of traders. Even if traders do not violate or make any complaints, they don’t want private information to be monitored by state management agencies. They could jump to other social platforms, and hamper e-commerce development,” said Linh.

She added that the platforms are assisting state management agencies in investigating illegal business acts, saying that providing registration information, transaction histories, and other documents on the issue on the e-commerce trading platform should be enough.

In addition, new regulations related to joint responsibility on goods and services on the platforms has caused headaches for e-commerce operators. The draft decree has added responsibilities in Article 36.11.d, and the representative of the Chinese e-commerce platform said this is impossible for them, which plays a commercial intermediary role only.

Without a legal framework, the role and responsibilities of e-commerce platforms continue to be highlighted. At the end of 2019, sneaker and sports apparel giant Nike ditched its deal with Amazon after two years, after noting its concerns about third-party sellers offering counterfeit products on the marketplace. Many brands are unhappy with how Amazon operates, with fake goods running rampant.

According to Bloomberg, the e-commerce giant is also notorious for identifying popular products sold by third parties on its website and then selling its own similar products at lower prices.

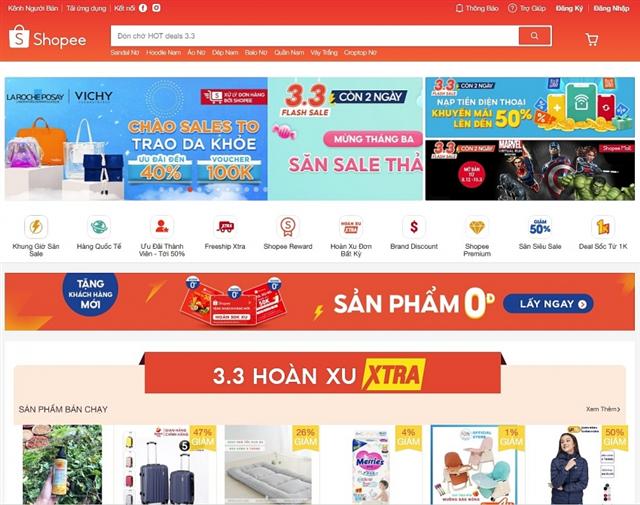

In Vietnam, e-commerce platforms like Shopee and Sendo are used to inspections for massive violations and complaints related to bad service or fake and prohibited goods.

Nguyen Minh Long, director of Dragon Law Company, said that e-commerce platforms should not shirk their duty to provide a management tool for state authorities, and take the joint responsibilities to improve themselves.

“In order to enhance the efficiency of these regulations, we need some sanctions strong enough to ensure owners of e-commerce platforms improve accountability and compliance, ensure good performance of online trading, and protect local consumers,” said Long.

He agreed with new provisions, saying, “In the context that online trading is increasingly developing, especially during the pandemic, strengthening the state management for the sustainable development of the retail market is necessary to maintain both benefit of businesses and consumer protection, and avoid e-commerce platforms developing as a place for trading illegal goods,” explained Long.

The draft decree amending 2013’s Decree No.52/2013/ND-CP on e-commerce is being compiled by the Ministry of Industry and Trade. The draft adds provisions on managing e-commerce activities involving foreign factors, and those on social networks. It also revises several regulations on the responsibility of both e-commerce platforms and their operators.

Some popular e-commerce platforms in Vietnam are backed by Chinese technology giants, or funded by regional venture funds. However, results often fail to match investment, and competitiveness increasing. In 2020, Lazada.vn fell behind Shopee and Tiki, according to Malaysian shopping aggregator iPrice Group, with a sharp month-by-month drop of its traffic, while that of the leading player Shopee has tripled Lazada and Tiki.